7 trends shaping polyester’s future

Just because the synthetic can be used in a multitude of incredible ways doesn't mean it should be. Read More

- Polyester’s 59 percent share of global textiles is baked into fast-fashion economics, and sustainability-minded brands barely register against ultra-low-cost giants.

- Bottle-to-fiber recycling, microfiber shedding and slow progress on textile-to-textile systems expose limits and potential unintended harms of today’s fixes.

- Innovators are exploring virgin polyester alternatives from waste textiles, captured carbon dioxide and crops, but have a long way to scale.

![]()

The world’s polyester spree over the past half century has nudged cotton to the margins.

The synthetic wonder makes up 59 percent of textiles, but its origins are problematic. Its long name, polyethylene terephthalate (PET), reflects its connection to crude oil and gas refining.

That is a big reason why fashion’s greenhouse gas emissions rose 7.5 percent in 2023, the last year for which data is available.

Polyester, in fact, carries all the fossil fuel burdens of plastic, from its creation to the long-term persistence of microfibers in the environment — and human bodies. Scientists have connected plastic bits in people’s arteries with a higher risk of heart attack and stroke.

Here are seven trends that will shape polyester production and consumption in 2026.

Polyester still rules fashion

Some labels, such as Eileen Fisher, Everlane, Reformation and Pact, have explicitly eliminated polyester from most of their clothes. Yet their combined scale is dwarfed by the likes of Shein, which makes liberal use of the material — and has estimated annual revenues of around $40 billion.

In other words, fashion is nowhere close to reaching peak polyester. The market for the fiber will grow from $135.6 billion in 2025, rising to $210.6 billion in 2035, according to Future Market Insights.

“If the industry is left on its own, and these so-called well-intentioned brands completely transition to more sustainable materials, there will always be someone else willing to build another Shein to capture the consumer demographic that prioritizes price and fashion trends over sustainability,” said Marcian Lee, an analyst with Lux Research.

Polyester and overproduction go hand in hand (with opacity)

Giant piles of wasted clothing are now visible from space, evidence of business models based on the planned obsolescence that cheap polyester enables. Shein and other fast-fashion purveyors can afford to cut, sew and ship thousands of synthetic new styles each week that ultimately feed landfills and burn piles.

Those sellers are simply maximizing long-established industry practices. That’s why serious climate accounting in fashion starts with a question most brands fail to answer: How much do they produce in the first place?

Brands aspire to source recycled polyester (sort of)

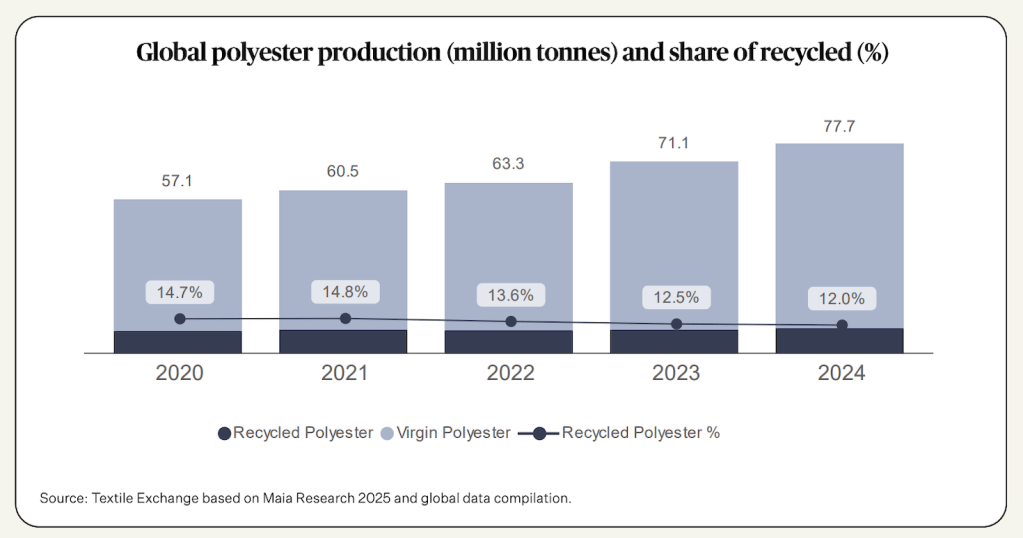

More than 110 companies including Adidas, Patagonia and Nike pledged through the Textile Exchange’s Polyester Challenge to use only recycled sources of polyester by the end of 2025. Only 26 percent have met that goal.

Most of the 1 percent of polyester that’s recycled comes from beverage bottles, which circularity advocates prefer to keep in closed-loop bottle recycling systems.

Microfiber risks are rising

Every polyester garment is a long-term source of plastic pollution, shedding fibers through each wear and wash. Shifting to recycled polyester reduces reliance on virgin plastics but may add microfiber pollution.

The nonprofit Changing Markets Foundation estimates that bottle-to-fiber recycled polyester sheds 55 percent more microfibers than virgin polyester. However, the Microfibre Consortium has found conflicting results, reflecting how little is understood or regulated.

The nonprofit is working with Fashion for Good and 11 large brands, including Adidas, Kering, Inditex and Levi’s, to understand how to address microfiber shedding across supply chains, including in garment design, yarn choices and textile finishing.

‘Circular’ polyester attracts funding

Startups seeking to scale “circular” polyester recycled from waste polyester textiles instead of bottles have collectively raised hundreds of millions of dollars. Without yet selling material at scale, some have inked deals to supply Nike, H&M and Gap in the future.

“Ultimately, we need [textile-to-textile recycled] solutions because even without new production we have enough polyester clothing on the planet to last many lifetimes, so we need a better way to process all of that waste,” said Ruth MacGilp, fashion campaign manager of the nonprofit Action Speaks Louder.

New entrants including Reju and Syre aspire to reduce fiber shedding through careful feedstock selection and recycling processes.

Regulation is emerging — slowly, unevenly and late

Regulations are gradually making it harder for brands and retailers to hide from the long-term impacts of their clothing and footwear. Extended producer responsibility laws in California and the European Union are beginning to require brands and retailers to track and manage their products’ waste after use.

Digital product passport requirements in the EU, as well as technological progress in AI and fiber tracing, will reveal more about the origins and ultimate paths of materials.

However, policy is globally inconsistent and lagging production rather than leading it, especially after the future of a Global Plastics Treaty looks shaky. No major jurisdictions are capping synthetic fiber production or regulating microfiber shedding.

Innovators look beyond petroleum

Oregon entrepreneur Tim Gobet believes fossil-based polyester will pose serious risks to brands as new science emerges about its negative health impacts. His Aktiiv brand of activewear mixes petrochemicals with corn-based polyester.

“‘Circular polyester’ sounds progressive now,” he said, but within a decade “it may be viewed more like the tobacco industry’s low-tar cigarettes — a technical improvement on one metric that leaves the underlying harm fundamentally unaddressed.”

Innovators experimenting with non-petroleum derivatives, including Kintra Fibers, are developing polyester made from fermented corn sugars, which Reformation, Zara and Bestseller have piloted. Textile tech company OceanSafe creates ocean-degradable naNea “copolyester,” which is Cradle Certified Gold for material health. Zara, H&M Move, Adidas, REI and Lululemon have piloted LanzaTech’s CarbonSmart polyester, derived from captured carbon dioxide.

“All of that is really cool,” said Bonie Shupe, founder of Rewildist, a Colorado fashion sustainability consultancy. “But every new material will have tradeoffs across its lifecycle. There’s still so much work to be done.”