Why Venus Williams wore wool at the U.S. Open

The material's evangelists see the tennis star's latest outfit as a 'breakout' moment for the fiber in high-performance settings. Read More

- Her Merino U.S. Open look reignited attention on wool as a sportswear fiber.

- Wool offers natural breathability, moisture management and biodegradability but faces cost and scaling hurdles versus synthetics.

- While big brands still rely on fossil fuel blends, smaller players and Woolmark-led collaborations are pushing wool into public view.

Tennis legend Venus Williams turned heads at this year’s U.S. Open, carrying a high-fluff shearling tennis racket case by small Venice Beach brand ERL. She flashed more sheep-forward fashion while playing with John McEnroe in a black Merino wool dress by Brooklyn designer Luar.

For more than 10,000 years, wool was an OG outdoor fiber. Like Merino sheep, people benefit from wool’s temperature-regulating properties in extreme cold and heat. Athletes like its moisture-deflecting, odor-resistant properties.

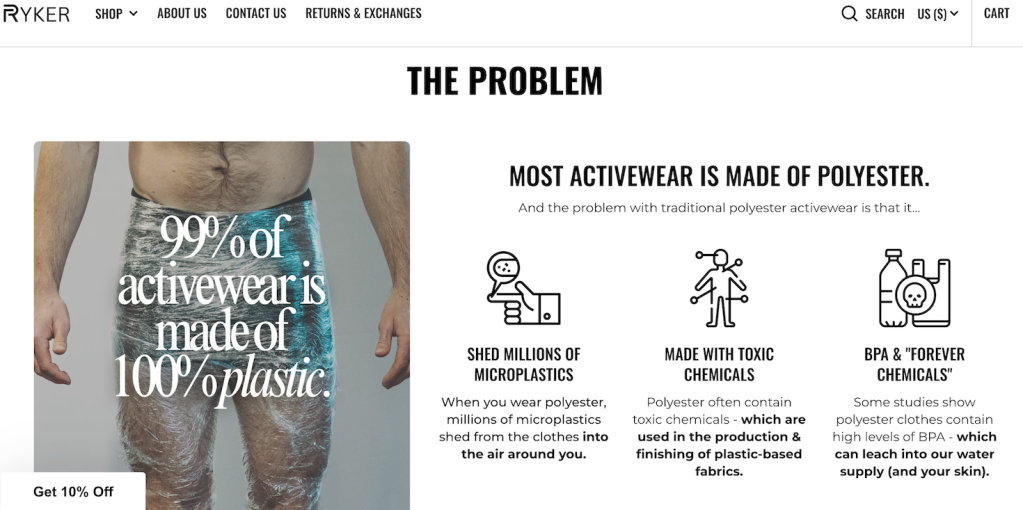

In a few short decades, though, stretchy synthetic blends became the materials to beat in sports. Pro leagues play in highly engineered polyester, nylon, spandex and elastane. Lightweight, fast-drying and highly specialized blends endure friction, torque and frequent washings. Adidas, Nike, Puma and Under Armour are continuing their commitments to synthetics for uniforms, but also investing in recycling systems and startups to slim the virgin petro-fibers from their climate footprints.

And with those synthetics making up two-thirds of all fashions, many younger adults have little experience with wool, thinking of the itch factor of rougher fibers rather than pliable, cushiony Merino.

A ‘breakout’ for wool?

But now, sustainability experts see the pendulum swinging back.

“Anything that one of the Williams sisters is promoting could be a breakout moment in tennis products,” said Cynthia Power, a former Eileen Fisher director who co-hosts the Untangling Circularity podcast.

Wool makes up just less than 1 percent of the global fiber mix, according to the International Wool Textile Organization (IWTO). That was about a million metric tons’ worth in 2023, based on a count by the Textile Exchange.

However, the demand for natural textiles will nudge the annual wool market from $43.9 billion in 2025 to $52.6 billion by 2030, with annual growth just under 4 percent, according to Mordor Intelligence.

And while brand giants are not yet championing wool, numerous small companies are using the material, casting it as free of the chemical and carbon burdens of oil-based fibers. The list of these makers includes Mons Royale, Ibex, Devold, Woolx, Woolly, Wool&, Ryker, Röjk Superwear, Ridge Merino and Duckworth.

“We’re excited to see Merino on a global stage,” said VF Corporation’s Alicia Chin, director of sustainability and social impact for emerging brands. VF, the parent of The North Face and Vans, snapped up wool labels Icebreaker in 2018 and Smartwool in 2011. Chin predicted that wool will reach the mainstream as companies further enhance its quick-dry time, moisture-wicking and cooling properties.

Smartwool, launched by ski instructors in 1994, helped to popularize fine Merino. The label’s formula blends in recycled polyester and Tencel fiber. VF does not break out sales of sub-brands or fibers, but Smartwool took in $31 million in 2024, according to ECDB analytics.

Since 1965, Woolmark of Australia has represented wool producers. To elevate the fiber, it has collaborated with a wide spectrum of designers. Among the examples of wool in high-sweat settings:

- Running: Optim technology, by Woolmark with Nanshan Group, stretches 100-percent fine Merino fibers before spinning, for a super-dense, windbreaking and water-resistant outerwear fabric. In 2023, a Woolmark-sponsored ultramarathon in Korea clad runners in Optim jackets made by The North Face. Wool also appears in shoes: Circle Sportswear’s Supernatural Runner, the Salomon PULSAR PRG KNIT and numerous Allbirds.

- Sailing: The Luna Rossa Prada Pirelli sailing team wore wool at the Americas’s Cup last year.

- Golf: The TaylorMade label, which partners with Tiger Woods, has marketed Merino apparel in South Korea.

- Swimming: Several companies are making wool swimsuits, with ads showing Olympic swimmers.

“Wool truly is an ideal fiber” for sports and recreation, said Nica Rabinowitz, who manages brand engagement and supply chain efforts at the nonprofit Fibershed. “A lot of these synthetic fibers are trying to recreate what wool does, but are not able to do it as well and likely never will.”

Wool’s edge

Merino base layers outperformed synthetics for regulating body temperatures in hiking, cycling and golf, according to a study by North Carolina State University (which was funded by Woolmark).

“Wool already has a meaningful share in base layers and multi-sport, next-to-skin applications,” said John Roberts, managing director of Woolmark in London. He foresees wool helping brands to phase out PFAS forever chemicals and combat microplastics.

Engineering wool to create outerwear without toxic water-proof coatings also aligns with regulatory pressure, Roberts added. Anti-PFAS laws are already on the books in New York and California, and spreading throughout Europe. As evidence builds about the health harms and prevalence of microfiber pollution, plastic textiles pose future risks to brands and retailers.

The sustainability question

Australia, China and New Zealand are wool production hotspots, and industrial transparency is scant. However, sustainability-driven brands emphasize their vetting of smallholder suppliers. Smartwool, for one, sources 85 percent from ZQRX-approved “regenerative” farms in New Zealand. Wool meeting the Responsible Wool Standard (RWS) for animal and land welfare practices, grew in market share slightly in 2023, to 4.8 percent over 4.2 percent a year earlier.

The sustainability picture for wool is complicated. Not least, sheep require ample land for grazing. That’s partly why wool is the third worst material for methane emissions, according to Collective Fashion Justice. Leather, wool and cashmere combined contribute 75 percent of the industry’s methane despite making up only 4 percent of its materials, according to the Australian nonprofit’s Sept. 15 report offering “the first methane footprint for the fashion industry.”

Wool boosters complain, however, that lifecycle analyses unfairly depict polyester and its ilk as less impactful. They point out orange-to-apples equations of the emissions of petrochemical fiber production against those from wool, which remain within the natural carbon cycle.

“One challenge is that natural fibers are often assessed on the wrong terms using models that don’t account for their ability to regenerate land or to biodegrade,” said Roberts of Woolmark. “Regenerative grazing sheep, for example, can improve biodiversity, store carbon and build soil health, so the farm itself becomes part of the circular system.”

The recycling rate for wool is only 6 percent, but that’s much higher than for other fibers. Only 1 percent of fabrics overall were recycled from waste textiles. And although 12.5 percent of polyester comes from recycled sources, most derives from plastic bottles or fishing nets rather than fashion waste.

Recycling 100 percent wool often results more in stuffing than sweaters. (The word “shoddy” originally described rags recycled from wool 200 years ago.) Blended fibers are generally impossible to recycle to their original integrity, and wool blends are no exception.

However, when wool waste naturally biodegrades, it can fix nitrogen and feed the soil, according to Rabinowitz of Fibershed. “Because it is so great for soil health, it is a wonderful renewable resource.”

Can wool scale in athletic wear?

There’s a bottom-line reason why polyester fleece, which Patagonia brought to market in 1979, has eclipsed the sheep-based original.

“Synthetics for the most part can be 20 percent less expensive,” said Tsui Pappas of the consultancy Pappas Creative in New York. “There is pressure from the C-suite at every brand to have higher margins.”

But apparel businesses can and should adjust cost or margins to prioritize natural fibers, according to Pappas, the former director of sustainability at Alice + Olivia. She points to the food industry: Consumer messaging about the value of organic produce eventually led to its mass adoption, and prices dropped when demand scaled.

And with enough development and support, biobased synthetics could address plastic shedding and lack of compostability in fabric blends. Advanced knitting technologies for wool, as well as blends with algae and other next-gen fibers, may also elevate sustainability and performance.

“We will continue our commitment to wool because we see its strengths: tech, versatility and legacy,” said Raul Lopez, founder of the Luar label, in a statement. “It’s why Venus chose wool for her U.S. Open kit.”

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders