JBS pledged to be net-zero by 2040. It’s far off track

The company has backtracked on its promise, calling it an "aspiration." Read More

-

- Ending deforestation in the Amazon will be critical to slashing emissions.

-

- The company’s roadmap lacks transparency.

-

- The Brazilian meatpacker was listed on the New York Stock Exchange in June, opening up new capital to fund its expansion overseas.

JBS, the world’s largest meatpacker, made its debut on the New York Stock Exchange in June, marking a comeback for a company that in 2020 had paid billions in fines to Brazilian and U.S. authorities to settle sweeping bribery and corruption cases.

The rebrand included setting ambitious climate goals to appeal to ESG-focused investors: zero deforestation in its cattle supply from the Amazon by 2025 and net-zero emissions in its global operations — which span from Brazil to the U.S. and Australia — by 2040.

Four years later, though, the company’s plans still lack transparency and credibility, according to sustainability experts. Jason Weller, its global chief sustainability officer, told Reuters in January that JBS’s net-zero pledge “was never a promise,” but an “aspiration.” The Brazilian company hasn’t disclosed how much of its greenhouse gas emissions are attributed to land-use changes such as deforestation, likely a significant source of its emissions, given that beef production accounts for more than three-quarters of the Amazon’s destruction.

The meatpacker, which supplies McDonald’s, Walmart and other big retailers, reported small cuts to emissions between 2019 and 2023 and is investing in new tools to monitor its network of cattle farmers in Brazil. But those actions aren’t enough to meet its climate goals, according to environmental watchdogs, sustainable investment analysts and groups that evaluate corporate climate plans. They noted that JBS’s public listing in the U.S. means it can raise more cash from investors to help fund expansion into countries such as Vietnam and Nigeria. Since June, JBS’s share price has risen to $15.60, an increase from its debut at nearly $14.

JBS didn’t respond to requests for comment. Chief Financial Officer Guilherme Cavalcanti told The Financial Times in June that it’s in the company’s interest to end deforestation “because we depend on the climate to have pasture for animals.”

Track record

In 2021, JBS was the first global meatpacker to announce a net-zero emissions goal. However, JBS’s net-zero plan now lags behind that of its peers, including Danone, Mars, Nestlé and PepsiCo, according to an analysis by the NewClimate Institute in June. The think tank rated JBS’s strategy as “very poor,” citing little evidence that the company is embarking on deep emissions cuts. That would require shifting to more plant-based products, reducing fertilizer use and food waste, and eliminating deforestation. JBS hasn’t disclosed whether it will rely on carbon offsets to achieve its 2040 goal.

“Without major innovations to drastically reduce the emissions footprint of meat production or diversifying away from this highly GHG emissions-intensive industry, it is not credible for livestock agribusinesses to claim that they are on a path to deep decarbonization,” the NewClimate Institute said.

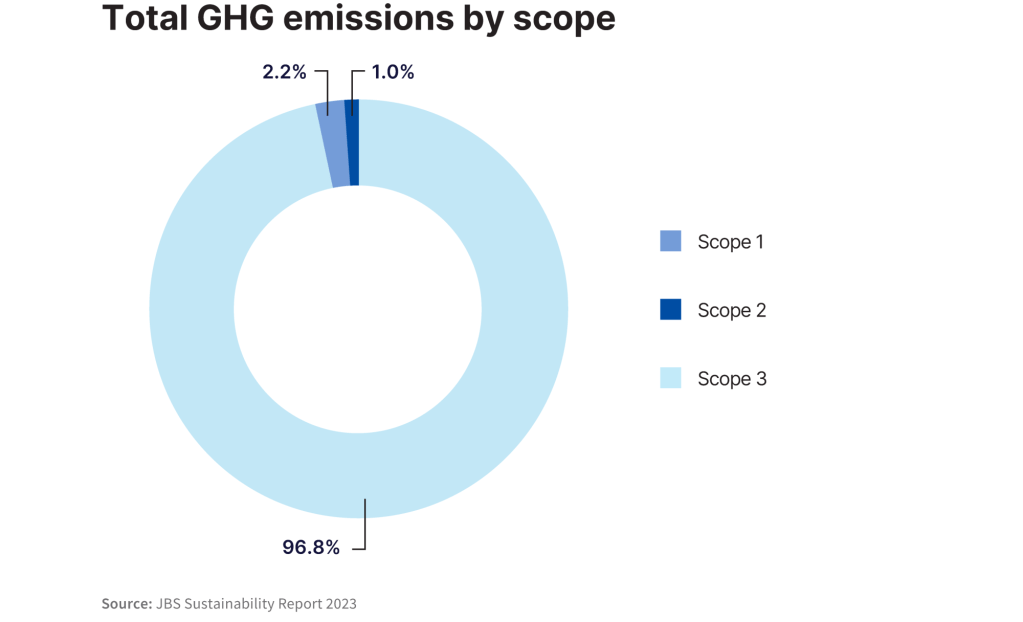

JBS’s targets cover only Scope 1 and 2 emissions, which, even if achieved by 2030, would lead to a 1.1 percent overall reduction compared to 2019. That’s because 97 percent of JBS’s emissions are Scope 3 — the result of tens of thousands of individual farming operations and millions of consumers cooking, refrigerating and disposing of its products.

Biggest challenge: deforestation

JBS slaughters some 76,000 head of cattle a day from farms across the globe. In Brazil, it’s particularly difficult for agribusinesses to link cattle to deforested lands because the animals pass through many farms before reaching the slaughterhouse, said Pablo Majer, conservation specialist at WWF-Brazil.

“The problem is those indirect suppliers, and meatpackers don’t have information on them,” Majer said.

Brazil’s federal databases of land records and livestock movements aren’t interlinked and have quality issues, reported Angela Flaemrich, director of stewardship services for Morningstar Sustainalytics, who traveled to Brazil in October 2024 to engage with companies, including JBS, on behalf of institutional investors.

Satellites can show where trees are cleared, but not when cattle move or who owns the land.

“I think JBS has put in a tremendous amount of work into this,” Flaemrich said, noting that the company traces direct suppliers — farms that are one step away from the slaughterhouse.

JBS created a Transparent Livestock Platform, which enables direct suppliers to submit information about the sources from which they purchased cattle.

That doesn’t solve the problem of tracing cattle from birth, however, which would require a nationwide animal identification system using tags affixed to calves’ ears at birth, said Flaemrich.

JBS has pilots underway, including with the government of Pará. The Brazilian state, which has some of the highest rates of deforestation in the Amazon, aims to tag all the cattle in the state by 2026. JBS said it will invest $43 million over three years to help farmers offset their costs.

Morningstar Sustainalytics gave JBS a “severe risk” rating on ESG issues. Sydney Krisanda, a research analyst, said the company has some strong initiatives to manage carbon within its own operations but continues to receive fines for sourcing cattle from deforested lands in Brazil.

Political and economic realities

There likely won’t be deforestation-free cattle from Brazil until its largest customers demand it — namely, China, the U.S. and Middle Eastern countries such as Egypt.

China buys about 40 percent of Brazil’s beef exports, Majer said, but the country is more interested in food security than ending deforestation. The U.S., the second-largest buyer, has rolled back its climate agenda under President Donald Trump. While the European Union is requiring traders to prove that cattle, soy, coffee and other imports don’t come from deforested land, the bloc is a relatively small customer for Brazil’s beef companies.

Between 2022 and 2024, the environmental watchdog groups Mighty Earth and AidEnvironment alerted JBS to more than 100 cases of deforestation in its cattle supply chain in the Amazon and Cerrado regions. JBS said the majority weren’t their suppliers, but provided no evidence to support those claims, Mighty Earth said.

Meanwhile, Brazil President Luiz Inácio Lula da Silva is focused on boosting the country’s economy, Majer said. Brazil is the world’s largest exporter of beef and soybeans, and agribusiness accounts for about 25 percent of the country’s annual GDP.

“It’s very tricky to balance these two agendas, economic and the environment,” Majer said.

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders