New carbon removals fund aims to spur project development

Terraset has announced the first round of pre-purchases of removals credits. Read More

- The fund aims to give carbon removal buyers a pathway to support early-stage projects without taking on early-stage risk.

- Project developers continue to scramble for capital to build their facilities and expand operations to fulfill offtake agreements.

- Revenue from sales of pre-purchased credits is returned to the fund, potentially making it self-sustaining.

Technologies to remove carbon from the atmosphere have progressed rapidly. Unfortunately, early-stage funding has not kept pace.

In 2022, non-profit Terraset set out to close this gap using philanthropic dollars. It has since deployed several million dollars purchasing durable carbon removal from more than a dozen projects that typically aim to capture and store carbon for millennia. Its latest initiative is a revolving fund created to give other carbon removal buyers a pathway to support early-stage projects without taking on early-stage risk.

Terraset launched its revolving fund in May with a seven-figure anchor grant from the Schmidt Family Foundation. Earlier this month, the non-profit announced the first round of pre-purchases from the fund. Once project developers deliver the verified credits to Terraset, the non-profit will resell to other buyers and return the sale proceeds to the fund to pay for new pre-purchases.

Purchasing carbon removal from Terraset’s revolving fund is like moving money into an earlier stage of project development, where it can be more catalytic, says Adam Fraser, Terraset’s CEO. “Corporate buyers could look at this as a way of purchasing credits in the same way they might purchase via any platform or direct procurement … but we will plow that money back in to support earlier, riskier projects.”

The power of pre-purchase

To stay on track with Paris-aligned climate outcomes, we’ll likely need to pull some 7 to 9 billion tons of carbon dioxide out of the atmosphere annually by mid-century, according to the Intergovernmental Panel on Climate Change. Offtake agreements — commitments to purchase credits in the future — are one of the best tools for building the carbon removal industry, as they provide a strong demand signal to the market. But few offtakes include upfront payments. That leaves project developers scrambling for capital to build their facilities and expand operations to fulfill the offtake.

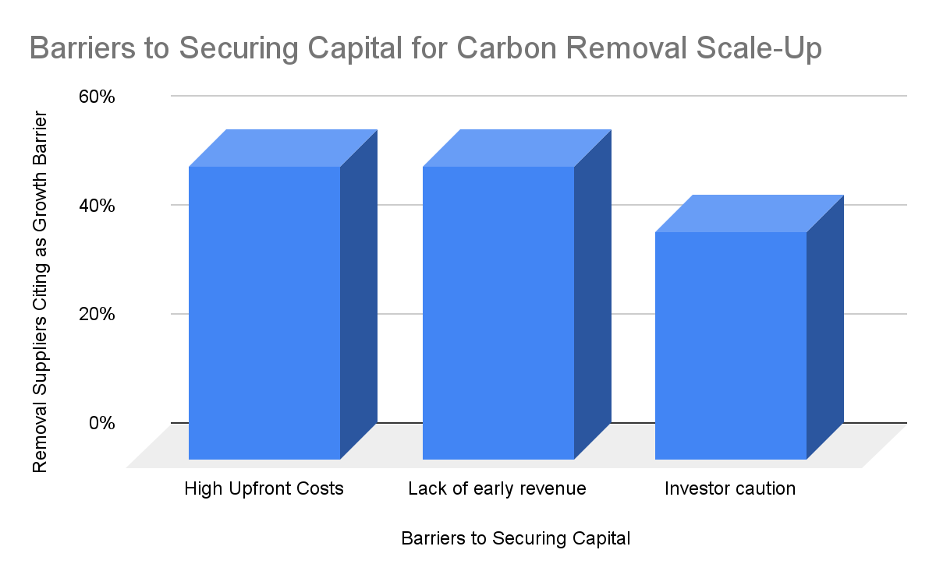

But without a playbook for commercial operation of most carbon removal pathways, low-cost capital to cover early development remains scarce. It’s a chicken-and-egg problem: as more projects successfully make it to the finish line, and deliver verified carbon removal credits, investors will gain confidence and the cost of capital will come down. But until then, the lack of early-stage capital remains a major blocker to scale, according to an industry survey Terraset published earlier this year.

The cost curves of many removal pathways exacerbate the problem, as projects have high setup costs and take several years to produce verified carbon credits.

Source: Terraset survey of carbon removal suppliers, 2025

Despite the need for early-stage funding, Terraset’s conversations with corporate buyers made clear that most aren’t ready to take on the risk of putting down money before credits are ready for delivery.

In the revolving fund, philanthropic capital provides bridge funding for scaling early-stage projects, essentially moving corporate purchases earlier in the process without asking end-buyers to take on the early-stage pre-purchase risk.

Project due diligence

Carbon removal companies can apply to the fund via the Terraset website. Terraset conducts due diligence based on its quality rubric, and leans on the expertise of its carbon council advisory board and other external advisers to provide investment recommendations to management and the board.

The first purchases from the revolving fund come from five companies: Eion, CarbonRun, UNDO, Andes and Charm Industrial. The companies use a range of removal pathways, including enhanced rock weathering and bio-oil.

“We’re capital-constrained,” said Fraser. “There are companies that have passed our due diligence with flying colors, but we just don’t have capital to purchase from them all.”

Terraset expects credit deliveries from the revolving fund throughout 2026 and 2027. Then it will begin re-selling credits to corporate buyers looking to include durable carbon removal in their climate strategies and net zero roadmaps.

Long-term plans

Fraser isn’t sure what the fund’s long-term financial performance will be, and he’s open to a range of outcomes. If Terraset is able to re-sell the carbon credits at its pre-purchase price, that will create an evergreen fund the non-profit can deploy multiple times, increasing the number of catalytic prepayments it can provide.

If Terraset is unable to recoup its upfront payments, Fraser — who will speak on a panel at VERGE in October — is still optimistic the fund will have a catalytic impact on the removal industry. “Let’s say we only got 50 percent of the money back,” he said. “It’s still going significantly further than if we do a one-and-done purchase and that’s the end of the road.”

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders