Volatile company carbon footprints skew Scope 3 estimates, study finds

In the search for accuracy concerning value-chain emissions, some companies are adopting a metric that is highly variable. Read More

-

- Data on corporate carbon footprints is too variable to be useful in estimating Scope 3 emissions, researchers warn.

-

- A study of the carbon footprints of 62 European companies revealed significant annual swings.

-

- Companies should focus instead on using information from key suppliers to refine conventional emissions estimates.

For companies seeking to improve the accuracy of Scope 3 inventories, corporate carbon footprints can offer an upgrade to more commonly used methods. But a new study from European researchers suggests that “unpredictable variation” in company-level data severely limits the usefulness of the approach.

To total up Scope 3 numbers — emissions from suppliers, use of products by customers and other indirect sources — companies most often base estimates on activity levels or spending. For a purchase of steel, for instance, a company might multiply the quantity purchased by an estimate of the emissions associated with the production of a typical ton of the material. Use of these emissions factors makes the process relatively easy to implement, but such broad estimates disadvantage suppliers selling lower-carbon versions of a product.

As an alternative, a supplier can estimate its total emissions — its corporate carbon footprint — and allocate a fraction of that total to its customers, depending on how much of its output each purchases. The process, used by CDP and other standard-setters, ensures the benefits of any emissions reductions implemented by the supplier will be passed on to customers — but it also means many less relevant factors influence the estimate.

Unstable estimates

Company footprints can fluctuate due to acquisition or divestments, for example. Product lines can be eliminated or expanded, and accounting methodologies change. All would affect a supplier’s footprint — and hence the emissions allocated to customers — but might not change the actual emissions associated with the customer’s purchases.

To examine the problem, crtl+s, a Berlin-based climate tech company, teamed up with researchers at the University of St Gallen in Switzerland. They looked at corporate carbon footprint data disclosed to CDP by 62 European companies, all of which had committed to emissions goals with the Science Based Targets initiative.

“All 62 companies exhibited strong volatility in specific emissions over the five-year period,” the team concluded in a white paper released this week. “Even among climate leaders, emissions data proved unstable.”

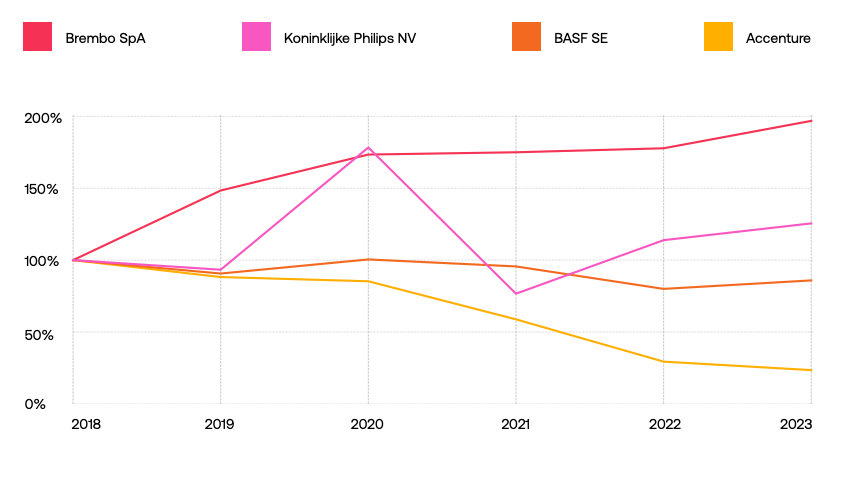

Using footprints from 2018 as a starting point, the group plotted percentages changes over the following five years. In the case of tech company Philips, total emissions came close to doubling one year before dropping back below baseline 12 months later.

Tracking emissions

The team will next search for the cause of such sudden changes. “But I know for sure it’s not specific emission reduction activities,” said ctrl+s CEO Moritz Nill. Changes from such causes are more likely to be in the 2 percent-per-year range, he added.

Product footprints are coming

The long-term solution, Nill and others say, is to use carbon footprints tied to specific products. Industry groups are collaborating to streamline the creation and sharing of such footprints, including Catena-X in car manufacturing, Mondra in food retail and sector-agnostic systems such as the Partnership for Carbon Transparency, being developed by the World Business Council for Sustainable Development.

In the meantime, Nill recommends sticking with emissions factors and refining the estimates using information from suppliers about specific emissions-reductions measures they have implemented.