New Texas law threatens viability of battery energy storage systems

Among several onerous provisions, HB 3809 mandates that battery energy storage infrastructure be dismantled at the end of its lifecycle. Read More

-

Effective September 1, HB 3809 mandates full decommissioning of battery storage systems at the end of their lifecycle.

-

BESS developers must provide financial guarantees for cleanup costs and comply with landowner requests for additional rehabilitation.

-

Renewables face stricter rules than fossil fuels, as a similar bill for oil and gas allows more flexibility, highlighting regulatory disparities in Texas energy policy.

Texas Gov. Greg Abbott signed House Bill 3809 into law May 29, mandating that all battery energy storage systems (BESS) facilities be decommissioned at the end of their lifecycle. This law, which takes effect Sept. 1, applies to both standalone BESS facilities and those co-located with solar and wind power plants, and requires developers to sign a non-waiver clause forbidding any contractual changes.

(A somewhat similar bill, SB 1150, was sent by the Texas legislator to Abbott’s desk requiring oil and gas companies to plug abandoned wells after 15 years, although that bill provides more opportunities for flexibility and extensions for the fossil fuel companies.)

Fundamentals of HB 3809

HB 3809 is very specific regarding its intended targets. The main provisions of the law are:

- Mandatory decommissioning of BESS facilities at their end of lifecycle: This process includes the removal of buried cables, transformers and inverters, and all foundations need to be dug at least three feet deeper than the original structure to ensure proper site restoration.

- Landowners’ right to request additional rehabilitation measures: Landowners can request that the owners of the BESS equipment undertake additional work such as removing internal roads, reseeding land with native plants and rehabilitating the land to agriculture standards.

- BESS developers must provide financial assurance for decommissioning measures: Projects owners will consult with a third-party engineer to provide a total cost for decommissioning, both before the start of the project and annually until the termination of the lease or the 15th year of the BESS.

Texas’ energy reality

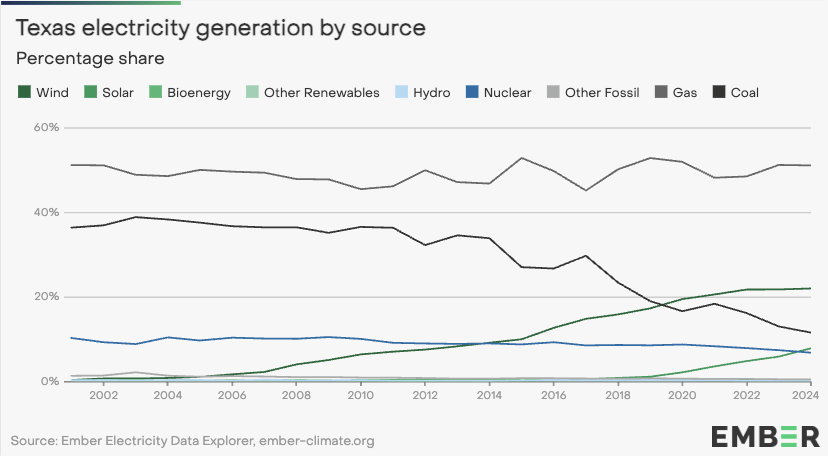

Texas ranks first in the U.S. in total wind power production, and second nationally for solar capacity. In 2024, wind and solar produced almost 30 percent of the state’s total energy, while coal produced around 11 percent. Gas is the largest source of energy within the state, accounting for more than half of all electricity production in 2024.

Infamous for an unreliable grid that fails in extreme weather, Texas solar energy and battery storage provided grid stability during the peak of summer 2024, generating 25 percent of power needs during mid-day hours between June 1 and Aug. 31, according to the Electric Reliability Council of Texas (ERCOT).

To store renewable energy, as of 2024 Texas built 6,500 megawatts of utility-scale battery capacity, according to the Energy Information Administration.

Economic impact on battery storage

What does HB 3809 ultimately mean for the the future of Texas’ battery storage industry?

“Its burden falls heaviest on lithium-based storage,” said J. Goldsbury, VP of strategy and development at Renuvi Energy, adding that HB 3809 “is more than just a regulatory shift – it’s a market signal.”

Goldsbury explained that developers using lithium-based batteries — the most widely available and market-ready type of battery — will face greater upfront costs due to HB 3809. And any money potentially recouped by selling or recycling the decommissioned lithium is far from certain.

“Lithium markets are volatile, and recovery economics are far from predictable,” explained Goldsbury. “Current recycling initiatives are costly and logistically complex with a limited number of companies currently available in the U.S.”

“It could make it harder for companies to keep there projects financially viable,” agreed James Allsopp, CEO of iNet Ventures, a PR agency that works closely with battery storage companies.

But there are some positive ramifications of the law.

“We see this law as a long-overdue recognition of what Renuvi has known from the start: not all battery systems are created equal and infrastructure-based deployments that support the power grid should be designed with typical grid lifecycles in mind,” said Goldsbury.

The law incentivizes continued battery storage innovation that will eventually cut waste from the technology. “It encourages eco-friendly practices and careful disposal,” said Allsopp.

Of course, a large portion of federal funding to pay for this innovation is up in the air as the Senate continues to edit the House’s reconciliation bill.

[Connect with more than 3,500 professionals decarbonizing and future-proofing their organizations and supply chains through climate technologies at VERGE, Oct. 28-30, San Jose.]

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders