Let’s incubate the Green Swans hatched by the COVID-19 Black Swan

History has shown us that government funding of visionary projects can have enormous positive outcomes. Read More

First in a three-part series.

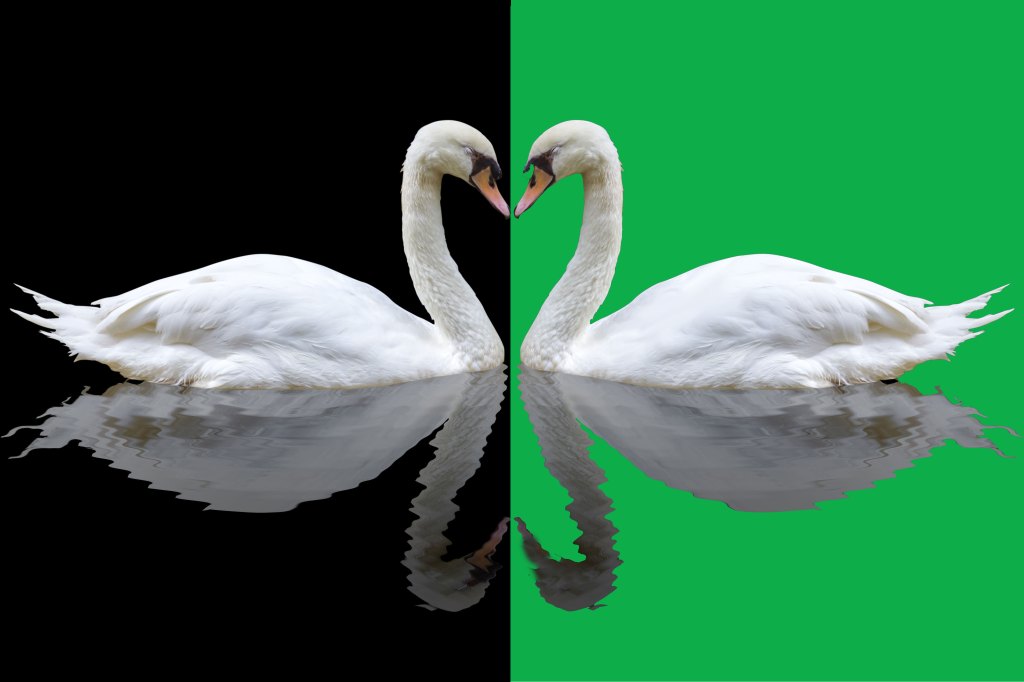

The global COVID-19 pandemic is a historic Black Swan event that offers a Green Swan of opportunities to harvest innovation from 50 years of converging exponential technologies. We are presented with a rare opportunity to invest in new innovations, rebuild our data and power infrastructures and supply chains to restore and strengthen the economy while healing the environment.

According to author Nassim Nicholas Taleb, Black Swans are unexpected, hard-to-predict events that result in extreme, unintended consequences. The coronavirus pandemic is a classic Black Swan. Over the past few weeks, we have witnessed countries and states scrambling for personal protective equipment and ventilators. Oil tankers are carrying millions of tons of oil with nowhere to go. Farmers are destroying food and supermarket shelves are missing essential items across the nation. These events, made visible by the COVID-19 virus, have shown us the fragility of systems pushed to their breaking point by design constraints to maximize return on investment in the absence of resiliency.

Green Swans, according to John Elkington, are positive market developments once deemed highly unlikely, if not impossible. They can have a profound positive impact across economic, social and environmental value creation.

To lessen the impact of current and future Black Swan events, we have Green Swan solutions that are ready to deploy on behalf of preparedness and resilience. Entrepreneurial innovation, new investment and regulatory models must be promoted and accelerated to prepare for future pandemics, climate change and to restore the environment.

Back to normal is not an option

To rebuild the economy, the United States government so far seems to choose to deploy the same playbook it did in 2008: funding legacy companies in industries such as oil and gas.

This old playbook will not return us to a pre-COVID-19 “normal.” The price of oil plunged below zero on some days, and customer demand remains at an all-time low. Bailouts paper over the fossil fuel industry’s weaknesses and “will create a zombie industry forever dependent on state aid for survival,” according to Jason Quay, director of the Global Climate Strategy Sunrise Project.

History has shown us that government funding of visionary projects can have enormous positive outcomes. In the United States, examples include the Transcontinental Railroad, the Manhattan Project, the Interstate Highway System and the Apollo program.

What if the government were to integrate support for clean energy into its COVID-19 economic recovery program? Renewables would emerge more robust than ever. Utilities already have found wind and solar power are less costly sources of energy. The economics of solar and wind including storage costs are quickly undercutting the economics of oil as a prime mover. According to MIT Tech Review, prices for solar energy have declined by 97 percent since 1980. Government policies that stimulated the growth of solar accounted for 60 percent of that price decline. Even without those policies — they soon expire — renewables are more than competitive against fossil fuels.

The national strategy for re-opening the economy needs to focus on resilience projects and creating an infrastructure that will absorb future shocks. Government must provide the regulatory support to amplify transformative innovation from the intersections of converging exponential technologies. We already have demonstrated the efficacy of investments directed to electrical distribution, water, transportation and renewable energy.

Green Swan solutions are already at work

Entrepreneurs are on the verge of creating an era that will be marked by abundance, sustainability and resilience. The world that emerges from COVID-19 could offer plentiful, zero marginal cost electricity, ubiquitous computing and cheap bio-manufacturing of high-purity drugs and environmentally friendly plastics directly from DNA.

As another example, the digitization of the electrical grid, is changing the way power is delivered and consumed. Cheap electricity drives electrons across the electrical grid where they become more accessible and offer a more affordable, cleaner and more resilient way to charge electric batteries. Among other benefits, that will increase EV adoption, leading to cleaner air.

Cheap electricity will increase access to clean water. One ingenious company, Zero Mass Water, has repurposed the same solar panels helping create cheap electricity to squeeze potable water from the air — even in desert conditions.

Cheap electricity also will drive synthetic biology — the intersection of information and biotechnologies, where Moore’s Law meets Mendel, the father of genetics.

Synthetic biology already has delivered safe, more economical, cleaner fuels, hardier crops and proteins that are brewed locally to fertilize crops and feed animals — including us humans. Futuristic, sustainable, brewed, high-performance materials already are manufactured locally, disrupting traditional supply chains.

Among the many companies demonstrating the breadth of this industry are Calysta (proteins for food production), Codexis (enzymes for multiple applications) and Geltor (proteins for nutrition and personal care products). These companies are demonstrating their products can be more effective than those developed from petroleum products or requiring the slaughter of animals.

Emerging digital and biological tools for traceability and reliability are helping build supply-chain resilience now when it is most needed. With digital and biological tools, entrepreneurs are mapping supply chains to increase traceability while offering new levels of transparency following goods as they make their ways from manufacturer to consumer.

Resilience, despite resistance

Entrepreneurs, new business models and investors will show us the way forward. Entrepreneurs have demonstrated time and time again that they can compress a century of progress into a decade. With the support of a community of enlightened venture capital investors, corporate strategic partners, financial institutions and governmental regulatory bodies, entrepreneurs can create exponential change and generate substantial value in short periods of time. With community inputs from technology, financial and regulatory bodies, entrepreneurs can generate greater returns on investment, and their efforts can create a template for the rest of the world.

We need to encourage and fund new business models that leverage converging exponential technologies. In the 1990s, business models were focused almost exclusively on share of wallet. For the past 20 years, digital technology has enabled the emergence of the business models that have driven the circular and sharing economies with their positive benefits. New business models are quickly emerging based on cloud computing, internet of things (IoT), artificial intelligence, blockchain, data analytics, augmented/virtual reality and combinations thereof. No doubt, they will bring countless benefits. Regulatory barriers for new business models should be eliminated or eased.

Don’t bet against America

We know this current crisis is a preview or warm-up act for a climate-changing world. The pandemic demands that business and government leaders be ready, willing and able to respond while building secure and resilient supply chains and infrastructure. The post-pandemic world requires that business and government leaders encourage creativity in preparing for the next crisis.

As we try to anticipate a resilient, reliable, secure, sustainable and prosperous future, we also have the chance to incubate and create that future. We can apply what we have learned from the past 50 years of entrepreneurial innovation, from Moore’s Law (semiconductors, information technologies and the Internet) and the mapping of the human genome, and their positive impact on global GNP. It is up to us to innovate and advocate to make the right choices.

In a letter to Berkshire Hathaway shareholders, investor Warren Buffett wrote, “America’s economy will continue to grow and prosper for generations to come.” He finished by saying, “For 240 years, it’s been a terrible mistake to bet against America.”

Applying our know-how and ingenuity to prepare for the next crisis is the right place to start.