Home Depot’s big plastic packaging purge

It cut enough Styrofoam in 2023 alone to fill 67 Olympic-sized swimming pools. Read More

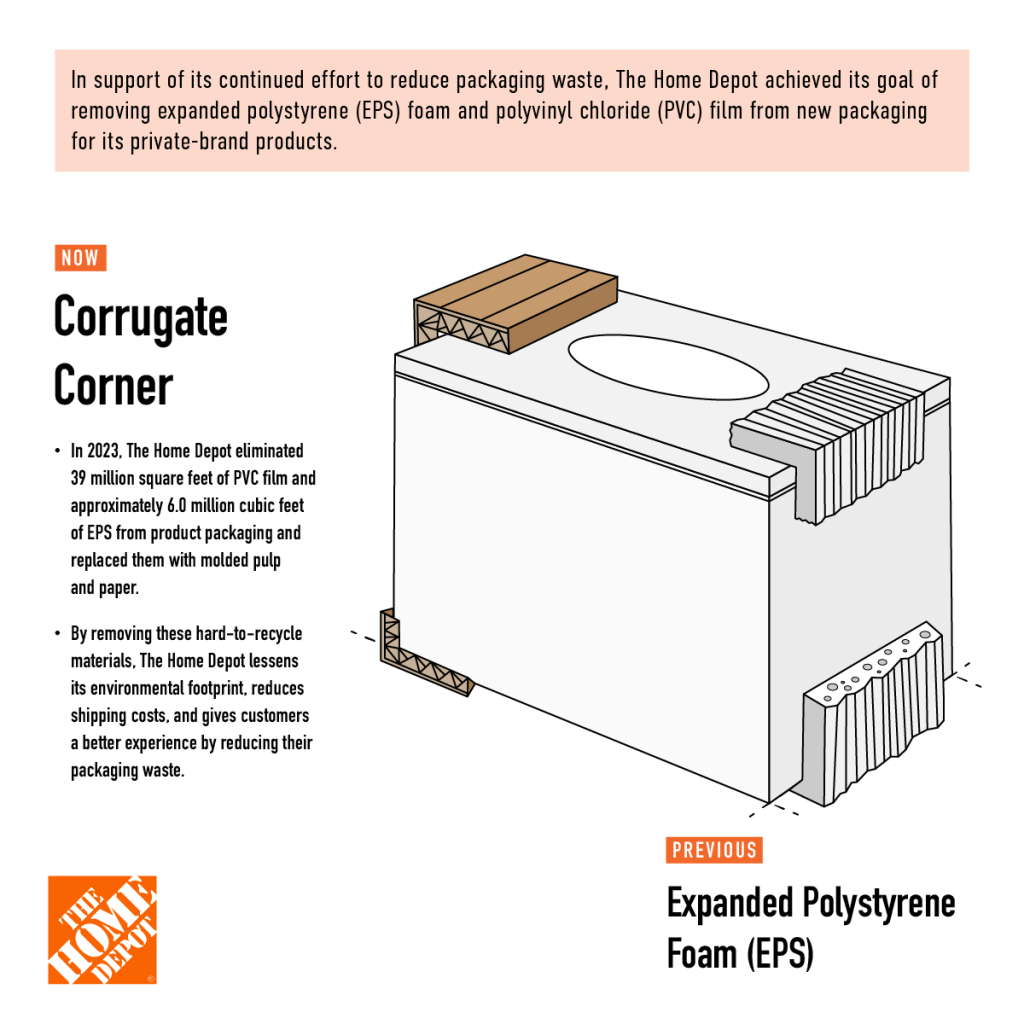

The world’s largest home improvement retailer Home Depot has eliminated Styrofoam, or expanded polystyrene foam, and polyvinyl chloride plastic film from packaging used for its private-label products.

Both materials take more than a decade to break down and are notoriously difficult to recycle within the current system. Chemicals used to make them also have been linked to human health issues, including cancer. Both are listed as “unnecessary” or “problematic” materials by the U.S. Plastics Pact, which guides corporate commitments to phase out plastic packaging.

The move isn’t groundbreaking, but it’s notable, given that countries including Canada, Spain and South Korea have banned PVC packaging, said Paul Foulkes-Arellano, founder of Circuthon Consulting. Home Depot, which had revenues of $153 billion in fiscal 2023, should set a goal to remove all petrochemical-based packaging over the next decade to stay ahead of legislation, he said.

An extensive overhaul

Home Depot’s reduction initiative required the redesign of close to 1,300 packages for its own brands — everything from ceiling fans to lightbulbs to bathroom vanity counters — between 2017 and 2023. The $153 billion company doesn’t disclose what percentage of its revenue comes from those products; its average store carries 30,000 to 40,000 SKUs.

“Our portfolio is significant,” said Candace Rodriguez, senior director of sustainability at Home Depot, describing the private-label portion as “meaningful.” The overhaul cut 6 million cubic feet of Styrofoam, enough to fill 67 Olympic swimming pools, and 39 million square feet of plastic film, which could cover 513 soccer fields, in 2023 alone.

Next focus is on compostable, recyclable and recycled fiber

Home Depot doesn’t discuss packaging goals in the context of greenhouse gas emissions reductions, but the redesign resulted in lighter, smaller packages. That increases how many items can be placed on shelves or packed into trucks transporting them to the retailer’s 2,341 stores, Rodriguez said.

Many replacement materials Home Depot used to purge plastic will factor in the company’s next goal, which is to transition to fiber-based packages that are compostable, recyclable or made of recycled contents by fiscal year 2027 (ending January 2028). That will mean a big shift to molded pulp, paper and paperboard, blister cards and corrugate.

Connecting Climate and Nature To Advance Corporate Sustainability Strategies

“Home Depot’s move reflects broader industry trends, particularly those in Europe, where companies have begun transitioning away from these harmful materials,” said Benjamin Elizalde, project manager and sustainability consultant at circular economy advisory firm Metabolic.

Paper and cardboard are supported by mature, robust recycling infrastructure that reduces the demand for virgin materials, he said. “From a circular economy perspective, moving toward materials that can be reused or recycled at their highest value presents one of the most impact strategies for long-term sustainability,” Elizalde said.

Another Home Depot goal is to cut out 200 million pounds of virgin plastic by the end of 2028 through packaging reductions or by substituting recycled or alternative materials.

Reduce and replace, without compromising protection

Packaging conversions will be prioritized based on availability of recycling infrastructure for the replacement materials and the size, weight and fragility of the products they are meant to protect, Rodriguez said. Some components designed for the plastic elimination, such as corrugated corners used to keep items from sliding around in boxes, will play a big role in the next packaging design target.

The goal is not just to replace packages but to improve the protection they provide. This required close collaboration between Home Depot packaging engineers, sustainability consultants and store managers. “A big part was working with them and educating them on the need for change,” Rodriguez said. The redesign for Home Depot vanities, for example, involved more than 20 vendors.

While plastic and Styrofoam are problematic, they “often have unique properties that are difficult to replace,” said Olga Kachook, director of sustainable packaging initiatives at nonprofit GreenBlue, and a Trellis columnist. The challenge in package redesigns is balancing protection with constraints around a product’s overall carbon footprint. “Finding alternatives is important and commendable work,” Kachook said.

Home Depot has committed to a 42 percent absolute reduction of greenhouse gas emissions across both its own operations and from the use of products sold in its stores. Emissions for Scope 1 and Scope 2, which include its stores and energy purchases, rose about 5 percent and 5 percent, respectively, in fiscal 2023, according to the company’s 2023 ESG report. Comparison data for emissions from product use was not available.