3 signs of progress for voluntary carbon markets in 2025

Prices for higher-quality credits trended upwards, among other encouraging signs. Read More

- Higher-quality credits now trade at a roughly 30 percent premium.

- Projects that combine carbon capture with industrial processes attracted significant investment.

- Google and others purchased credits from projects that capture and destroy highly potent greenhouse gases.

Twelve months in voluntary carbon markets tends to feel like at least twice as long, such is the pace of change. This year was no exception. There were controversies — what else did you expect? But 2025 also saw an uptick in quality, alongside an overdue focus on super-pollutants.

Here are three key trends that help make sense of the year:

Markets continue to mature

More than half of businesses expect to moderately or significantly increase engagement with carbon markets between now and 2030, according to a survey released last month by SE Advisory Services, consulting arm of energy technology company Schneider Electric.

The finding was the latest to suggest that while buyers remain cautious, a corner has been turned and interest in credits is on the rise. And that interest appears to be supporting higher-tier credits, which this year traded at a roughly 30 percent premium compared to lower quality tiers, according to an index maintained by Calyx Global, an independent rater of credit projects, and ClearBlue Markets, a consultancy.

Markets nonetheless contain plenty of problematic credits. Another Calyx Global index that tracks the quality of newly minted credits took a nosedive this quarter, mainly due to the issuance of low-quality credits for hydropower projects. A reminder of the dangers of buying from the wrong project came in October when the status of carbon-neutral claims made by Volkswagen, Nespresso and other companies were thrown into doubt after Verra, the world’s largest carbon credit registry, concluded it had issued millions of excess credits.

Growing interest in industrial integration

A spate of projects that bolt carbon capture and storage onto existing industrial processes got funded in 2025, including Microsoft’s purchase of 4.9 million tons of removal credits from Vaulted Deep, a startup that buries organic waste underground. “Microsoft wants your poop to lower its emissions,” ran a headline in the Wall Street Journal.

The startup takes “bioslurry” — organic waste from paper mills, livestock operations and wastewater treatment — and injects it hundreds or thousands of feet below the ground. The process is carbon negative because the waste contains carbon originally removed from the atmosphere by plants.

Entrepreneurs are increasingly realizing that other industrial processes can form the basis for carbon removal. Carbon dioxide is being stripped from water flowing through desalination plants, for example. A startup named Arca has tested a system for churning the surface of mine waste, exposing minerals that react with carbon dioxide in the atmosphere. And in April, the Frontier buyers’ coalition said it would pay $33 million to fund the installation of carbon capture technology at Norway’s largest waste incineration plant.

Methane is having a moment

The chorus of voices arguing for more attention to be paid to methane and other super-pollutants has been steadily growing in volume. And that advocacy is paying off, with a continuing surge in interest in methane credits.

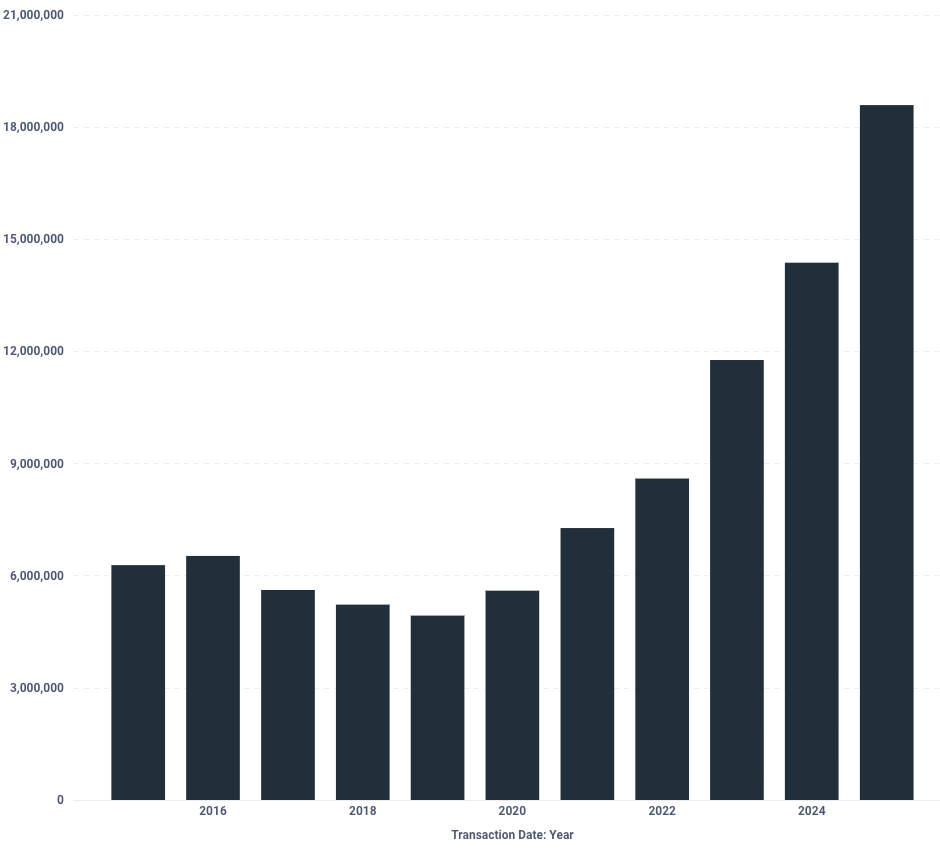

Around two-thirds of methane leaves the atmosphere after 12 years, but during that time its impact on warming is up to 150 times greater than that of carbon dioxide. Projects that capture the gas from landfills, disused mines and other sources have been gaining in popularity this decade: Annual retirements of credits from methane projects have tripled to more than 18 million metric tons of carbon dioxide equivalent since 2019, according to Allied Offsets, a carbon markets data firm.

Annual retirements of methane credits

Google is one of the more notable buyers. In May, the tech giant said it had contracted for credits generated by projects that will eliminate 25,000 tons of methane and hydrofluorocarbons (HFCs) by 2030. Because the two gases trap heat more effectively than carbon dioxide, the impact of the credits over 100 years will be equivalent to eliminating 1 million tons of CO2.

Google’s purchases fund projects that destroy HFCs from HVAC systems and capture methane from a landfill. Creators of earlier-stage technologies could soon get a boost from Mission Methane, a new competition from XPRIZE designed to accelerate the progress of fledgling methods for avoiding methane releases or removing the gas from the atmosphere. The prize will launch next year, provided funding can be finalized.

Subscribe to Trellis Briefing

Featured Reports

The Premier Event for Sustainable Business Leaders