How to visualize your company’s opportunities in the circular economy

Here’s a visual framework to help you navigate the challenges of the circularity journey. Read More

Not all industries face the same challenges or opportunities in making the transition to circularity. Some sectors are well-positioned today, some are awaiting innovation to unlock circularity and others will likely require policy and regulation to transform incumbent business models.

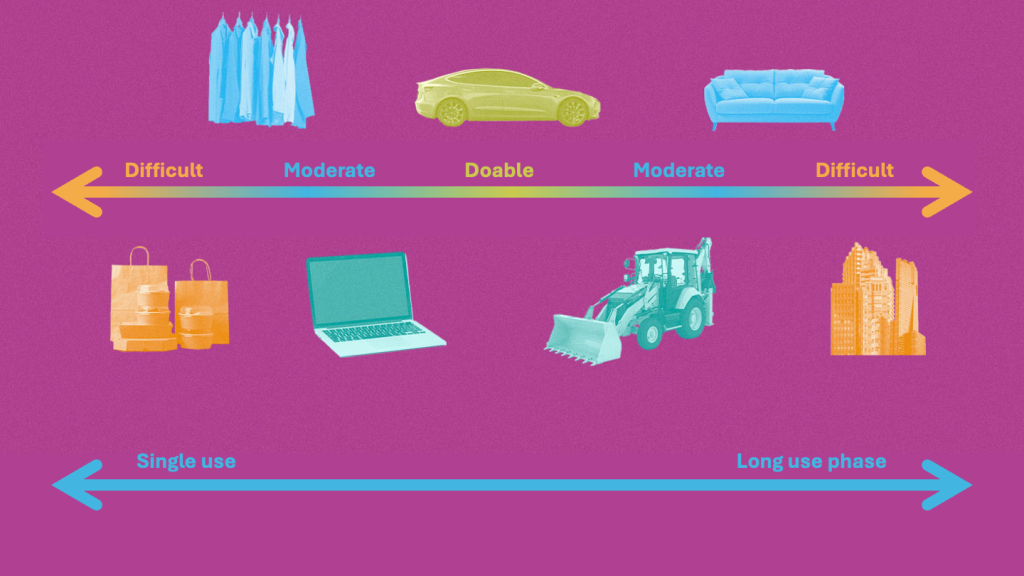

These opportunities and challenges fall along a spectrum where the extremes are difficult (for various reasons depending on the sector) and the middle is the current prime opportunity space.

In most sectors of the global economy, though, the transition to circularity has been a struggle since 2010, when the concept first took hold with the founding of The Ellen MacArthur Foundation, the first organization focused on accelerating the transition to a circular economy.

A new report underscores these challenges: the global economy is losing ground in the transition toward circularity, according to the 2024 edition of the Circle Economy Foundation’s annual Circularity Gap Report, and now sits at only 7.2 percent, down from 9.1 percent in 2018.

Given the lack of forward momentum, I’ve developed this framework, which could help push certain sectors of the economy from traditional, linear models to circular systems. Let’s start in the middle.

Exploring the middle

In the middle of the spectrum are products that have a high frequency of use, relatively long productive lifetimes and (maybe most importantly) high material values and replacement costs.

Consumer electronics, servers, automobiles and heavy machinery all fit in this category. We find existing business models to support circularity in all these industries, including repair, resale, refurbishment, remanufacturing and acquisition models that don’t require outright purchase, such as leasing and rental.

Because the companies in the middle are well-positioned for progress in circularity, companies here are already moving on initiatives to recover their products and parts for second use. The automakers, for example, have been doing this for some time. They are now engaged in work to make vehicles more circular through reductions in moving parts, innovative material selection for interiors and other initiatives. The Circular Cars Initiative, for example, includes 30 global automotive companies and suppliers working “to facilitate the transition towards an automobility system that is firmly grounded within a 1.5°C scenario.”

The quest for durability

Further to the right on our spectrum are the building products, infrastructure materials (like roads and bridges), and the furniture and furnishings that make up the built environment.

The products here are made to last decades. In the quest for durability, the construction methods for these products make them difficult to deconstruct and separate materials for reuse, remanufacturing or recycling. In addition, the individual materials that make up these products do not have high value on their own: Concrete, asphalt, glass, steel and wood are all important materials in buildings that have not experienced long-term supply shocks or price increases that would provide the return on investment required to make them easier to recover.

The challenges of packaging

The plastics, packaging and other short-lived products of the left end of the spectrum have been the central focus of many conversations in this space since its introduction, leading to the introduction of extended producer responsibility laws in the European Union and certain U.S. states.

Here we find a variety of materials including plastic, aluminum, glass and paper products. The materials here are chosen for low cost relative to their function with the assumption that they will not be reused. Low cost, though, makes devising a business case for circularity difficult. If it’s cheaper and easier to choose virgin materials for packaging or clothing, as it usually is today, the incentive to opt for recycled or innovative materials is almost non-existent.

Most movement toward circularity at this end of the spectrum will be driven by policy. Laws are already on the books in nearly every part of the world, including extended producer responsibility, specific single-use plastic bans, and even producer pays laws that target fast fashion.

While reusables are being adopted to some extent for food, beverage and cosmetics packaging, the vast majority of companies will require policy and regulation to fully buy in.

Understanding the current state and how companies can learn from industries across this spectrum is important for making real progress on the circular economy. This framework provides not only an understanding of what levers must be pulled, but also how to advocate within companies and across industries for accelerating the transition to circularity.