3 Climate Week NYC themes you should know

Companies remain committed to climate action. Artificial intelligence spurs debate. Natural gas isn’t going away. Read More

- Given political headwinds, companies are quieter about their commitment to climate remidiation.

- Many sustainability teams see AI as a net positive despite its electricity demands.

- The rise of natural gas is complicating emissions reduction plans.

The corporate climate “actionists” who converged in New York last week for the 16th annual Climate Week NYC are resigned to the reality that federal policy won’t favor their agendas for at least another three-plus years.

Even so, the majority of corporations with net-zero aspirations are not retreating from their top-level commitments. They’re just not talking about them as loudly.

At least three research analyses published to coincide with Climate Week NYC suggest that companies committed to reducing emissions and conserving nature and biodiversity are actually doubling down on that agenda:

- The number of U.S. companies with net-zero commitments rose 9 percent in the past 12 months, according to the Net Zero Tracker’s 2025 stocktake, which did note that most of those pledges aren’t very robust.

- A focused study that included 75 top companies by market capitalization found that while roughly 13 percent retreated from programs between April 2024 and May 2025, nearly one-third increased their investments.

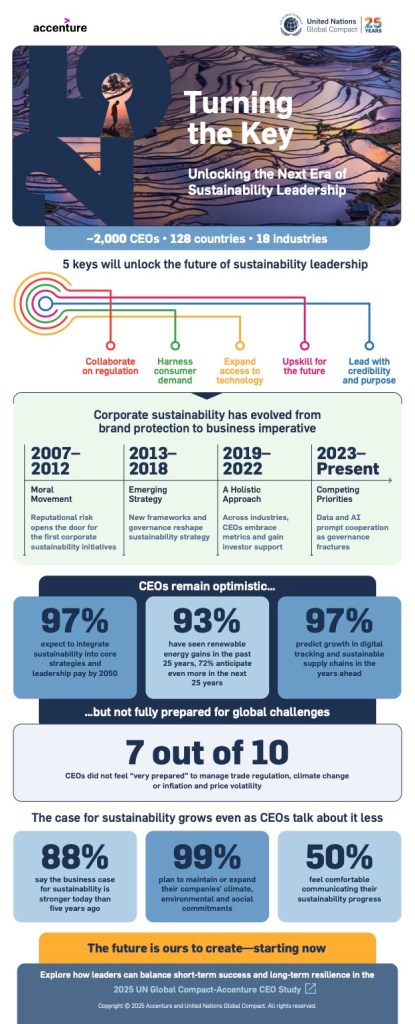

- Close to 90 percent of CEOs think the case for sustainability is stronger now than five years ago, according to research by Accenture and the United Nations Global Compact, which represents more than 20,000 member companies. Almost all of 2,000 surveyed executives expect to include these metrics in their core strategies and compensation structures by 2050.

“That makes sense, because being a business leader is not about opinions from one day to another, it’s about building, it’s about investing, it’s about transformation,” said Ingka Group CEO Jesper Brodin, referencing the Global Compact data during a panel discussion at the Nest Climate Campus. Ingka, IKEA’s largest retailer with $47 billion in revenue in 2024, is on pace to meet its 2030 target to halve emissions. A cross-functional committee of business leaders that meets at least eight times annually manages this strategy.

Only half of the CEOs responding to the UN Global Company survey, however, felt comfortable communicating this agenda — a refrain discernible in the other analyses.

“I think the corporate sector has gotten pretty quiet on these issues, whether or not they are moving forward,” said Patagonia CEO Ryan Gellert during a panel discussion at the Nest Climate Campus. “I think there’s a real lack of leadership right now from the business sector, a real lack of leadership response to what we’re navigating.”

Here are three themes of note from the weeklong industry gathering:

Real work continues

Some 100,000 people came to New York to attend more than 1,000 summits, panels, receptions, climate tech pitch sessions and countless face-to-face meetings.

“This week for me, is about finding new people that I have not known before, hearing about new climate initiatives,” said Kate Heiny, vice president of sustainability for Booking Holdings, the company behind travel sites including Booking.com, Kayak and Open Table. “I often look to other industries and not the one that I’m in. I think that learning from other places has always been something that I would look to for growth. So it’s people, it’s ideas.”

That need for connection, validation and fresh perspective was echoed in many of my interviews throughout the week. “I think it has just been great to see that the majority of companies are just plowing on like we are,” said another chief sustainability officer, speaking on background.

“I see very serious people doing really extraordinary things, continuing at full force and momentum,” said Andrew Mayock, who headed the federal government’s sustainability strategy under President Joe Biden.

Mayock was appointed the inaugural vice chancellor at the University of Colorado Boulder in March. He’s already shaping new master’s programs for integrating sustainability into business, engineering and policy. Mayock is also coordinating development of a new classification from the Carnegie Foundation for the Advancement that will recognize colleges and universities that include climate action as part of their mission.

“I’m really buoyed by being here,” he said.

AI debate gets more nuanced

Plenty of companies in attendance were willing to talk about how artificial intelligence stands to accelerate both their company’s environmental agenda and revenue growth.

Packaging company Ranpak, which counts Amazon and Walmart among its many big-name customers, is already deploying AI for applications such as rightsizing packages or detecting how much cushioning is needed to protect items in them. “What excites me, frankly, is the stuff that we haven’t figured out yet … the problems that haven’t even been identified yet that can be solved with all of this data,” said David Murgio, chief sustainability officer at the company.

NVIDIA’s head of sustainability, Josh Parker, downplayed ominous predictions about AI load growth that could strain the U.S. grid, suggesting that the electrification of vehicles and industrial loads is a bigger load factor over time and AI plays an important role in easing bottlenecks.

“AI is helping us modernize the grid, helping us integrate renewables and batteries,” he said during one panel.

NVIDIA’s influence on the AI ecosystem cannot be understated. Its chips are at the center of data center buildouts by Amazon Web Services, Google and Microsoft, and the company Sept. 22 announced a deal to invest up to $100 billion in OpenAI’s infrastructure ramp-up.

Natural gas isn’t going away

The biggest tech companies are spending billions of dollars on the AI data center buildout. To tame the associated emissions they’re investing in creative contracts to keep nuclear power on the grid, support new nuclear technologies and add emerging generation options, such as geothermal.

Here’s the thing few of them are talking about: 40 percent of the electricity powering U.S. data centers comes from natural gas, and it will be the biggest contributor of additional capacity between 2025 and 2030, according to the International Energy Agency.

Meta’s big $10 billion project in Louisiana, as one example, will require three new gas turbines. Elsewhere, natural gas plants that weren’t running at full capacity are being commissioned for more load, said Julio Friedmann, chief scientist for carbon removal advisory firm Carbon Direct. “The thing that people don’t talk about, the hidden aspect of what’s actually happening, is that the easiest thing to do is just ramp up existing natural gas capacity,” he said.

While the tech firms are investing in as much renewable energy as possible to counter this rise, the Trump administration is making those deals tougher to complete. It plans to stop the retirement of aged coal power plants, for example, and U.S. Department of Energy Secretary Chris Wright last week said data center operators should be prepared to shoulder the burden of their loads by co-locating near specific sources. That’s what Amazon plans to do, for example, near a nuclear plant in Pennsylvania.

Natural gas is a better alternative than coal, although much of the capacity being added is “uncontrolled,” meaning the methane emissions are vented into the atmosphere, Friedmann said. Adding carbon capture and storage to natural gas facilities presents one potential solution, but the U.S. Environmental Protection Agency’s plan to kill the Greenhouse Gas Reporting Program could make it harder — if not impossible — for companies to tap into the 45Q tax incentives for those projects.

“The other thing is that all of this action on natural gas means the prices are going up, which is making all of this more expensive,” Friedmann said.