Why IKEA’s $47 billion retailer is on pace to halve emissions by 2030, while rivals falter

Its biggest advantage is its close relationship with its main supplier of products. Read More

- The large private company that sells most IKEA products — Ingka Group — invests in startups and technologies crucial for achieving its net-zero goal.

- Its emissions plans hinge on how quickly IKEA can transition to lower-carbon materials.

- Circular economy processes, such as featuring secondhand products and encouraging repair, are other important strategies.

Like many of its competitors in retail, Sweden’s Ingka Group — the IKEA brand’s primary retailer — faces a daunting Scope 3 challenge: Value-chain emissions made up 98 percent of the 30 million tons of carbon dioxide equivalent (tCO2e) the company emitted in 2016, the baseline year for its net-zero target.

Chasing Net Zero

Yet Ingka is unlike its peers in that it has made remarkable progress toward its targets, which call for a 50 percent reduction by 2030 and reaching net zero by mid-century. In 2024, the company emitted 21 million tCO2e, putting it roughly on track for its end-of-decade goal.

By contrast, at least half of the world’s biggest retailers don’t have a formal net-zero target at all. For example, Walmart, the world’s largest retailer — known as a pioneer in supply chain decarbonization — is struggling to deliver on its own short-term commitments.

Ingka’s secret weapon? The company’s commitment to investing in climate projects is significant: the more than $5 billion it’s spent on solar and wind projects since 2009 have accrued enough assets for Ingka to be classified as a midsize energy company.

But this second profile in the Chasing Net Zero series — our company-by-company look at progress toward 2030 climate goals — reveals that just as important might be Ingka’s close ties with Inter IKEA, which supplies it with everything from bookshelves to Swedish meatballs. Few other retailers are as dependent on one supplier. While Ingka buys from 1,500 suppliers, 81 percent of its climate footprint comes from IKEA foods and products, according to data published by both companies. By comparison, Walmart has at least 100,000 purchasing relationships.

Ingka and IKEA are separate, privately held entities with individual net-zero targets, but their goals were developed in close collaboration and validated last year by the Science Based Targets initiative (SBTi). Senior staff from both organizations participate in the Inter IKEA Strategic Sustainability Council, which meets twice a year.

“This is not just a sustainability transition to the sustainability team, it’s about the whole of IKEA and the whole of the business,” said Simon Henzell-Thomas, climate and nature manager at Ingka.

This relationship provides granular insights into supplier emissions that create an advantage few others in the sector enjoy. “As a retailer, it is a huge lift to get at this data because you are the last point on a very long supply chain,” said Honor Cowen, global head of retail and apparel at consulting firm Anthesis Group.

Largest liability: Materials

Ingka manages 574 locations in 31 countries and generated $47 billion in fiscal 2024 — 90 percent of IKEA’s total sales. The retailer’s top emissions source by a wide margin is purchased goods, which made up 36 percent of its Scope 3 total in its 2016 baseline year.

The Scope 3 emissions come from operations as diverse as cattle ranches and data centers, but the highest impact within the category, at almost 10 million tCO2e, is from raw materials. Ingka is aiming to squeeze that down to 5.5 million metric tons by 2030, according to its first net-zero transition plan, published in February.

To reduce those numbers, Ingka will need Inter IKEA to change how its goods are designed, produced and transported. “Moving toward more renewable materials, more sustainable materials, that is going to be a huge part of reducing our footprint,” said Henzell-Thomas.

Clues about the potential for Ingka’s progress are found in Inter IKEA’s 2024 climate report. Here are plans for three of the five materials that contribute most to Ingka’s and IKEA’s emissions:

- Metals. Reducing the steps required to manufacture products can cut emissions. IKEA is using stronger grades of steel for some products, such as its Mittzon desks, to reduce the amount of the material required. It’s also boosting use of recycled metals: The company uses a minimum of 70 percent recycled aluminum in widely available products including cabinet doors and mirrors.

- Wood. IKEA plans to switch to recycled wood for one-third of its wood products by 2030, up from 16 percent now. One sticking point is the lack of recycling infrastructure for fiberboard and particle board. The company has set up its own recycling line in Poland to produce pegboards and better understand what’s needed to scale this work. It’s also investigating bio-based glues, which help cut emissions from board production. The downside is that bio-based glues could make it harder to disassemble certain products, hindering IKEA’s and Ingka’s recycling goals.

- Textiles. IKEA is switching to lower-carbon sources for the fabrics, foam and stuffing used in bed linens, curtains, rugs, towels, sofas and mattresses. Promising developments in 2024 included curtains made of waste polyester and a sofa stuffed with felt made of fabric waste rather than polyurethane foam.

These changes will require technologies that are still emerging, along with policy changes and infrastructure investments. “We have a plan, but we also have gaps there that we’re going to close,” Henzell-Thomas said.

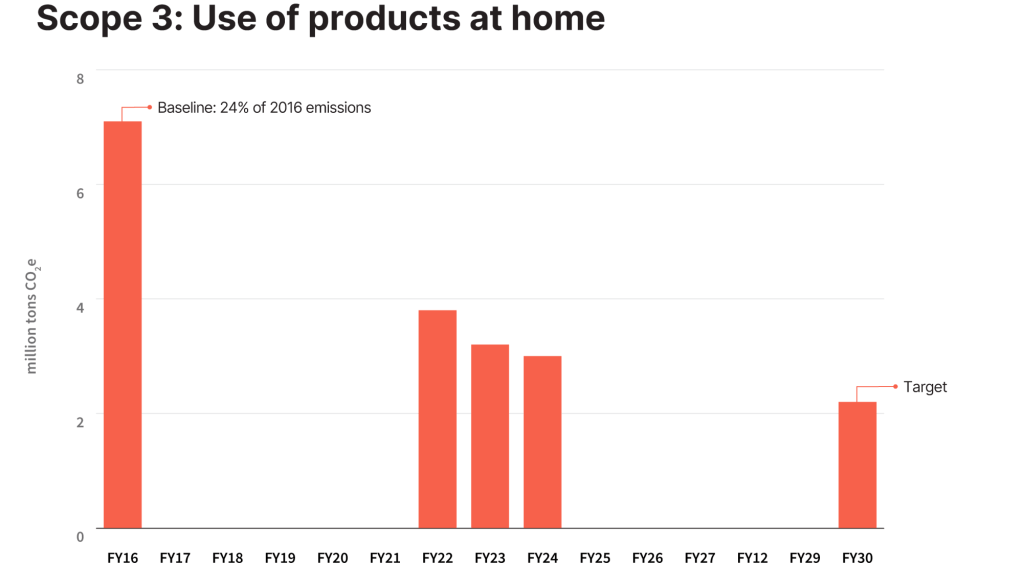

Bright spot: Product use at home

Ingka’s second biggest Scope 3 liability, at 24 percent of its 2016 total, comes from emissions generated by its customers’ use of the ovens, stoves, refrigerators, lighting and other products it sells. This is a bright spot for the company: It has met its high-level goal of cutting the impact in half by reducing emissions to 3 million tCO2e tons in 2024. The push now is to slice an additional 2 million tCO2e off the category by 2030.

Product-level changes are a big part of this success. IKEA improved the efficiency of its entire lighting line by 90 percent simply by phasing out sales of incandescent bulbs, for example, decreasing related emissions by 57 percent from its 2016 baseline. Now the focus is on reducing the electricity used by appliances such as refrigerators and ovens.

Ingka’s clean energy services, which help customers install solar panels or heat pumps at home, are another key driver of reductions in this category. And Ingka’s investment arm plans to spend $3 billion more before 2030 on more renewable energy installations and other key technologies for the clean energy transition, such as alternative fuels and grid-scale batteries.

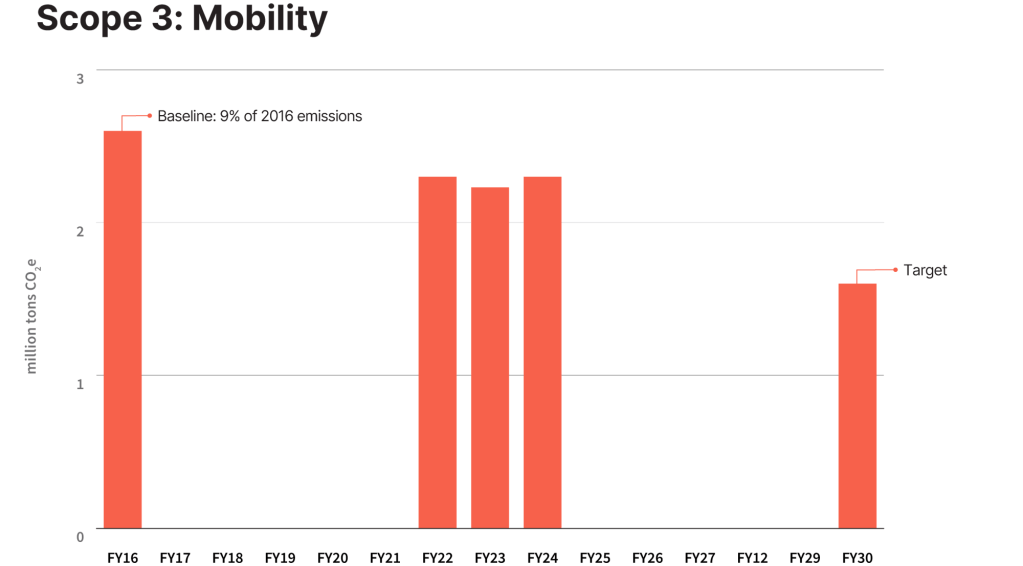

Policy-dependent lever: Mobility

Ingka’s third-largest Scope 3 component contains the transport-related emissions from delivery services, as well as customer, co-worker and business travel. The retailer has reduced this footprint by just 13 percent, to 2.3 million tCO2e, since the 2016 baseline year. What’s more, emissions rose slightly between 2023 and 2024. Ingka’s transition plan calls for an additional 40 percent reduction by 2030 to 1.6 million tCO2e.

To achieve that, Ingka is investing in electric and alternative-fuel vehicles to increase the proportion of home deliveries it fulfills with zero-emissions vehicles from 40 percent to 90 percent by 2028. The retailer is also providing more pick-up locations near customers’ homes.

Ingka is prioritizing work in regions where regulatory support for a transition to zero-emissions vehicles is more favorable. In Paris, for example, Ingka uses boats on the Seine to transport goods to distribution points where they are picked up by EVs and delivered.

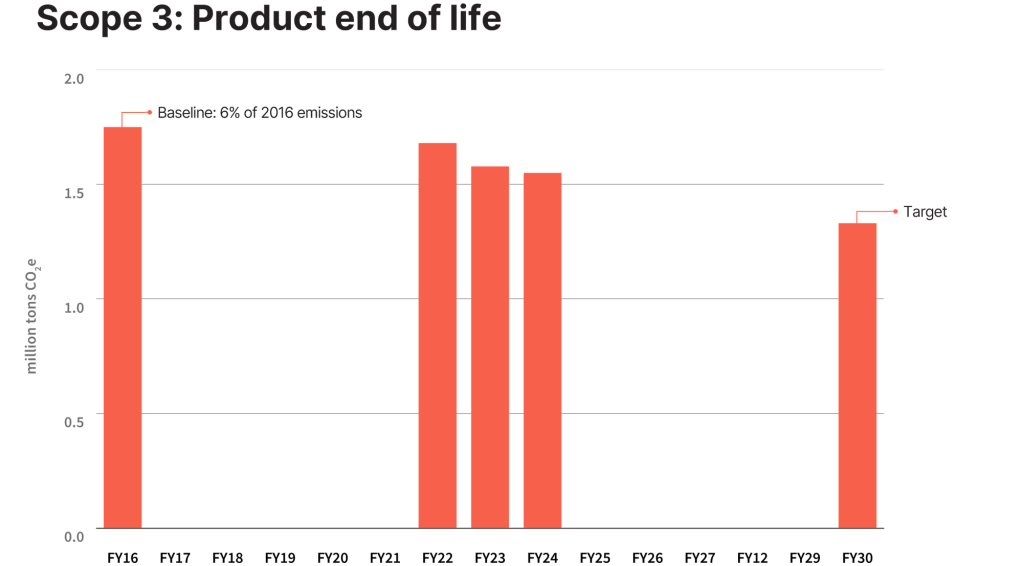

Circular solution: Product end of life

Ingka’s circular economy initiatives intersect with the work IKEA is doing to cut materials emissions. These efforts reduce Ingka’s emissions related to product end-of-life — which contributed 6 percent of Ingka’s overall footprint in 2016 — while providing IKEA with a source of recycled materials.

Ingka reported 1.6 million metric tons in emissions for product end-of-life in 2024, down 15 percent from 2016. It achieved this by expanding sales of secondhand items to a majority of stores, distributing millions of free parts to encourage repairs, refurbishing the IT equipment it uses in stores and cutting food waste. The goal is now to cut 0.3 million more tons by 2030.

Sriram Rajagopal, head of climate at Inter IKEA Group, said he was confident of hitting the 2030 goal for these emissions. But he noted that Ingka and IKEA can’t solve systemic issues, such as limited recycling infrastructure, on their own. “We need collective effort where many actors contribute to a circular economy and society,” he said.

Ingka’s investment arm is also putting $1 billion into circular economy startups. The retailer estimates that those ventures have so far recycled around 1.9 million metric tons of materials, avoiding 5 million tCO2e.

One example is RetourMatras, which recycled more than 1 million mattresses in 2024, avoiding an estimated 90,000 tCO2e. It sells that material back to customers such as IKEA for use in new production.

Ingka’s edge: Net-zero integration

Leaders across all levels of Ingka are accountable for delivering on emissions reductions. Ingka’s chief sustainability officer, Karen Pflug, is part of the group’s management team, which meets at least eight times annually. The group is directly accountable to Ingka’s executive board, which includes the CEO, deputy CEO/CFO and group legal counsel.

This sort of deep integration is indicative of leaders in retail sector decarbonization, said Evan Sheehan, head of the retail, wholesale and distribution practice at Deloitte. The most successful companies, he noted, share a few best practices:

- Top executives buy into the company’s sustainability strategy and provide resources to support it.

- Teams agree on clear metrics for demonstrating the return on these investments.

- Well-defined models are developed to capture and use data to drive net-zero goals.

Ingka does all three. CEO Jesper Brodin is fond of saying that “being climate smart is also resource smart, cost smart and business smart.”

Up to 85 percent of the privately held company’s profits are also put toward business improvements, including those designed to reduce emissions. Historical analysis suggests other retailers, including Walmart, reinvest around 40 percent of profits.

That board level support is another reason Ingka says it is poised to deliver on its 2030 goal. “We’re pleased with where we are,” said Henzell-Thomas.

Create your own user feedback survey