Data-center demand sends electricity prices soaring

Unfortunately, renewable energy alone will not be enough to meet increased demand. Read More

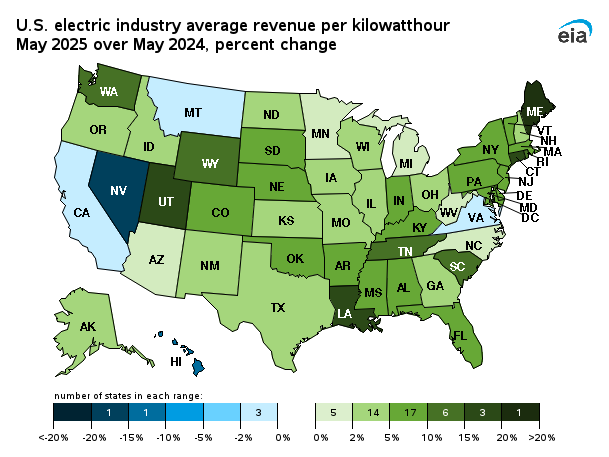

- The average retail price of one kilowatt-hour of electricity in the U.S. rose 6.5 percent between May 2024 and May 2025.

- President Trump’s drastic tariffs, and the assault on renewable energy, will likely push power prices even higher.

- Annual energy use by data centers will nearly triple by 2028 according to a recent forecast by Lawrence Berkeley National Laboratory.

American consumers and businesses are experiencing sticker shock this summer when they open their electricity bills.

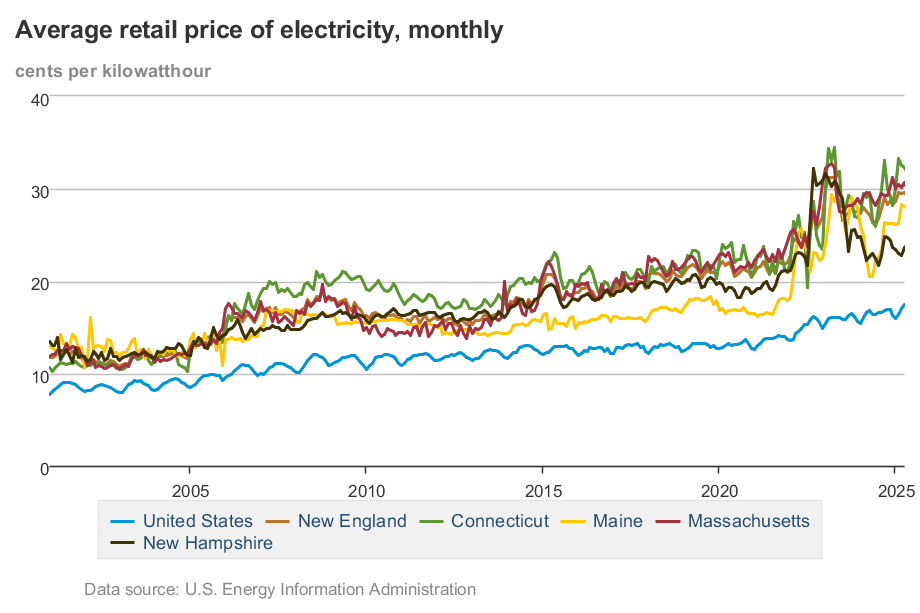

A combination of soaring demand from power-hungry data centers, scorching weather and pass-along costs from utility infrastructure investments is driving electricity prices — which had been relatively stable for a decade or so prior to the pandemic — to alarming highs.

The effects of President Donald Trump’s drastic tariffs could push power prices even higher as the raw materials for transmission lines become more expensive and utilities scramble to keep up with the demand of new generation.

New U.S. manufacturing capacity, aided by federal onshoring policies, will further drive increases.

Energy earthquake

According to the U.S. Energy Information Administration, the average retail price of one kilowatt-hour of electricity in the U.S. rose 6.5 percent, to 17.5 cents from 16.41 cents, between May 2024 and May 2025.

Some states have been hit especially hard: ratepayers in Maine saw prices jump 36.3 percent in that period, followed by Connecticut (18.4 percent) and Utah (15.2 percent).

The effects are being felt by Las Vegas Strip merchants and New Jersey homeowners alike.

“Yesterday’s earthquake wasn’t tectonic,” wrote a member of the Midland Park, NJ Facebook group Aug. 3. “It was every NJ resident opening their PSE&G bill at the same time.”

NV Energy, which serves southern Nevada including Las Vegas, requested a 9-percent rate increase from state regulators earlier this year. The projected cost of its giant transmission project, Greenlink, has nearly doubled, to $4.2 billion from $2.5 billion, and could balloon even more as a result of the administration’s 25 percent tariffs on many relevant products from Mexico.

Don’t blame renewables

It’s often claimed by clean energy opponents — including U.S. Energy Secretary Chris Wright — that more renewable generation on the grid drives higher energy prices, but the data shows otherwise (see this deep dive on Sustainability by numbers for the full picture). Solar and wind, being variable resources, do drive volatility in prices, which helps contribute to public perceptions of a power grid out of whack.

And the Trump administration’s assault on federal support for renewable energy projects is bound to lead to higher prices, according to a recent report from think tank Energy Innovation. Some of the biggest increases will likely come in red states.

The primary driver of price increases, though, is still demand. Looking ahead, the data-center boom — and the resulting demand spike — shows no sign of slowing down.

Annual energy use by data centers will nearly triple, reaching between 74 and 132 gigawatts by 2028, according to a recent forecast by Lawrence Berkeley National Laboratory; that represents 6.7-12 percent of total U.S. electricity demand. Many large operators, such as Google and Microsoft, are investing heavily in low-carbon generation to meet their needs. Unfortunately, on the public grid, renewables alone cannot meet future demand growth.

Bloomberg NEF’s New Energy Outlook 2025 found that future load growth will help prolong the hydrocarbon era. Sixty-four percent of the increased generation for data centers will come from fossil fuels, and “added data-center demand could help extend the life of existing coal and gas plants.”

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders