CSRD: What you need to know about the EU reporting mandate

Here's an essential guide to the sustainability directive to help you kick-start your mandated disclosure journey. Read More

The launch of the European Union’s Corporate Sustainability Reporting Directive, known more commonly as CSRD, is quickly approaching. Beginning Jan. 1, companies within the EU must begin collecting data to submit in their first, mandatory report in 2026.

CSRD requirements are comprehensive and complicated, posing a daunting task to EU-based and international companies alike. But no one can tackle the intricate details without first understanding the basics.

Here’s a basic breakdown of what you and your company need to know to ensure you’re prepared for CSRD.

What is CSRD?

The CSRD mandates that over 50,000 European companies and 10,000 internationally based companies, of which the U.S. make up around 30 percent, disclose sustainability information, including metrics ranging from associated emissions to gender pay differences.

For a company to fully comply with the CSRD, it must submit reports that meet the requirements laid out in the European Sustainability Reporting Standards (ESRS). The goal of the ESRS framework is to create a standardized view of a company’s ESG risks, impacts and opportunities. (Think of the ESRS as the meat and potatoes of CSRD).

The standards are composed of two major categories; ESRS 1 and ESRS 2.

- ESRS 1: This outlines the general mandatory sustainability requirements disclosed from a company, including general drafting conventions, due diligence procedures, and the definition of double materiality, among others.

- ESRS 2: The second category presents cross-cutting requirements for general sustainability disclosures over four areas of focus — impact, risk and opportunity management (IRO), governance (GOV), strategy (SBM), and metrics and targets (MT).

Once all of the data is compiled into a report, companies must acquire and receive approved third-party assurance.

Why ‘double materiality’ is important in CSRD

Double materiality is composed of two perspectives: financial materiality and impact materiality. Financial, often coined the “outside in” view, is the material risk or opportunity of sustainability matters that could affect a company’s financial performance.

Impact, or “inside out,” hones in on the external impacts a company’s supply and value chain can have in the immediate, short and long term.

Defined in ESRS 1 and reported in ESRS 2 within impact, risk and opportunity, companies are required to take a double materiality assessment. The assessment will determine if the company must disclose additional data deemed “material” by the EU’s standards.

How CSRD will affect companies outside Europe

Of the 10,000 international companies required to comply with CSRD, the U.S. makes up the highest percentage, followed by Canada and the U.K.

Companies with headquarters abroad are held to different standards for compliance from EU-based companies.

Qualifying requirements for non-EU companies include:

- Non-European companies with branches or subsidiaries with a net turnover of $165.3 million in the EU.

- Non-EU companies with listed stocks or bonds on a regulated market in the EU.

- Companies outside of the EU with an annual EU revenue of more than $165.3 million and an EU branch with net revenue of more than $44.1 million.

- Companies outside of the EU with an EU subsidiary that is defined as a large company by meeting at least two of the three following criteria:

- More than 250 EU-based employees.

- A balance sheet above $22.05 million; or

- Local revenue of more than $44.1 million.

Take note of these deadlines

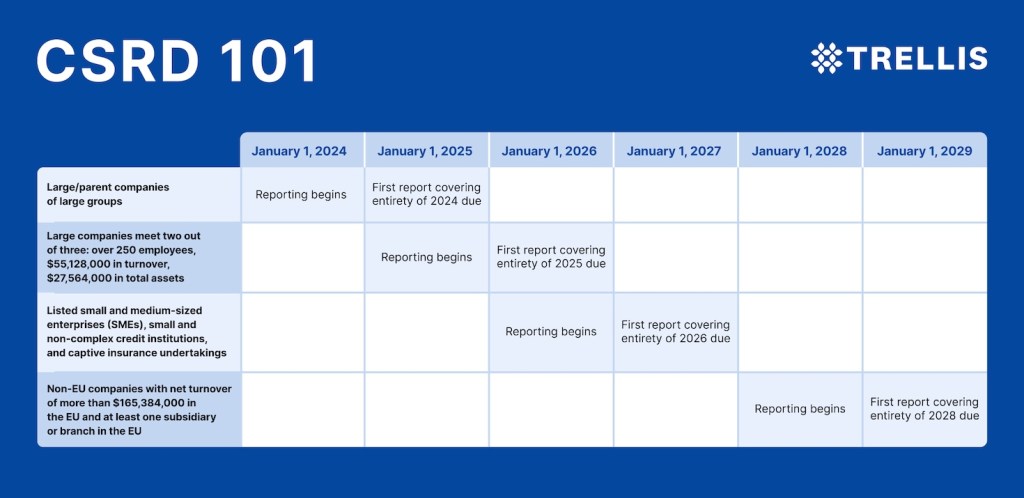

The reporting timeline for EU-based companies and international organizations are different.

The timeline for companies based in the EU is as follows:

- Large/parent companies of large groups:

- Reporting began Jan. 1

- First report is due in 2025 covering the entirety of 2024

- Large companies that meet two out of three categories including employing over 250 employees, $55.2 million in turnover, and/or $27.5 million in total assets:

- Reporting begins Jan. 1

- First report is due in 2026 covering the entirety of 2025

- Listed small and medium-sized enterprises (SMEs), small and non-complex credit institutions, and captive insurance undertakings:

- Reporting begins Jan. 1, 2026

- First report due in 2027 covering the entirety of 2025

For all companies based outside of the EU, the timeline is slightly more forgiving:

- Non-EU companies with net turnover of more than $165.4 million in the EU and at least one subsidiary or branch in the EU:

- Reporting begins Jan. 1, 2028

- First report due in 2029 covering the entirety of 2028

Penalties if you don’t comply

Because CSRD is a European Union law, the penalties for non-compliance are left to the EU’s 27 member-states and three EEA EFTA states to create and enforce.

As of now, penalties are still unknown, with many countries still approving and transposing individual CSRD implementation laws. One of the few countries to officially announce penalties is France, which approved a fine up to $81,400 and jail time for up to five years for any corporate director who fails to comply.