Chanel aims to elevate luxury circularity with materials ‘hub’

A "visionary" new division also seeks to secure a competitive advantage for the high-end brand. Read More

- New venture Nevold will reuse and remake textiles, targeting Scope 3 emissions and long-term material security.

- By controlling recycling and inviting partners, the company aims to elevate material quality and shape a future market.

- A luxury sector latecomer to sustainability, Chanel is embedding circularity into its brand.

Chanel is looking beyond virgin materials to craft its signature tweed jackets and calfskin handbags. The 115-year-old luxury house shared plans on June 9 to create a new division to recirculate, recreate and repurpose used textiles. Chanel is calling the enterprise Nevold, a merger of the words “never” and “old.”

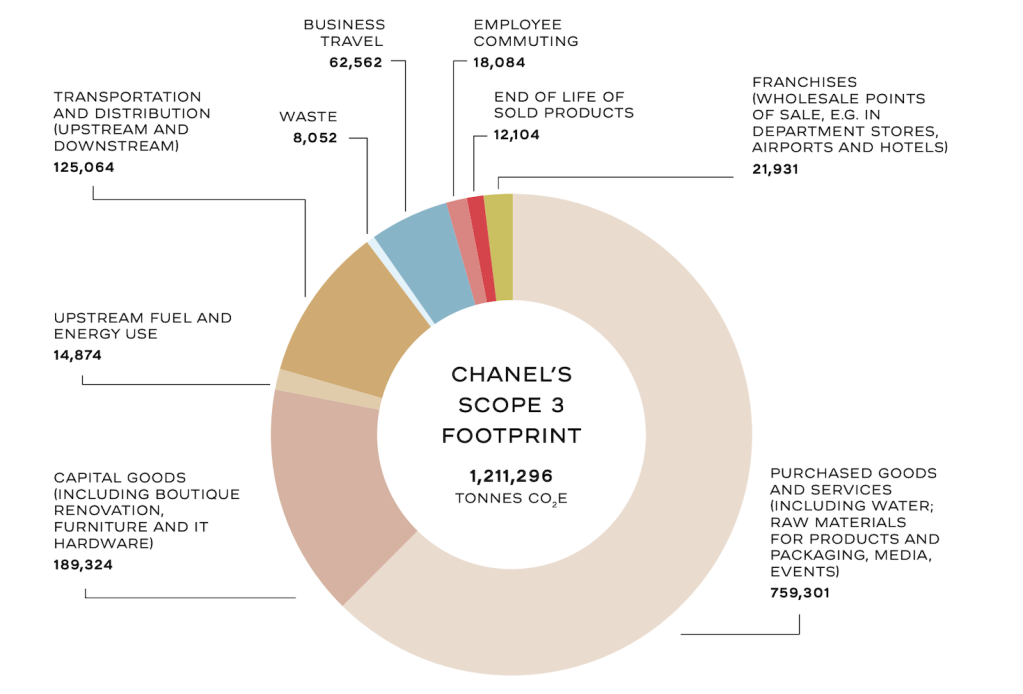

With purchased goods causing nearly two-thirds of indirect, Scope 3 carbon emissions for the privately owned brand, the launch advances efforts to reduce both its climate footprint and supply chain risks.

In addition, Nevold could help the fashion empire control and elevate the quality of recycled materials, a sticking point for elite brands. In this light, Chanel may be seizing an opportunity to corner a future market of high-end materials.

“We are not trying to replace what nature gives us,” Chanel President of Fashion Bruno Pavlovsky told Vogue Business. “But the ability to get the best quality with full transparency and traceability is becoming more difficult. Nevold is how we explore long-term alternatives — not for next season, but for the next generation.”

‘Strategic material infrastructure’

Sophie Brocart, the former CEO of LVMH’s Jean Patou brand who joined Chanel in January, will lead Nevold independently of the overall group’s fashion division. The effort has three partners so far: leather upcycler Authentic Material, yarn mill Filatures du Parc and materials sorter L’Atelier des Matières. The University of Cambridge and Politecnico de Milano will also be involved.

“The launch of Nevold is a positive signal that circularity is gaining traction in the luxury sector,” said Eva von Alvensleben, executive director of the Fashion Pact in Paris, a network of brands, including Chanel, to advance sustainability. “It reflects a growing recognition that material reuse and recycling must be scaled to meet the industry’s broader sustainability and net zero goals.”

“To me this sounds like the work of a sustainability visionary, less concerned about the luxury image and truly interested in creating impact,” said Cynthia Power, co-host of the Untangling Circularity podcast.

Nevold creates an “open” business-to-business system to manage — and potentially profit from — scrap or post-consumer materials that Chanel was unsure how to handle. (The brand does not incinerate unsold merchandise, according to Pavlovsky.)

“This signals a pivotal shift in how luxury approaches circularity,” said apparel sustainability consultant Liz Alessi. “Not just as a sustainability gesture, but as a strategic material infrastructure.”

Or, as reporter Jill Ettinger wrote in Ethos: “It’s a slow-motion land grab for control of the next generation of luxury inputs.”

How will it work?

Nevold has been several years in the making, according to Chanel Chief Sustainability Officer Kate Wylie. “There are two solutions already underway: a thread blended from end-of-life materials and virgin materials and a recycled leather to create reinforcements inside bags and shoes,” she posted on LinkedIn. Thirty percent of the brand’s handbags and 50 percent of its shoes already have recycled reinforcements, she added.

Indications of how Nevold will take shape may be found in its Paraffection division, a craftsmanship preservation effort that has snapped up at least a dozen artisanal workshops since 1985. These include button maker Desrues; embroiderers Montex, Lesage and Lanel; and glovemaker Causse. The late Karl Lagerfeld debuted the Métiers d’Art fashion show in 2002 to spotlight the work of the ateliers, who in 2019 got their own 84,000 square foot Paris headquarters, Le 19M.

“Whilst most brands are struggling to get a handle of their supply chain, Chanel own their subsidiaries through Chanel Métiers d’Art,” Lydia Brearley, founder of the Sustainable Fashion School in Malmo, Sweden, posted on LinkedIn. “Now, with the introduction of Nevold, they’re positioning themselves as the Maison de la Circularité in luxury fashion.”

Many questions remain, however, including whether Nevold will operate from a centralized location. Chanel describes a distributed “hub” approach that is likely to enjoin its internal R&D and waste materials with outside recyclers and processors.

“Chanel can vet the ecosystem of partners with a trusted company,” said Lauren Fay, founder and principal consultant at BFG Lab in New York City. “That efficiency saves money, builds trust with clientele and puts them at the forefront of the circularity conversation, which is great for their brand equity.”

Exclusivity + sustainability

Nevold’s open approach does not suggest exclusivity, which is one of Chanel’s five key “performance drivers.” But sustainability is another central driver alongside design, engagement, and people and culture.

Although famously buttoned-up about its raw materials suppliers, Chanel claims to source following the Responsible Wool Standard and Good Cashmere Standard. Most of its manufacturing likely centers in Europe, especially France and Italy.

Chanel was one of the last luxury brands to develop a public sustainability strategy, debuting its Mission 1.5° strategy in 2020 to align with the Paris Agreement. The Science-Based Targets initiative validated its net zero targets for 2040 last year. These include cutting all direct and indirect climate emissions by 90 percent by 2040 over a 2021 baseline, and slashing forest, land and agriculture-related emissions within Scope 3 by 72 percent. For the near term, the targets include halving emissions for Scopes 1 and 2 by 2030 and cutting them by 42 percent for Scope 3, with a 30 percent cut for forest and agriculture emissions.

From quiet luxury to loud circularity

Most luxury purveyors, Chanel included, have declined to pursue branded resale, letting third parties capitalize on the value-retention of $5,000 dresses and $10,000 handbags. But the sector is slowly starting to flash circular intentions. LVMH, parent of 75 brands including Christian Dior, Celine and Givenchy, gives second lives to waste materials and unsold goods within its LVMH Circularity strategy. And Kering, which runs more than 13 brands including Bottega Veneta, Gucci and Yves Saint Laurent, features a circularity strategy that features “upcycling, recycling and regeneration.”

And many in the group are investing in next-gen materials, including Hermes, which markets fungus-based handbags.

Still, the launch of Nevold is timed well for Chanel to meet new European Union requirements for apparel brands to take responsibility for their products after use.

“As regulations tighten and resources become scarcer, the brands that can turn yesterday’s inventory into tomorrow’s fabric will set the pace for the next growth cycle in luxury,” Nick Vinckier, VP of corporate innovation at the Dubai-based luxury retailer Chalhoub Group, posted on LinkedIn.

[Join more than 5,000 professionals at Trellis Impact 25 — the center of gravity for doers and leaders focused on action and results, Oct. 28-30, San Jose.]

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders