California’s deadly fires illuminate an insurance industry ill-prepared for the climate crisis

Estimated damages at week's end from the Southern California apocalyptic fires reached $150 billion. Read More

As the inferno in Los Angeles County spread this past week, causing 10 deaths, 9,000 destroyed buildings and 35,000 scorched acres so far, experts also feared it is exacerbating a home insurance crisis gripping California and much of the nation.

AccuWeather estimated Wednesday that total damages will exceed $52 billion, with estimates of insured losses $20 billion. By Friday, AccuWeather increased nearly tripled its total damage estimate, to a range of $135 billion to $150 billion.

While the fire’s spread was being contained in areas finally, the Santa Ana winds keep whipping across the bone-dry Los Angeles area, whose usual winter rainy season never arrived, transporting embers to ignite neighborhoods and hillsides. The Pacific Palisades, Eaton, Hurst and Sunset fires continue to burn and are only minimally contained.

“This is not a normal red flag alert,” said Los Angeles County Fire Department Chief Anthony C. Marrone at a news conference. “L.A. County and all 29 fire departments in our county are not prepared for this type of widespread disaster.”

Neither is the insurance industry. Providers were already in crisis mode over its handling natural disasters that many believe are the result of climate change, so much so as they chose to pull back on offering policies or abandoning at-risk regions altogether. This latest disaster is likely to see more calls for reform and for new models to help property owners recover their losses over extreme weather-related incidents. The issue of climate change will undoubtedly be front and center in those discussions.

Age of catastrophe

Extreme weather events and catastrophic losses are not a California-only problem. A few months ago, Hurricane Milton pummeled Florida, causing more than $100 billion in total losses including an estimated $34 billion in insured losses. Two weeks earlier Hurricane Helene and its floods racked up damages of $59 billion, according to the North Carolina State Budget Office, only a quarter of which was insured. Insurers have retrenched all over the country, hiking premiums or not renewing policies and leaving some states altogether.

The U.S. Senate Banking Committee released a report last month finding that the home insurance crisis has spread to 17 states, while the percentage of non-renewals rose in 46 states in 2023. Homeowners in Oklahoma, Iowa, South Dakota, New Mexico, Nebraska and elsewhere have joined those in Florida, Louisiana, California and North Carolina scrambling for insurance.

Meanwhile, insured losses due to “U.S. natural catastrophes” hit $109.6 billion in 2022, about a twentyfold increase from $4.6 billion in 2000, according to the Insurance Industry Institute. Globally, damages from extreme weather totaled $320 billion in 2024, of which $140 billion were insured losses, according to Munich Re, numbers that double the average annual losses over the last 30 years.

Here’s what’s being tried to solve the insurance debacle in California, and what’s recommended:

As of Jan. 1, California implemented new regulations to attract insurers back to the state. In its Sustainable Insurance Strategy, California now allows property-casualty insurers to calculate premiums based on models of future catastrophic risks, not just historical catastrophic risks, and to incorporate their reinsurance costs into their premium formula. In exchange for these carrots to the industry, California regulators require insurers to increase underwriting in wildfire risk areas in a formula based on a percentage of their market share in the state.

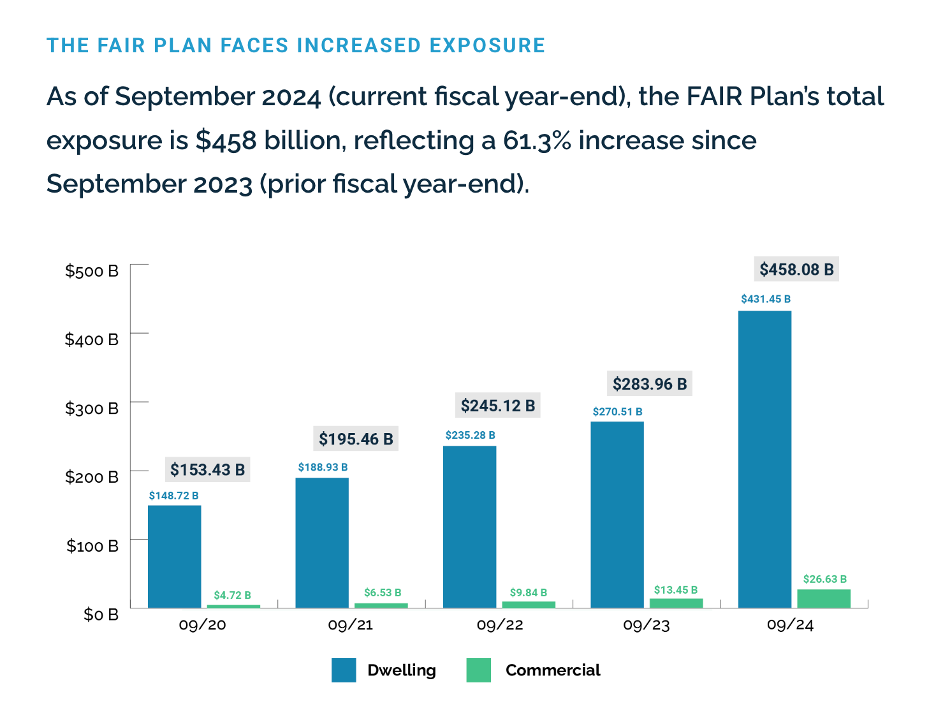

Source: California FAIR Plan Property Insurance

The hope is these changes will also help shore up the FAIR Plan, the insurance of last resort here that’s funded by private insurers and their customers.

Will these changes work to stabilize the market?

“We have been very supportive of the reforms and think they will stabilize the market. The key one is to allow catastrophe models to project forward instead of looking backward,” said Seren Taylor, vice president for the Personal Insurance Federation of California. Already Allstate Insurance announced in December it would resume writing several types of home insurance policies in the state.

But independent experts and consumer groups have different opinions.

“In the short term, these regulatory changes will allow insurers to write more policies and incentivize their return to the market,” said David Jones, director of the Climate Risk Initiative at the Center for Law Energy & the Environment at the University of California Berkeley Law School and a former California Insurance Commissioner.

“But in the long term we are not going to outrun climate change with insurance price increases,” Jones said. “We are not going to be able to rate hike our way out of the crisis.” He cited the experience of Florida, which allows future catastrophe modeling and reinsurance costs in premium formulas but which has a severe insurance scarcity and affordability problem. “Florida has done everything insurers have asked for in California. Yet in Florida, national insurers are still not writing insurance,” he said, “and rates are four times the national average.” Florida had the highest non-renewal rate of any state in 2023.

“I think the tragic Southern California fires are another sad result of our failure to reduce burning of fossil fuels and transition fast enough to a low carbon economy,” he said, noting the abnormality of the extremely dry conditions in what is Southern California’s rainy season.

Mike DeLong, research and advocacy associate for the Consumer Federation of America, said, “We are not a fan of Commissioner (Ricardo) Lara’s Sustainable Insurance Strategy. We don’t think it will work for consumers; it won’t make insurance more affordable and accessible.” He said future catastrophe modeling “can be a good thing,” but models need better data.

What might work to solve the problem?

“Most importantly, we need to move faster to transition the economy away from fossil fuels, which are the major contributor to greenhouse gases that drive climate change, which drives extreme weather disasters” said former Commissioner Jones, citing this as the most important change needed. Those weather disasters are causing deaths, property destruction and ultimate insurance price hikes and scarcity.

Secondly, he said, property owners, communities and governments need to actively mitigate risk by hardening homes and thinning forests and landscapes. Thirdly, insurers need to reward them for mitigation. In underwriting decisions, insurers don’t currently account for mitigation.

Lastly, California needs to shore up its FAIR Plan. According to its website, the FAIR Plan’s total insurance exposure rose 61 percent in one year, between September 2023 and September 2024, as more homeowners use FAIR for insurance. A San Francisco Chronicle analysis found FAIR insures $24 billion in properties in the zip codes now burning, but the Plan has only $385 million in reserves.

Other ideas to help solve the insurance crisis include asking insurers to be part of the solution instead of part of the problem. Most insurers are big investors in fossil fuels either by underwriting fossil fuel projects or investing in fossil fuel equities and debt. A study by Ceres, ERM and Persefoni of the assets of large U.S. insurers found insurers held $536 billion in fossil fuel assets in 2019. State Farm Insurance held large stakes in tar sands and coal investments — the two dirtiest and most destructive of fossil fuels.

State Farm was also the first big home insurer to stop renewing California policies.

[You’re leading change in an unpredictable environment. Get the strategies you need from the world’s top sustainability leaders at GreenBiz 25, Feb. 10-12, Phoenix.]