These entrepreneurs are staying grounded as climate tech soars

Flush times also tend to create a boom mentality. But serial founders Gene Berdichevsky and David Crane are approaching the exuberance with pragmatism. Read More

Money is flowing into climate-tech startups, investor funds and related public markets more than ever before. Just check out the over 50 special purpose acquisition companies (SPACs) created in 2020 to bring climate tech companies public. That’s a good thing, right?

Overall, yes. The planet needs as much capital as possible invested into potential solutions to fight climate change.

However, a sudden influx of money into a sector also tends to bring along growing amounts of wasted or lost money. That’s partly because a boom attracts newcomers, who might have less expertise; and partly because more money just increases the number of misses, along with the hits. Flush times also tend to create a boom mentality: The money’s plentiful, so let’s spend it.

But for 37-year-old Ukrainian immigrant Gene Berdichevsky — founder and CEO of battery startup Sila Nanotechnologies and the seventh employee at Tesla — boom times are a time to stay pragmatic. “I remember what it’s like on the upswing the first time around, and even at Tesla, it was brutally hard. I’m cognizant of how precious every dollar is,” Berdichevsky said in an interview with GreenBiz.

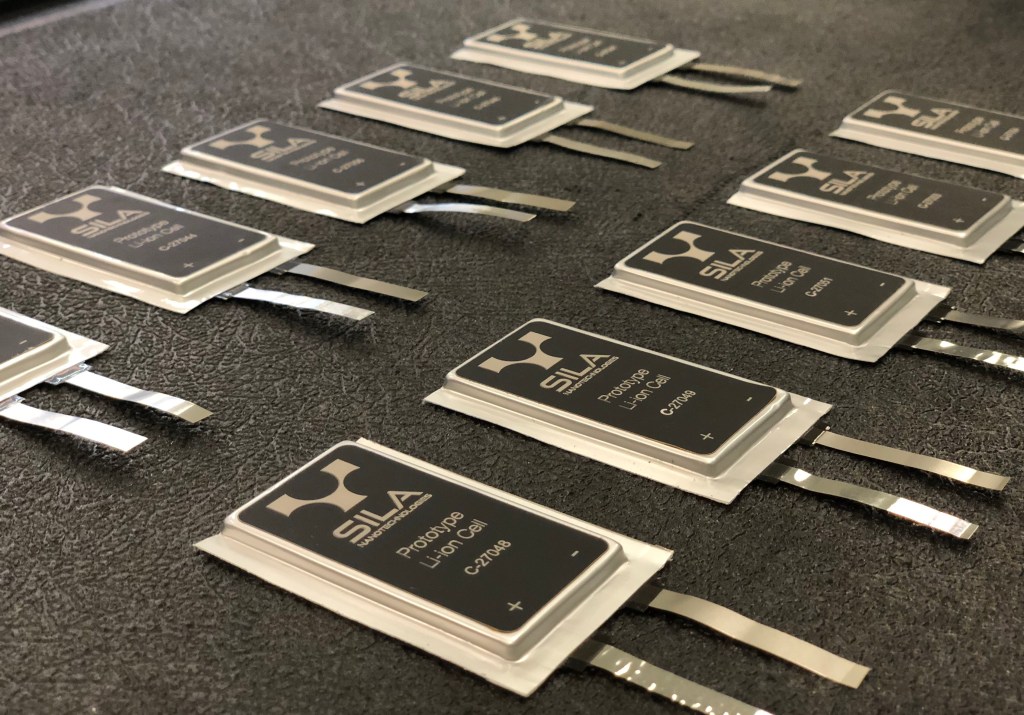

Sila Nano sells a battery material — a silicon-based powder that goes into the battery anode — designed to boost the energy density of a battery cell and ultimately lower the cost of electric vehicle batteries. The company has a factory in Alameda, California, producing battery materials that will be shipped in small consumer electronics devices, such as fitness trackers, wireless earbuds and smart trackers, sometime this year.

But the company’s big target market is batteries for electric vehicles. To get there, Sila Nano just raised a whopping $590 million in funding, from private investors Coatue and T. Rowe Price Associates, giving the company a valuation of $3.3 billion. “This is first and foremost for the piggy bank for our next factory,” Berdichevsky explained. (Unlike many EV-related companies opting for SPACs, Sila Nano chose to raise private capital.)

The factory, which will be somewhere in North America, will be a 100 gigawatt-hour plant (that’s large) that will make its silicon materials for electric vehicle batteries, with the goal to start factory production in 2024. The idea is for Sila Nano’s tech to be used in EVs in 2025, and presumably first with automaker partners such as Daimler and BMW Group. The company plans to also use the funds to hire 100 more employees this year, many of them engineers and researchers to work on R&D.

If Sila Nano is able to scale and widely commercialize the silicon material, which lowers the cost of EV batteries and amps up the energy density, it ultimately could help electric vehicles move onto the path of becoming mainstream. To reduce the cost of lithium-ion batteries, the industry needs all these incremental innovations such as Sila Nano’s tech that will continue to push down the cost, Berdichevsky explained.

Now at the helm of a $3.3 billion battery materials company, Berdichevksy — still in his 30s — is in the unusual position of being a seasoned cleantech old-timer. He described the company’s new funds as “a luxury that we’re taking advantage of. The plan wasn’t to raise this type of money at this point.”

As climate-tech funds raise billions and new investors pour into the space, it’s easy to move into a boom mentality. But those who have been around the block a few times suggest something else: Stay pragmatic.

David Crane — investor, entrepreneur and former NRG Energy CEO — is another longtime cleantech vet who’s been through the trenches. A decade ago, as leader of NRG Energy, he oversaw the creation of EVgo, a company building out electric vehicle charging infrastructure.

That idea was a bit before its time. Electric vehicles were still niche, and only a handful of EV models were available. “We knew when we started we were five years too early, but it’s really been 10 years. And timing is everything in business,” Crane said.

Last year, Crane helped form a new SPAC, which began looking for opportunities to bring a climate-tech company public. Lo and behold, in a virtuous circle, Crane’s SPAC recently merged with EVgo to take it public. EVgo plans to raise $575 million, valuing the company at $2.6 billion.

Crane isn’t too nostalgic about the reunion, but says he’s ultimately excited that the time finally has come for electric vehicles.

For SPACs, the climate-tech boom times have soared to some eye-popping heights. And Crane, like Berdichevsky, has the seasoned perspective of having been through financial cycles before.

“We can see just in the SPAC world, the enthusiasm is getting a little over-exuberant,” he said. “When Wall Street finds a good thing, it tends to do it to excess and then there’s an overcorrection. I’m not here to say, ‘Let the good times roll forever.'”

For now, anyone who’s been through the ups and downs of cleantech over the years is likely enjoying the ride.

This article has been updated to correct that Sila Nano’s CEO Gene Berdichevsky is actually 37 years old, not 34.

Want more great analysis of electric and sustainable transport? Sign up for Transport Weekly, our free email newsletter.