The Trellis Climate Tech Startup of 2025

Among five standouts, a carbon nanotube innovation emerged as the audience favorite. Read More

- Dexmat emerged as the winner among the Trellis 25 Climate Tech Startups to Watch, a group that reflects a new generation of climate innovators.

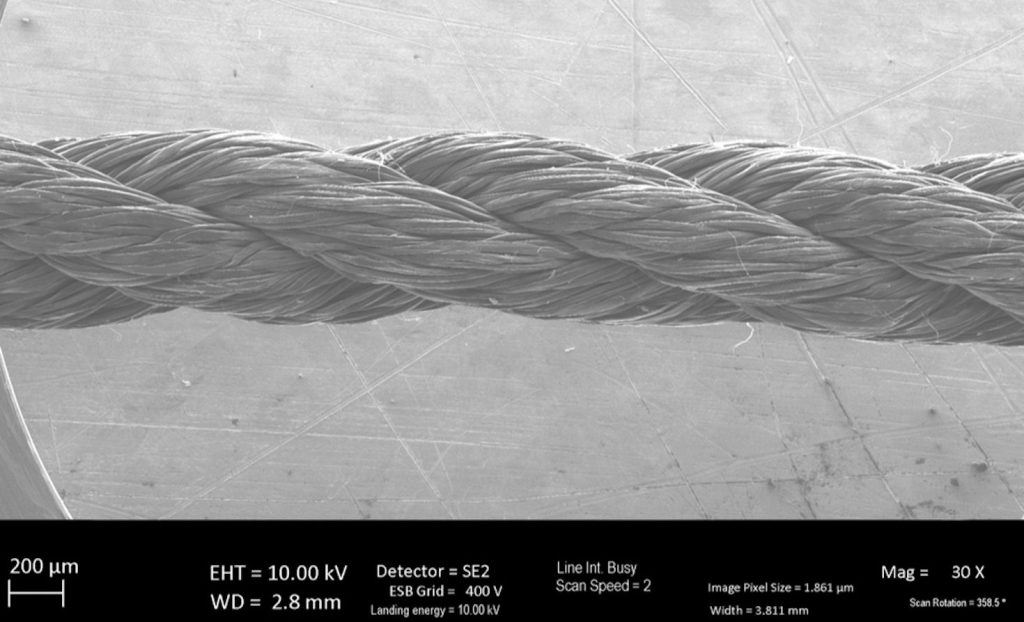

- Its carbon nanotube material is lighter and stronger than copper and will have a range of applications in energy, transportation and aerospace.

- The contenders all proved commercial traction under tough conditions, having raised more than $750 million collectively.

The Trellis Impact climate tech startup of the year is Dexmat, which produces a conductive nanomaterial that can be spun into fibers, films and wires for aerospace applications, EVs and energy storage. The product, Galvorn — derived from carbon nanotubes that have the potential to store carbon — is ultra-strong, lightweight and exceptionally flexible. It could potentially replace steel, aluminum and copper.

The Houston company won a live audience vote at Trellis Impact on Oct. 29 in San Jose, California, after five companies made 2.5-minute pitches to investors and corporate leaders.

The early-stage companies among the Trellis 25 Climate Tech Startups to Watch tackle emissions from every angle: energy, carbon, industry, nature and transport. Moreover, they represent a new generation of entrepreneurs that focuses not simply on cutting emissions, but on rebuilding the systems that power the global economy. It is a generation, though, currently facing a drop in climate tech funding and challenging policy shifts.

Dexmat is backed by Shell Ventures, the U.S. Department of Energy and other investors in advanced materials for decarbonization. Galvorn emerged from research in the lab of co-founder and Chief Science Advisor Matteo Pasquali, a professor at Rice University, that was conducted in collaboration with Nobel laureate Richard Smalley. Dexmat Co-founder and CTO Dmitri Tsentalovich, who holds a chemical engineering Ph.D from Rice, has worked for 15 years on carbon nanotube technology.

“Dexmat was able to show the audience how the problem they are solving affects everyone in the room, and the potential for climate impact at scale,” said Alex Behar, a partner at Buoyant Ventures in Chicago. “Copper is fundamental to upgrading the grid to support the energy transition and increased demand for energy from data centers, but it is resource-intensive to produce. Dexmat avoids these challenges by using alternative materials that can deliver similar or better performance.”

The finalists

Before choosing Dexmat, the finalist in the Industry category, the Trellis Impact audience also heard pitches from four other category finalists:

Energy: Ammobia is reinventing ammonia production, delivering a low-pressure, lower-carbon process that uses renewable hydrogen and air to decarbonize feedstocks for fertilizer and fuel. Founders: Karen Baert and Tristan Gilbert; San Francisco

Carbon: Planet Savers is developing modular, low-cost direct air capture systems to remove gigatons of carbon dioxide from the atmosphere. Founders: Kei Ikegami and Kenta Iyoki; Tokyo

Nature: Airbuild uses microalgae and pyrolysis to transform polluted water and air streams into clean water, biochar and long-term carbon storage. Founders: Richard Mariita, David Gory Jr. and John William Bucur; San Diego

Transport: Photon Marine designs high-power electric outboard motors and fleet management software to electrify commercial vessels and phase out fossil fuels in marine transport. Founder: Marcelino Alvarez; Portland

Choosing the contenders

Trellis winnowed and published pitch videos of 25 finalists from a pool of 109 applicants from 13 nations. The applicants were judged on: solution, business model, customer need and traction, as well as team and pitch presentation.

Collectively, the applicants have attracted more than $750 million in funding. Each was required to have at least one full-time worker and seed or Series A funding.

“It was impressive how much commercial progress each finalist had achieved in a short time, with minimal resources,” Behar said. “They are all engaging partners, which is a smart way to grow faster with less capital.”

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders