Survey says: North America lags the rest of the world on value-chain data

European Union regulation has pushed companies in the region to invest in better data-collection methods. Read More

- An MIT survey of 1,200 professionals shows higher use of spend-based estimates and industry averages in North America.

- The EU’s Corporate Sustainability Reporting Directive is one reason for the regional difference.

- Using lower-quality data limits opportunities to engagement with suppliers and collaborate on emissions-reductions efforts.

North American firms lag their counterparts around the world in the use of higher-quality Scope 3 data, a survey of more than 1,200 professionals from close to 100 countries shows.

The survey, conducted by the MIT Sustainable Supply Chain Lab, included responses from professionals working in supply chain, procurement, logistics, operations and sustainability.

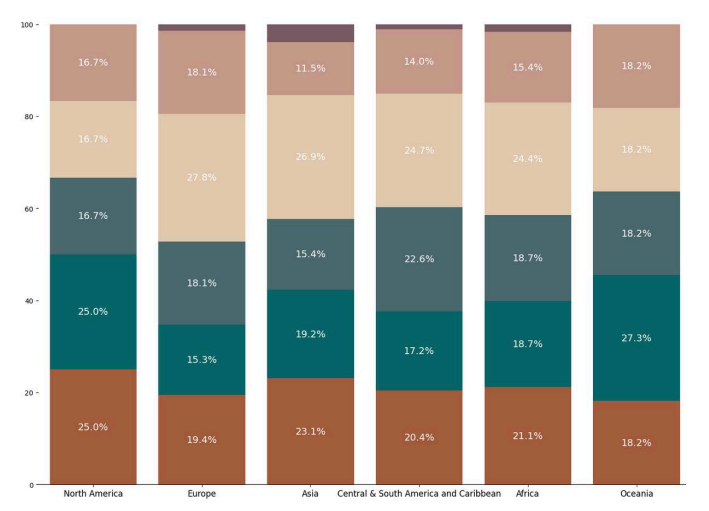

Half of all respondents in North America reported relying on the most basic kind of data on value-chain emissions — industry averages or spend-based estimates — compared to just over a third in Europe.

Use of data sourced direct from suppliers, which is generally more accurate, also showed regional differences: 28 percent of European businesses reported using supplier data, more than 10 percentage points higher than the rate in North America.

Data sources for Scope 3 measurement

The difference stems from the factors driving sustainability in the two regions, said Sreedevi Rajagopalan, an MIT research scientist and an author of the report.

European firms’ sustainability initiatives are more strongly shaped by regulation, particularly the EU’s Corporate Sustainability Reporting Directive, which requires standardized disclosures and greater transparency. These regulatory pressures have pushed European companies to invest in custom tools and supplier-level data collection.

In contrast, North American firms are primarily driven by investors and board priorities, which can be satisfied using spend-based estimates and industry averages.

“These methods are quicker and provide broad comparability — even though they’re less precise,” added Rajagopalan. “The trade-off is that spend-based and industry-average approaches can obscure real supplier-level improvements and sometimes even disincentivize sustainability investments. Companies using more detailed supplier data not only achieve more accurate emissions estimates but also strengthen supplier engagement and uncover new opportunities for emissions reduction.”