SBTi wants more small companies to set net-zero goals. Here’s how it’s wooing them

Proposed changes to corporate standard are also designed to bring more midsize firms into the fold. Read More

Key takeaways

- Science Based Targets initiative’s net-zero revision introduces a new corporate classification for companies with less than $450 million in sales.

- Some requirements, such as third-party assurance of carbon accounting, are optional.

- It holds special appeal for businesses in lower- and middle-income countries.

Most companies with validated net-zero goals are big multinational organizations, but the Science Based Targets initiative’s proposed revisions include changes intended to boost adoption by small and midsize enterprises (SMEs) — especially those in emerging economies.

The 132-page proposal circulated for feedback through June 1 suggests a revised categorization model based on company size and geography. Category A refers to large multinationals. The new Category B includes small and micro enterprises with less than $50 million in annual revenue and fewer than 250 employees; and medium businesses from low- and middle-income countries with up to $450 million in sales and 250 to 1,000 workers.

Category B companies will get more time to have net-zero targets validated after they commit: two years instead of the one-year deadline set for larger companies. In addition, some requirements — such as the need to get carbon accounting verified by a third party or to trace supply chain emissions within a specific period — are optional.

The proposed revisions are more welcoming to small companies, allowing them to stay focused on directly making “good quality reductions” to emissions from their facilities and electricity purchases that are more within their control, said Cooper Wechkin, founder and CEO at consulting firm RyeStrategy.

“It was hard to blame a company for balking,” he said. “This can be tricky and expensive.”

Large-company mindset

The new model replaces criteria SBTi previously set for smaller companies and are more “realistic” for SMEs and enterprises in developing nations than the previous framework, said Chris Hocknell, director of consulting firm Eight Versa.

“This is a shift from the previously nearly uniform approach, which could offer some businesses more attainable paths toward net zero,” he said.

Many small companies that Eight Versa has advised have been frustrated with the rigidity of SBTi’s requirements, and some have chosen not to act because of that. “It’s this all-or-nothing mentality,” Hocknell said. “That is part of the problem. There’s not a perceived alternate route of even second best that is considered credible enough.”

While SBTi’s new net-zero standard is more flexible, it still requires absolute reductions for Scope 1 and 2, which can be a particular challenge for fast-growing startups — including those developing climate technologies that can help reduce emissions.

“It betrays a naivete about business that hasn’t been addressed,” Hocknell said.

Ripple effect across supply chains

One-third of the roughly 1,500 companies that already have validated net-zero strategies are small and midsize businesses — the U.S. classifies SMEs as those with fewer than 500 employees and $1 billion in annual revenue. Small companies represent a growing percentage of those booked for validation in the second quarter, according to SBTi.

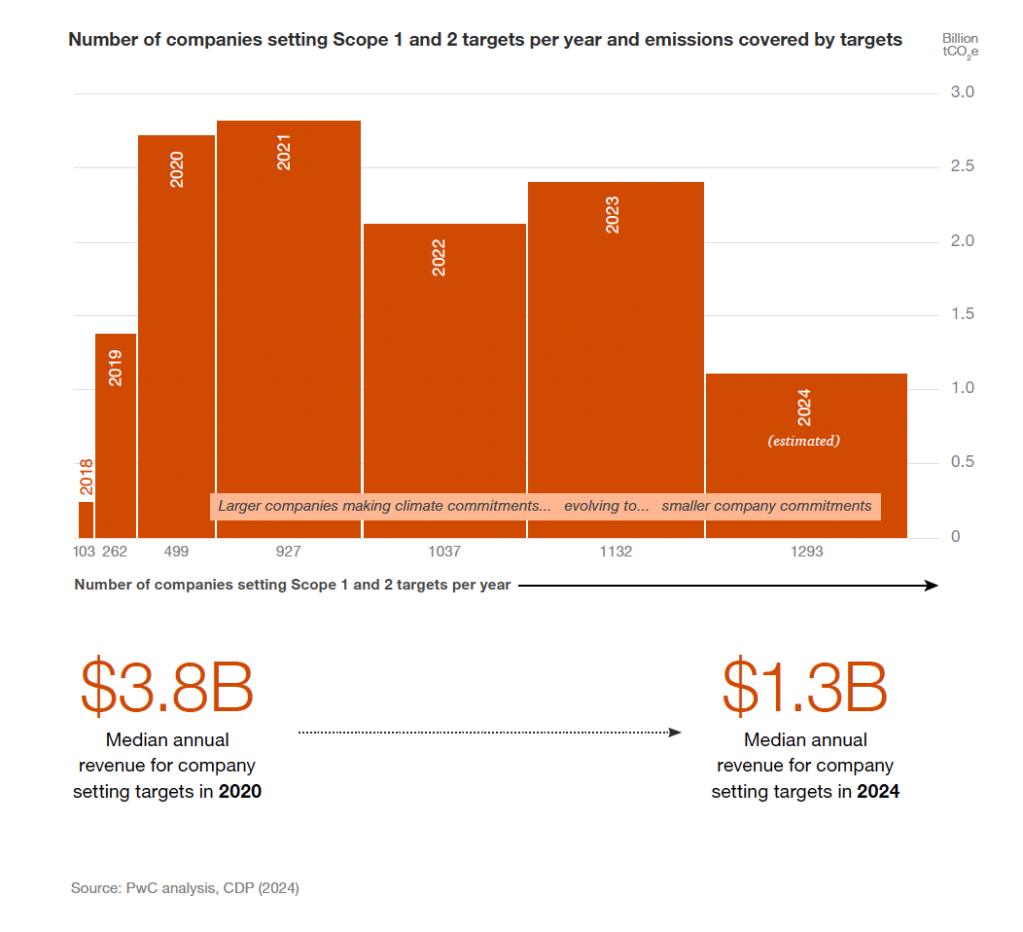

That aligns with PwC’s recent analysis of disclosures to CDP. Between 2020 and 2023, the number of companies setting greenhouse gas emissions reductions goals surged but their median annual revenue shrank to $1.3 billion in 2024 compared with $3.6 billion in 2020.

Many smaller companies are moving to set targets because they’ve been encouraged to do so by large multinationals. “We call this a ripple effect,” said PwC Partner David Linich. “Over time, they will turn to their own suppliers and ask them to do the same thing.”

Primary motivators for SMEs

Small companies considering whether to set emissions reduction goals often weigh three questions, said Mahesh Ramanujam, CEO of Global Network for Zero, which helps companies with net-zero certification. They are:

- Can I cut my costs?

- Can I get more business by doing this?

- Will I lose a customer if I don’t take this action?

“This shouldn’t be one size fits all,” he said, talking about the difficulty most companies have in calculating emissions inventories and reporting progress. “At the same time, it should not require a consultant. It should be a simple plug-in.”

Approximately 60 percent of SMEs are setting targets in response to client expectations, up from 40 percent in 2024, according to a recent survey by We Mean Business Coalition.

“Our investors want to see real, measurable progress, while our guests choose us for our commitment to sustainability,” said Ananda Putra, sustainability manager for OXO, an Indonesian property developer. “Since publicly disclosing our emissions, we’ve noticed stronger investor confidence, increased guest loyalty and reduced unnecessary energy and water, directly cutting costs.”

[Connect with more than 3,500 professionals decarbonizing and future-proofing their organizations and supply chains through climate technologies at VERGE, Oct. 28-30, San Jose.]

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders