2 ways to strengthen SBTi’s new net zero draft

Scope 1 targets alone will make little difference in scaling carbon removal technology. Here's what will. Read More

The new draft of the Science Based Targets initiative (SBTi) corporate net zero standard acknowledges the critical role of companies in mobilizing climate finance and proposes a larger role for market-based climate action tools, such as carbon credits, to accelerate progress. But the proposed updates fall short of what’s needed to meet the scale and timeline of the climate emergency.

Carbon credits appear in two sections of the draft. First, the draft proposes new near-term carbon removal targets for residual emissions, but only for Scope 1. Second, it proposes stronger incentives for companies to mitigate ongoing emissions on the road to net zero, but leaves this mechanism both optional and vague.

The draft is not final. SBTi has opened a public consultation period through June 1.

Removal targets now included

The draft proposes new interim targets for carbon removal to neutralize residual Scope 1 emissions. Residual emissions are those left at the net zero year, after companies implement all possible emission reduction measures. In most cases, they’ll make up 10 percent or less of baseline emissions.

To achieve net zero status, companies need to purchase and retire carbon removal credits annually beginning in their net zero year, to neutralize their residual emissions.

The current net zero standard has no requirement that companies begin funding carbon removal prior to their net zero year — typically around mid-century — nor to estimate what their future removal needs will be. The new draft proposes a more proactive approach, introducing both near- and long-term removal targets that would require companies to ramp up carbon removal purchases on the path to net zero.

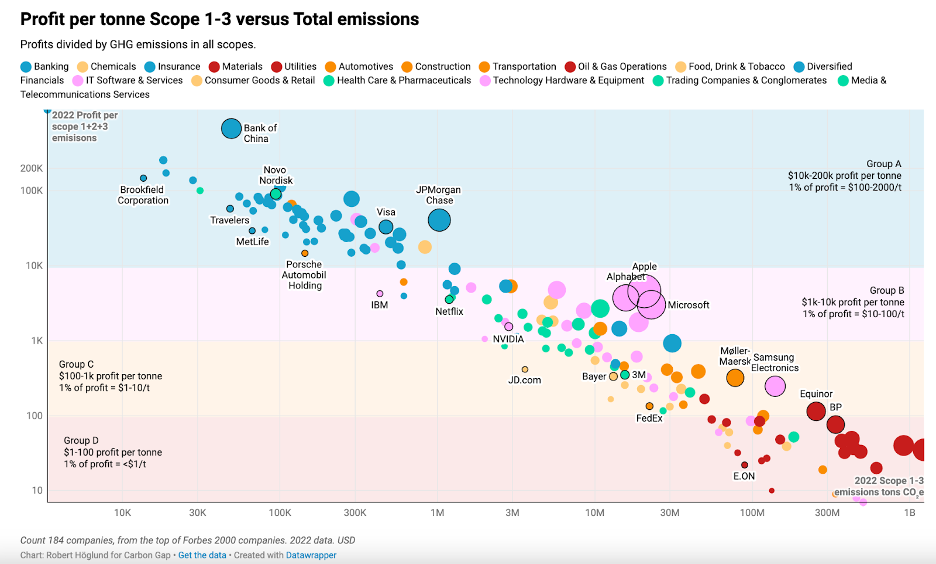

Source: Carbon Gap 2023, Who Can Pay for Carbon Removal?

Scope 1 only

But the draft limits removal targets to Scope 1 emissions only. While near-term targets of any kind are a welcome step, as written they will not not make a major difference in scaling carbon removal, according to Robert Höglund, co-founder of CDR.fyi, a carbon removal market data platform, and a member of SBTi’s technical advisory group.

That’s because large Scope 1 emitters are less likely to set SBTi targets. Indeed, SBTi will not currently validate targets for companies with direct involvement in fossil fuel extraction. Meanwhile, the bulk of emissions from SBTi-participating companies come from Scope 3 sources.

Interim removal targets for Scope 1 emissions could create demand for up to 2 million carbon removal credits by 2030 from current SBTi participants, according to an analysis from Isometric, a carbon removal registry. Unfortunately, that’s not nearly enough to bring the planet in line with a net zero pathway by mid-century, a goal that will require gigaton-scale removal.

What’s more, high Scope 1 emitters typically have the least ability to pay for carbon removal, as they have the thinnest profit margins per ton of emissions. Meanwhile, downstream companies with high profit margins per ton of emissions — such as finance, professional services and technology — have much lower Scope 1 emissions but higher Scope 3. These companies have a unique role to play in helping to scale carbon removal.

SBTi’s reason for not including projected residual Scope 2 or 3 emissions in interim targets is twofold: companies will eliminate all energy generation emissions (Scope 2) by their net zero years, and estimating residual Scope 3 emissions is complex, based as it is on value chain action. But leaving Scope 3 out of interim removal targets means the lion’s share of residual emissions from companies participating in SBTi will remain unaddressed.

Simplify the calculations

There’s a simple mechanism to solve the complexity problem. Assuming Scope 3 emissions decrease by 90 percent by mid-century, in line with overall emission reductions, that would leave companies with around 10 percent of their baseline Scope 3 emissions to neutralize at their net zero year. Interim near-term removal targets could start there.

A simplified calculation such as this would avoid placing new, burdensome emissions calculations on participating companies while recognizing the reality of the scope of carbon removal needed to hit climate targets.

How to address ongoing emissions

Companies will continue to release ongoing emissions on the decades-long path to net zero. They differ from residual emissions, which companies can’t eliminate and will need to neutralize via removals. Both have a large climate impact that will compound year over year for decades.

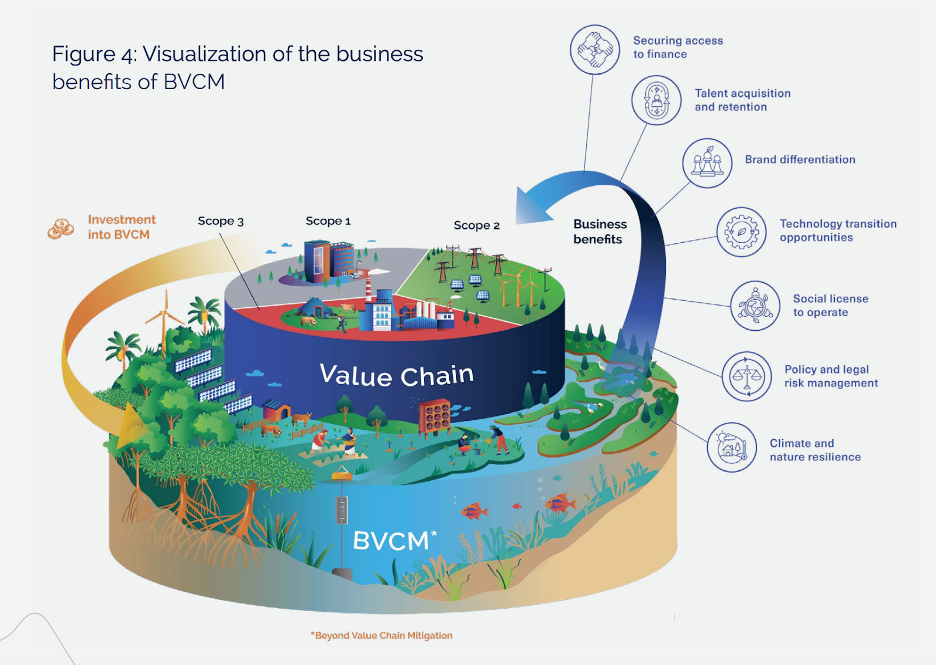

The current standard encourages companies to undertake beyond value chain mitigation (BVCM) to minimize the impact of their ongoing emissions, but there’s no requirement nor recognition for doing so.

Beyond Value Chain Mitigation (BVCM)

Source: SBTi 2024, “Above and Beyond on BVCM”

SBTi’s stated reason for not requiring mitigation of ongoing emissions is that it is aiming to “remain inclusive for companies with varying resources.” This is a surprising explanation. SBTi has never, to my knowledge, mentioned inclusivity as a guiding principle. Its publicly stated purpose is to define best practices for science-aligned climate action consistent with limiting warming to 1.5 degrees Celsius — with no mention of cost.

The draft says the initiative is seeking new ways to incentivize companies to address ongoing emissions. But this section is among the most vague in the document. Exactly what form this additional recognition will take for companies that choose to mitigate ongoing emissions isn’t defined.

Similarly, the method by which companies can address their ongoing emissions is also left undefined, but will likely follow one of the options described by SBTi in its report on this topic last year. They are a money-for-ton (or ton-for-ton) approach and using carbon credits to funnel investment into projects that accelerate global climate progress.

A framework that unleashes climate finance

SBTi is clearly listening. Adding interim carbon removal targets and strengthening recommendations around mitigating ongoing emissions are signs the body is heeding the steady drumbeat of requests from the climate community to open up all mechanisms for global climate action.

But the draft, as written, hamstrings itself. Including Scope 3 in interim carbon removal targets, and requiring action on ongoing emissions, would transform SBTi’s net zero standard into a mechanism that could unleash one of the most powerful untapped tools for climate action: private finance.

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders