Get ready to weigh in on an overhaul of carbon accounting for electricity

The Greenhouse Gas Protocol will accept public comments about proposed revisions to the Scope 2 starting in October. Read More

- Public feedback on the revisions will be solicited over a 60-day period.

- Proposed changes will complicate reporting and tracking, especially for smaller companies.

- A legacy clause that would honor existing contracts is under consideration.

The Greenhouse Gas Protocol, which publishes rules used by 97 percent of companies that calculate and disclose their greenhouse gas emissions, is finalizing proposed revisions to how companies can report on emissions related to their electricity usage.

The recommended changes will make it more complicated for companies — especially ones with smaller electricity loads — to claim emissions reductions by signing virtual power purchase agreements, a type of contract that has financed the addition of 100 gigawatts of clean electricity to the U.S. grid since 2014, according to those familiar with the proposal. The organization is also considering a separate rule that covers “consequential” accounting methods, which would allow companies to estimate emissions avoided through projects being added to electric grids where there is a scarcity of renewable energy.

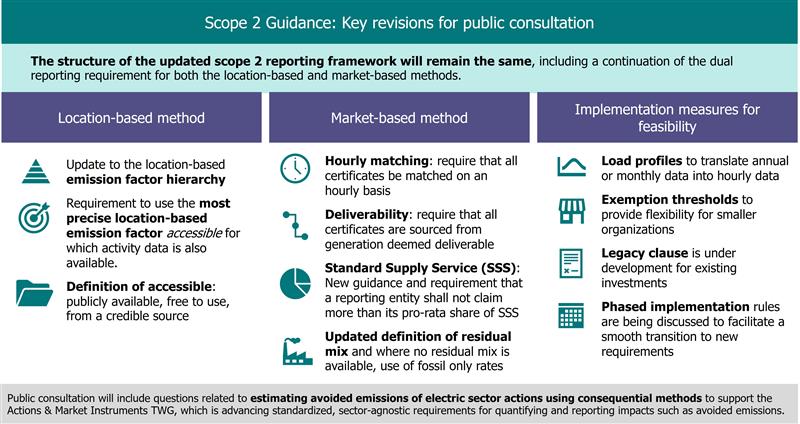

The existing GHG Protocol methodology, originally published in 2015, lets companies claim emissions reductions for electricity, categorized as Scope 2, by matching their annual consumption with power from renewable sources.

The revision prepared for public comment, drafted by a technical working group and approved over the summer with modifications by the GHG Protocol’s Independent Standards Board, favors requiring companies to match their electricity loads on a much stricter hourly basis using local renewable sources on the same grid as the company’s original consumption.

“The most concerning element of this proposal is the lack of procurement options that would support hourly matching for buyers of our size,” said Jay Creech, manager of net zero for retailer REI Co-op, commenting about what is known publicly. “Even now, an organization as large and sophisticated as the co-op may struggle to access corporate procurements, which often have a minimum offtake of more than double our annual electricity need.”

Work in progress

The GHG Protocol hints that it will exempt smaller organizations from the strictest new requirements in a blog published Sept. 29, allowing companies to take the approach that is most feasible for its individual circumstances. The organization is also considering a legacy clause for existing contracts, which is important for the deals companies are scrambling to close before U.S. tax incentives go away in July 2026.

The standards body is soliciting feedback for both the main Scope 2 rule and the separate consequential accounting methodology as part of a 60-day public feedback period that opened Oct. 20. It’s holding an Oct. 27 webinar to review the material.

Revisions to the current Scope 2 draft will be circulated in 2026 — as part of a second public consultation period — with a final version anticipated in 2027. Comments on the consequential accounting rule will be referred to the Actions and Market Instrument Technical Working Group, which is developing that methodology, but no timeline was provided.

It will be several years before the changes take effect, but corporate sustainability professionals and renewable energy financing experts said the proposed revisions will make it more difficult to justify investments in long-term power purchase agreements at a time when the U.S. market already has been hobbled by tariffs and increasingly hostile federal policies.

“While we all share the goal of a 24/7 clean energy future, our focus now must be on the path forward,” said Mike Matterra, director of corporate sustainability and ESG officer at Akamai Technologies, referring to the push for a method that more accurately reflects a corporation’s investments in renewable electricity on a local basis. “We must champion an organic evolution of our clean energy resources by deploying them where they can have the greatest impact — on our dirtiest grids — to make our 24/7 goal a reality.”

A separate proposal that would provide a way for companies to be recognized for different sorts of deals, such as contracts that include energy storage technology or that add more solar or wind power on grids heavily dependent on fossil fuels, was referred to a different work stream with the GHG Protocol for additional discussion.

That metric is no longer part of the Scope 2 revision process but ought to be, given the huge amount of renewable capacity that should be added to the worldwide grid each year to reduce emissions, said Miranda Ballentine, senior advisor with consulting firm Green Strategies. “We have to unleash markets, not hamper markets,” she said.

Unintended consequences

The GHG Protocol’s rationale for updating the Scope 2 rules “reflect a modern reporting landscape, evolving grids and closer scrutiny of claims,” according to the nonprofit’s blog. Market experts agree that an overhaul is warranted but worry that it will slow down project development at a time when renewable electricity adoption should be accelerated.

The Clean Energy Buyers Association, which sent a letter to GHG Protocol in May urging it not to make the revisions too strict, said providing more certainty around whether existing contracts will be exempt under the new rules is crucial for encouraging continued corporate investment in renewable energy over the next three years.

“Our basic stance has not changed since we put the letter out, but circumstances have changed dramatically,” said the association’s CEO, Rich Powell, pointing to the decimation of U.S. tax incentives for solar and wind. “We continue to think this will do more harm than good, and risk shrinking the market.”

The new rules risk limiting market participation to an elite class of the largest electricity consumers, said Michael Leggett, co-founder of Ever.green, which facilitates corporate renewable contracts, and the author of an exhaustive document that outlines the potential impact of the proposed changes.

Among his many points: Fewer than a dozen corporations, including Google, Ingka Group, JPMorgan Chase, Mercedes-Benz and Microsoft do hourly Scope 2 accounting today. Corporations play a critical role in project finance for grid-integrated projects that isn’t adequately considered in the current revisions, and by cutting out all but the largest buyers, “it could slow down, instead of speed up, addressing climate change,” Leggett said.

The current revision will motivate some corporate renewable buyers to move away from long-term contracts to instead buy renewable energy certificates from existing projects closer to their operations, which would slow new renewable additions supported by corporate offtake agreements, said Patti Smith, electricity decarbonization lead for advisory firm Carbon Direct.

“Some feel it creates a deterrent to renewable energy investment by favoring locations that have greater sources of renewable energy and favoring the organizations that can site themselves near those sources,” she said.

Rising prices

The changes as proposed will “massively increase complexity around tracking and reporting,” said Roberta Barbieri, vice president of global sustainability, climate and water, at PepsiCo. It will also increase renewable contract prices for corporate buyers, since it will force them to mitigate electricity loads from facilities separately rather than aggregating them and negotiating a more favorable price, she said.

This won’t affect PepsiCo’s immediate plans, but it comes at a time when a growing number of large companies including Apple, Mars, PepsiCo and Walmart have been negotiating contracts on behalf of smaller companies within their supply chains. Mars disclosed its latest such transaction Oct. 7, covering 100 small solar projects in Poland.

Contracts for solar and wind projects are already more expensive — an average of 4 percent since Republicans passed the One Big Beautiful Bill Act, which eliminates credits many companies were using to buffer their costs, said Patrick Swords, carbon and renewable energy advisor with consulting firm Anthesis. The price for unbundled renewable energy certificates, which many smaller companies use to claim reductions in Scope 2, are also on the rise.

“Companies who haven’t made commitments yet, you may see them think twice or delay making commitments at this point,” Swords said.

Editor’s note: This story was updated Oct. 20 to add more information about the feedback process.