What Meta’s big nuclear deals say about corporate clean energy strategy

The social media giant's commitment underscores broader corporate interest in clean power that's available at night. Read More

- Close to 18 percent of corporate clean energy deals in 2025 were for fusion, geothermal, hydro and nuclear generation.

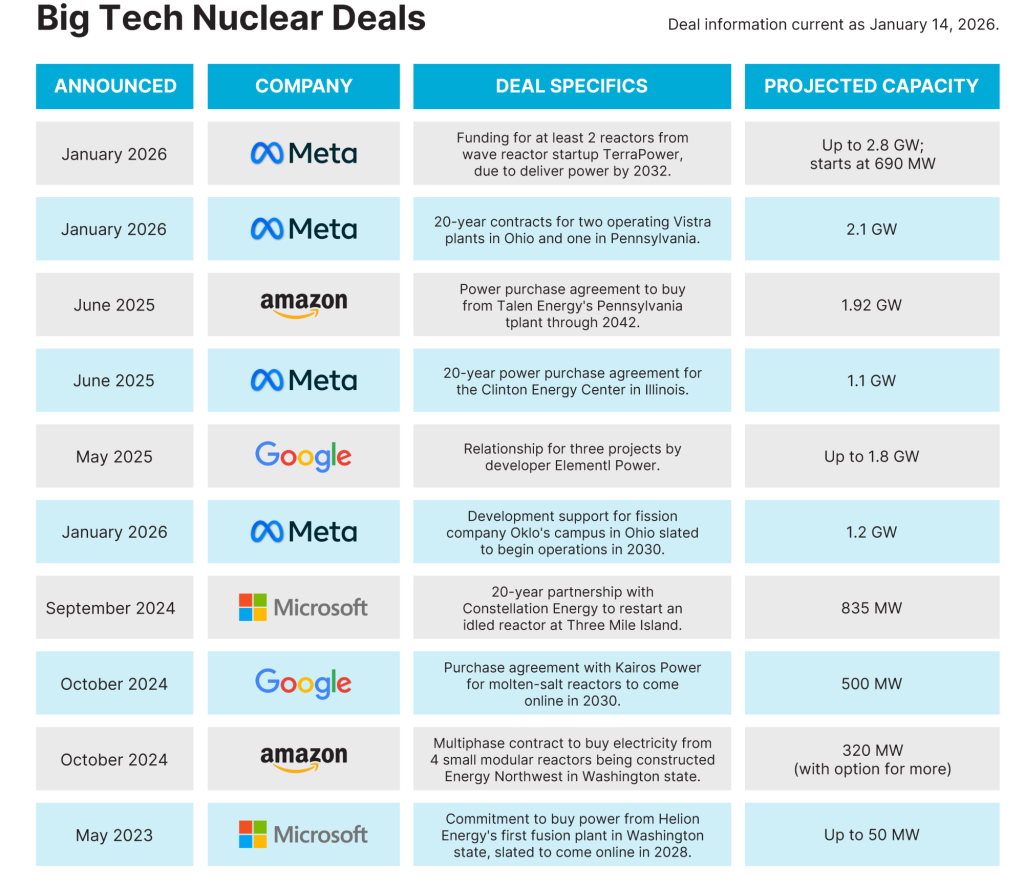

- Amazon, Google, Meta and Microsoft have publicly contracted for at least 13 gigawatts of nuclear energy and invested in advanced startups.

- The contracts cover both legacy power plants and unproven technologies, including fusion.

Meta’s three new deals for up to 6.6 gigawatts in nuclear energy aren’t just record-breaking; they underscore growing corporate interest in clean power that’s available at night.

Contracts orchestrated by companies with emissions reduction commitments added (or will add when the projects are complete) close to 128 gigawatts of renewable or clean energy to the U.S. electric grid from 2014 through November 2025, according to data collected by the Clean Energy Buyers Association (CEBA).

Wind farms and solar installations represent the vast majority of that new power, but deals from generation resources that can run around the clock, such as fusion, geothermal, hydro and nuclear, are growing. They accounted for 17 percent, or 3.4 gigawatts, of new capacity in the first three quarters of 2025.

There are 21 related contracts since 2021 in 10 states: Illinois, Nevada, New Mexico, Ohio, Pennsylvania, Tennessee, Texas, Virginia, Washington and West Virginia.

“No matter how you slice the data, it is a fast-emerging trend. This is taking off fast,” said CEBA CEO Rich Powell. “I have every reason to expect you will see significant deals through 2026.”

Nuclear energy has been undervalued for some time, but corporations interested in sourcing low-carbon electricity are reevaluating this resource because it can provide power when solar panels cannot, said Gavin McCormick, co-founder and executive director of nonprofit WattTime, which tracks grid emission data.

“Why it’s valuable is because it works at night,” he said.

Several announced deals — and the corporate funding behind them — have had the effect of adding nuclear power plants back to the grid or keeping them operating. “Preventing a nuclear plant from closing is excellent additionality, even if it’s not new,” McCormick said.

Big Tech loves nuclear power

Amazon, Google, Meta and Microsoft are behind the biggest corporate nuclear deals, but big industrial manufacturers, including steel maker Nucor and chemical company Dow are also signing contracts.

The publicly announced nuclear deals for Big Tech alone will support close to 13 gigawatts. Nuclear plants account for close to 20 percent of the power on the U.S. electric grid, and almost half of the resources that are considered “zero emissions” (which includes solar, wind, hydro and geothermal).

With its latest deals, Meta has now committed to buying more nuclear power to address its emissions goals than any other U.S. company, with approximately 7.7 gigawatts of contracted electricity.

The company signed a power purchase agreement in June 2025 with Constellation that covers 1.1 gigawatts from an Illinois power plant over the next 20 years.

Meta’s three new contracts support a mix of legacy and advanced nuclear. They include 20-year deals with Vistra to extend the life of two plants in Ohio and one in Pennsylvania, as well as to expand their capacity. Meta is also funding advanced reactors to come online early next decade from startup TerraPower, well funded by investors including Microsoft founder Bill Gates; and Oklo, heavily backed by OpenAI CEO Sam Altman.