How Trump’s ‘Big Beautiful Bill’ is affecting climate tech investment

It's mostly wait-and-see mode for startups and investors, but at some point “markets will come roaring back,” said one venture capitalist. Read More

- Overall first half funding is down 19 percent compared to 2024, even as “mega-deals” have increased.

- While the bill changes the policy outlook for climate tech, the tailwinds started by the IRA aren’t fully gone.

- Even as Washington retreats on certain tax credits, some regional players — especially California — are filling the gap.

Based on results from the first half of 2025, climate tech investment is in wait-and-see mode.

Grappling with shifting macroeconomic factors, geopolitical tensions and domestic policy changes, investors have shored up cash, waiting for markets to find some semblance of certainty to start re-allocating capital with confidence.

“We found a real slowdown in the first half of the year … people are just not investing in the face of uncertainty,” said Yi Jean, a partner at Clean Energy Ventures, which invests in early stage companies scaling decarbonization solutions.

First half funding is down 19 percent compared to 2024, according to CTVC. And while “mega deals” (greater than $100 million) are up 31 percent, early-stage climate tech investment has decreased, with seed and Series A investment totals dropping by 26 percent and 12 percent, respectively,

This deceleration has forced startups to get back to fundamentals. It’s important for founders and investors to recognize the moment we’re in, said Gabriel Kra, co-founder at Prelude Ventures, investing in climate technologies since 2009: “In today’s climate tech new normal, cash and unit profitability is more important than growth.” In essence, he continued, “you can’t sell an investor on a vision, you have to prove unit economics and profitability, and how you’re not dependent on tax incentives to reach profitability.”

While uncertainty weighs on both startups and investors, how have the specifics of the Trump administration’s budget and policy bill, the “One Big Beautiful Bill Act,” affected investor sentiment? Does it provide additional certainty or muddy the waters further?

Less than disastrous

While the bill changes the policy outlook for climate tech, tailwinds from the IRA aren’t fully gone.

“The sense of disaster has been overhyped,” said Leonardo Banchik, investment director at early-stage venture firm Voyager. “While the IRA could have been stronger, several important provisions remain intact, which makes a real difference for the sector.”

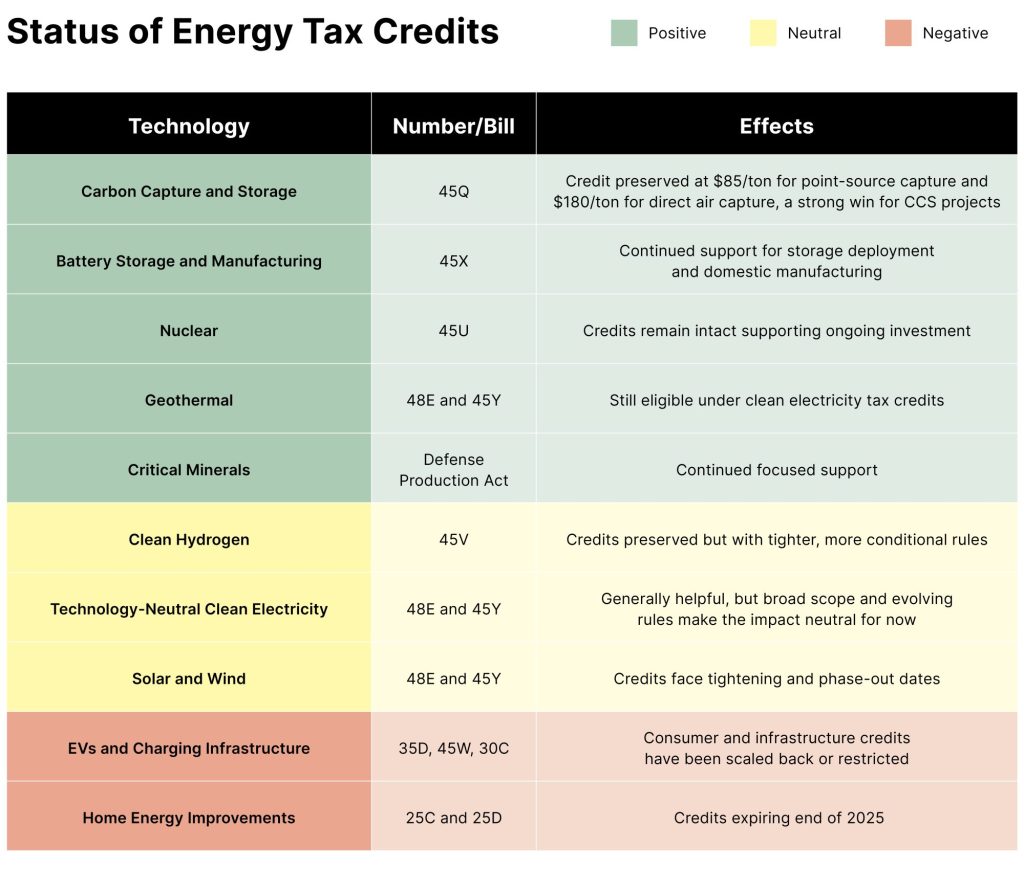

The table below shows which sectors the new law is positive, neutral or negative for. For a comprehensive breakdown of the bill, I recommend exploring reports, including one from Columbia University and another from Rhodium Group.

Startups respond

It’s a mixed bag for startups, dependent on their tech and business models.

The strategy of Ateios Systems, an early-stage battery startup that designs electrodes without toxic chemicals, is focused on unit economics, operating towards profitability without help from policy, said founder and CEO Rajan Kumar. The bill “is helping our business [from the domestic manufacturing perspective] but it’s not the only thing,” he added. With tax credits for battery manufacturing still in place, Ateios should be able to lower its prices and increase its margins.

For Harvest Thermal, an early-stage smart HVAC startup, the bill is both boost and drag. With home energy credits expiring at the end of this year, homeowners will no longer be able to claim a 30-percent tax credit on technologies such as Harvest Thermal’s. “While the loss of 25D creates headwinds, it has also encouraged us to deepen our partnerships with state and local programs, where we see much of the momentum shifting anyway,” said Jane Melia, the company’s co-founder and CFO.

The state of California, for example, is offering up to $25,000 in combined incentives for systems such as Harvest Thermal’s. So while Washington retreats on certain tax credits, some regional players are filling the gap.

At the same time, other tax credits, such as 48E, provide a 30-50 percent credit for advanced HVAC systems through 2033.

At the end of the day, said Melia, “policy shifts like this remind us that incentives come and go, but customer value must remain permanent.”

The case for optimism

Even under the current administration, tailwinds remain for a number of climate technologies. The current environment requires startups to get creative with regional incentives and focus on creating superior products.

Voyager’s Banchik expects the bill to inject certainty into the market and fuel more investment in the rest of the year. “While we invest in companies with strong fundamentals that don’t depend on policy incentives, having these provisions enshrined in law reduces risk and eliminates countless hours of discussions to build confidence,” he said. “We’re already seeing this certainty in the investments we’re making. It’s as simple as: Credits are extended, so let’s move forward.”

Kra of Prelude Ventures referenced James Taylor: He’s seen fire and he’s seen rain. At some point, “markets will come roaring back,“ Kra said, and “companies that meet that moment with unit economics will be poised for growth and tremendous financial success.”