5 actions to maximize corporate carbon credit strategies

The global carbon credit market is expected to surge in the coming years, with projections of up to $250 billion by 2050. In 2024 alone, corporations purchased around $1.4 billion in verified carbon credits globally, supporting projects that avoid or remove millions of tons of carbon dioxide equivalent… Read More

The global carbon credit market is expected to surge in the coming years, with projections of up to $250 billion by 2050. In 2024 alone, corporations purchased around $1.4 billion in verified carbon credits globally, supporting projects that avoid or remove millions of tons of carbon dioxide equivalent (CO₂e)—emissions reductions that otherwise would never have occurred. Carbon credits, each representing 1 ton of avoided, reduced or removed CO₂e, fund crucial climate solutions like forest conservation and the destruction of non-CO2 greenhouse gases—often referred to as “super pollutants”—that fall outside a company’s direct control.

Enabling work that wouldn’t happen otherwise

Carbon credits have driven renewable energy in remote areas, safeguarded endangered forests and reduced super pollutants—including methane from leaking wells and refrigerants from old appliances, industrial equipment and stockpiles—worldwide. Without this market, these types of projects would grind to a halt, allowing highly potent greenhouse gases to keep leaking into the atmosphere at a time when swift action is most needed. In addition to cutting emissions, high-quality credits deliver tangible social and environmental co-benefits like creating local jobs, protecting biodiversity and improving air quality in vulnerable communities.

Credits are crucial for corporate climate goals

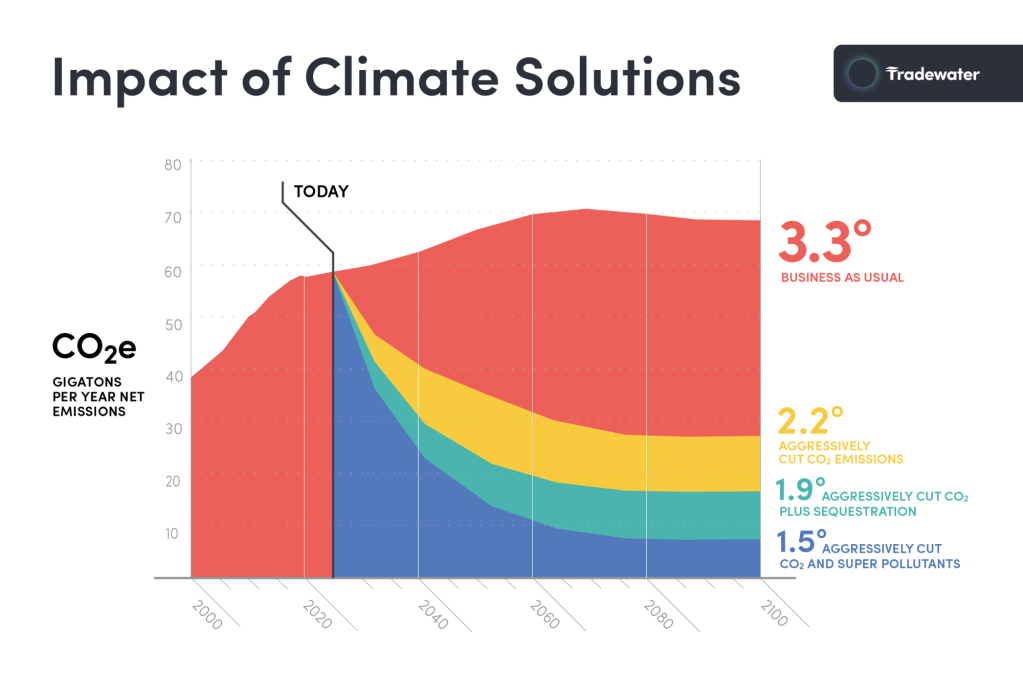

No realistic corporate roadmap to net-zero emissions or 1.5 degrees Celsius alignment relies solely on direct emissions cuts. By definition, net zero requires indirect actions. Many companies face hard-to-abate emissions—Scope 3 emissions, industrial process emissions, fugitive methane and others—that cannot be eliminated immediately. Carbon credits bridge this gap, enabling organizations to offset residual emissions while advancing long-term decarbonization.

High-quality, transparently reported credits strengthen corporate integrity and signal genuine, measurable climate action. Properly sourced credits show a company is going beyond compliance to drive meaningful impact and align with the latest science—without them, many firms cannot credibly claim science-based or net-zero targets with confidence.

What is a corporate carbon credit portfolio?

A strong corporate carbon credit portfolio strategically curates a mix of credits to offset residual emissions following direct reductions and energy transitions. To ensure both long-term permanence and immediate climate impact, effective portfolios diversify across project types, geographies and registries.

Registries such as ACR, Verra’s Verified Carbon Standard and oneshot.earth’s Open Carbon Principle issue credits under a range of methodologies—from nature-based solutions like reforestation and avoided deforestation to high-impact super-pollutant mitigation like methane capture and refrigerant destruction, as well as emerging permanent removal technologies like direct air capture. Leading companies strengthen resilience and credibility by balancing these approaches, prioritizing credits that are verifiable, additional, permanent and deliver measurable social and environmental co-benefits.

Delivering immediate, high-impact reductions

Effective carbon strategy requires balancing climate urgency with long-term goals. While nature-based solutions and advanced removal technologies ensure lasting carbon storage, early investment in mitigation projects delivers the greatest impact. Acting now—rather than waiting until the end of a net-zero timeline—prevents additional years of cumulative emissions, accelerates learning curves, and strengthens market momentum for emerging solutions.

Targeting super pollutants like refrigerants and methane offers one of the fastest, most cost-effective ways to secure permanent reductions. Projects that eliminate these gases deliver exceptional climate returns per ton avoided and can be deployed quickly, helping bend the global emissions curve now.

Integrating solutions focused on these high-impact gaps allows companies to build a robust, mixed portfolio that manages both short-term risks and long-term targets. By filling these crucial gaps, a comprehensive portfolio ensures the company’s overall climate strategy aligns with scientific urgency and maintains integrity.

5 actions to maximize carbon credit portfolio strategies

- Impact and alignment: Prioritize carbon credit projects that deliver measurable, verifiable and permanent emissions reductions grounded in sound science. Align your portfolio with Intergovernmental Panel on Climate Change (IPCC) guidance and credible decarbonization pathways, using credits to address emissions you cannot yet eliminate. Integrate these credits into your broader climate strategy to complement—never replace—deep, structural reductions.

- Cost-effectiveness: Evaluate credits by cost per ton of CO₂e, balancing long- and short-term projects. Optimize pricing using advance or bulk purchases, and don’t assume super-pollutant projects are cost-prohibitive; many are undervalued and deliver massive climate benefits per dollar. Smart integration maximizes climate return.

- Speed and scalability: Balance your portfolio by selecting projects that deliver immediate, verifiable emissions reductions to meet near-term targets while longer-term solutions mature. Give focus to projects with potential for scale via replication, geographic expansion or early deployment. Super-pollutant solutions particularly shine here; the technology to implement quickly and scale rapidly for outsized impact already exists.

- Risk and resilience: Diversify across credit types (super-pollutant mitigation, nature-based, technological removal) and standards to strengthen your portfolio. Work with project developers that apply rigorous monitoring and verification frameworks and consider safeguards—like buffer pools or insurance—to manage financial, reputational and reversal risks. If there is a risk of reversal, continuously assess for unintended consequences or leakage to ensure lasting climate integrity.

- Transparency and influence: Publish your outcomes, actions and challenges to build credibility and advance market integrity. Transparent reporting drives higher standards, inspires peers and creates demand for high-quality credits. Sharing both successes and lessons learned strengthens collective climate action and accelerates market progress.

A high-functioning carbon credit strategy is fundamental, not optional, for organizations pursing credible climate leadership. By investing early in verified, scalable and cost-effective projects—and by reporting transparently and aligning with science—companies can accelerate progress, demonstrate integrity and drive lasting change. Climate leaders like Tradewater are helping make that impact tangible today.

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders