Is it time for your company to outsource energy management?

Writing clean power purchase agreements and evaluating ever-evolving technologies is an increasingly complicated matter. Read More

The idea of engaging outside experts to manage power procurement across multiple locations more efficiently isn’t anything new. It’s a process that energy services companies have specialized in for many years.

Still, fewer than half of big companies officially use outside experts for data or strategy, which could be limiting the potential to curtail their power consumption or spending, according to recent research by advisory services firm Edison Energy.

“Most energy managers believe that the vendors and providers in the current energy services space aren’t capable of providing guidance on the full spectrum of challenges and solutions relevant to large organizations,” the company notes in its report. “A full 41 percent of companies surveyed cited the lack of a credible partner as a major barrier to new investments in energy.”

Naturally, Edison Energy would love an opportunity to fill that void. The organization, which is owned by the same holding company that owns Southern California but isn’t a regulated or related business, officially launched in March with headquarters in Irvine, California.

It sells “energy as a service” — an arrangement under which it assumes ongoing energy management responsibilities for its clients.

At a basic level level, that means negotiating more consistent prices across multiple sites. It also means, however, keeping on top of energy policies and incentives and helping companies evaluate whether investments in energy storage or clean power technologies such as solar or wind make sense for a client.

A holistic view

Many other organizations seek to make it simpler for businesses to climate-size their energy strategies, although many of them handle just one piece of the puzzle.

In April, for example, REC Solar (backed by Duke Energy) and Sungevity (which handles Lowe’s solar initiatives) launched a program specifically catering to businesses considering solar investments. “Together, we can help many more potential customers connect with the best solar company for the job and reduce energy costs from day one,” the companies said in a joint statement.

What makes Edison Energy’s pitch unique is that it provides a more holistic view of the situation. The company actually was created through the merger of three previously independent firms:

- ENERactive Solutions — A consulting organization from Asbury Park, New Jersey, that offers a broad range of engineering, optimization and project development services.

- Delta Energy Services — A specialist in data management, renewable energy integration and policy analysis from Dublin, Ohio.

- Altenex — A Boston-based firm that often negotiates long-term PPAs; it has access to developer representing more than 4,500 biomass, hydro, solar and wind energy projects.

Collectively speaking, Edison Energy has a presence at more than 10,000 locations, according to a top executive. That includes businesses, public sector work at schools and other government agencies, industrial sites and so forth.

“We’re looking at this from the lens of the largest users who have to pay the bills, pay less when they possibly can, build a sustainable energy profile,” said Edison Energy President Allan Schurr. “Sometimes, [these buyers] are very focused on continuity service. That may require additional equipment.”

Widespread interest in ‘high availability’

The needs of Edison Energy’s customers are pretty diverse, but one concern they share is finding better options for ensuring continuous power at facilities regardless of what may or may not be going on with the local electric grid. That is spurring continued interest in fuel cell technologies, especially in places such as data centers, Schurr said.

In order to qualify for federal tax credits on fuel cell projects, however, they need to be completed by Dec. 31. That’s prompting more organizations to evaluate projects that use energy storage technologies as a means of continuous power, a central idea behind San Francisco-based Advanced Microgrid Solutions.

The company, which will discuss its model during a panel at the upcoming Verge Hawaii, uses massive lithium-ion battery networks (built on Tesla technology) to help building owners rethink how they manage energy both when it comes to improving efficiency and incorporating renewables into their power portfolio.

The four-year-old company’s first big installation is across close to two dozen buildings for the Irvine Company. The idea is to make it far simpler for the owners to participate in demand response initiatives, using the batteries as a backup source of power when demand on the main grid is at its peak, said Advanced Microgrid CEO Susan Kennedy. Over time, they’ll be key to the management of solar and wind resources, she believes.

Kennedy has pretty strong credentials to back up her thesis: She was chief of staff for former California governor Arnold Schwarzegger and served as a California Public Utilities commissioner. “This helps provide response without inconveniencing tenants,” she said. “If you size it large enough, batteries are a way to make money at demand response.”

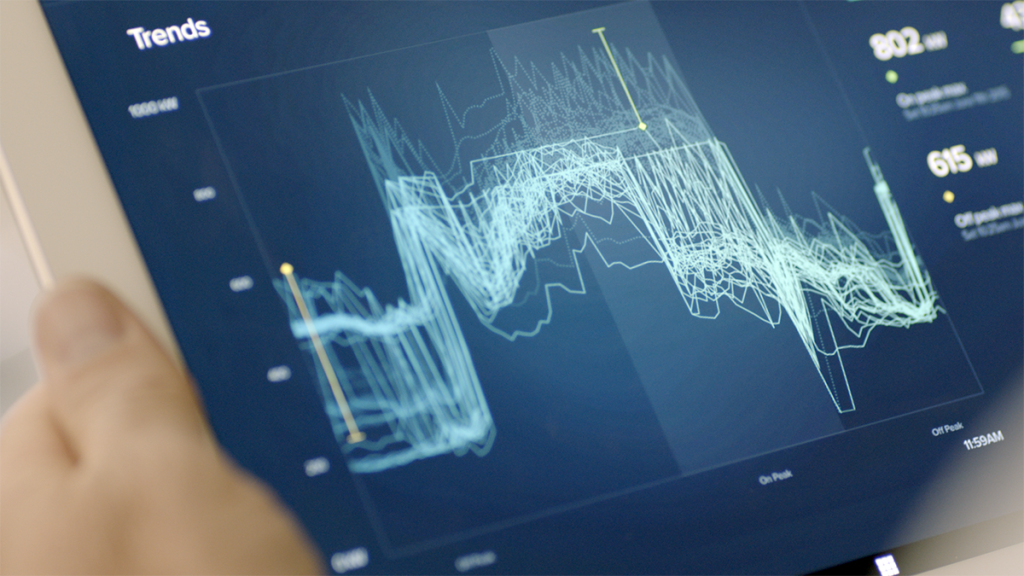

Advanced Microgrid acts as the active manager of these “Hybrid Electric Buildings,” working both with property owners and the local utility (in this case Southern California Edison) to install and maintain the technology, and run analytics that help unearth ways to reduce consumption. Its deal in Orange County authorizes it to deploy up to 50 megawatts of battery capacity.

The company’s relationship with Inland Empire Utilities Agency (PDF), a water utility in San Bernardino County, is perhaps even more intriguing. There, the “Powerpack” batteries — ranging in capacity from 150 kilowatts to 1.25 megawatts — will be used to manage the “intermittency” of Inland’s 3.5-megawatt solar installation, as well as a small wind turbine. When rates are higher, Inland will be able to draw on electricity generated from its clean power sources and stored on the batteries.

It’s a perfect example of why it’s time for organizations to start asking whether they should be using internal resources differently — and hire outsider to considers siloed initiatives.

“We are proud of our investments in energy efficiency, renewable generation and sustainable water management practices,” said Terry Catlin, president of the Inland board, in a statement. “Energy storage is the key to maximizing the value of those investment, allowing us to use our resources more efficiently, reduce costs for our customers and participate in building a more resilient electric grid for the whole region.”