Finance sector failing to curb deforestation, new report finds

$8.9 trillion remains tied to forest-destructive companies. Read More

- Only 40 percent of major financial institutions have a public deforestation policy — down from 45 percent in 2023, reversing a decade of progress.

- Vanguard, BlackRock and JPMorgan together provided over $1.6 trillion to companies driving deforestation.

- The EU deforestation law could be a game-changer, but experts warn that global regulations are needed to level the playing field.

Financial institutions funneled $8.9 trillion into companies driving deforestation last year, according to the new “Forest 500” report from Global Canopy. Despite a decade of rising ambition, fewer financial institutions have public deforestation policies than in previous years, the report found, a setback that researchers warn undermines global climate and nature targets.

The report assessed 150 financial institutions funding 500 companies with the largest influence on deforestation through high-risk commodities, including soy, beef, palm oil and timber.

Only 40 percent have a public deforestation policy in place, down from 45 percent in 2023.

“This troubling shift is in contrast to the trend over the previous decade, when financial institutions increasingly set deforestation policies,” said Pei Chi Wong, strategic finance engagement lead at Global Canopy.

Policy failures

Between 2023 and 2024, three financial institutions eliminated their deforestation policies altogether and seven “failed to improve in line with best practice,” meaning their policies no longer receive passing grades.

The former group includes Ameriprise Financial and Fifth Third Bancorp in the U.S., and Germany’s DZ Bank.

On the other hand, 11 institutions — including Allianz, Lloyds Bank and Bank Rakyat Indonesia — published new deforestation commitments.

The analysis also spotlights financial heavyweights such as Vanguard, BlackRock and JPMorgan Chase, which together provided more than $1.6 trillion to companies on the Forest 500 list in 2024. Many of these companies have significant links to deforestation and associated human rights abuses.

Even institutions with strong policies continue financing high-risk clients, the report found. Dutch bank ING, for instance, has comprehensive policies on six commodities and publishes outcomes of its engagement with clients — yet still provided over $6.6 billion to corporate “laggards” that lack any public deforestation commitment.

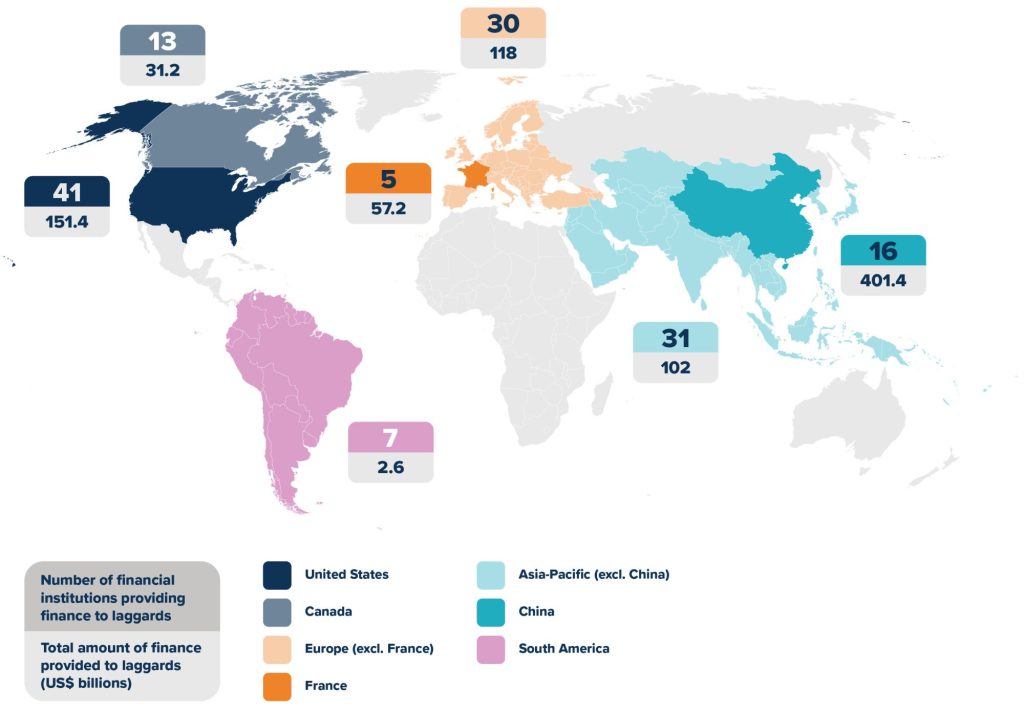

In total, the 150 institutions analyzed in the report provided $864 billion to laggards last year. By far the largest amount, $401 billion, came from institutions in China.

Sources of finance for deforestation

Source: “Forest 500 — Finance report: Deforestation is a bad investment,” Global Canopy

‘A solvable crisis’

“Deforestation is a solvable crisis,” Wong told Trellis. “It is a good entry point for financial institutions to navigate wider nature-related risks as it has the most advanced guidance, data and metrics in the nature space.”

At the moment, he added, no legislation requires financial institutions to conduct due diligence for deforestation risks.

One potential catalyst is the EU Deforestation Regulation (EUDR), which takes effect later this year. The law will require companies trading in the bloc to prove their products are not linked to deforestation.

“The EUDR has put deforestation on the agenda,” Wong said, “but for the legislation to make a significant impact, robust regulations in other jurisdictions are also needed to create a level playing field.”

Financial institutions have the leverage to drive systemic change across commodity supply chains. With the world’s forests vanishing at alarming rates, the clock is ticking.