3 best practices for sustainability value creation

With insights from some of their 150,000 customers, Salesforce has pulled together its top three tips for turning sustainability into business value. Read More

This article is sponsored by Salesforce.

The pressing need to address climate change, paired with mandatory environmental, social and governance (ESG) disclosure requirements, has accelerated sustainability efforts across industries. At Salesforce, we work with over 150,000 customers worldwide, and increasingly, we find ourselves talking to sustainability, finance and technology teams about sustainability value creation.

As a leading business-to-business company, Salesforce has a unique window into how the most successful companies are advancing sustainability value creation. Through these customer conversations, we’ve identified three best practices from the most sustainability-mature enterprises:

- Be clear about the business value of sustainability

- Manage sustainability performance data effectively

- Focus on the “magic triangle” of sustainability, finance and technology

In this article, we’ll dive into these best practices and why they are critical for maximizing sustainability value creation.

1. Be clear about the business value of sustainability

Leaders continue to report that sustainability is a business imperative. One study found that 93 percent of leaders across sustainability, finance and technology think sustainability is important to commercial success. Another found that 80 percent of investors see ESG as an important factor in decision-making.

Today, we see a sharp focus on specifying the explicit value of sustainable business practices. In our conversations with sustainability-mature customers, the most common value drivers we hear are risk mitigation, cost savings, growth and talent.

Risk mitigation

Risk mitigation is often the most obvious business benefit of sustainability, particularly with the rise of mandatory ESG reporting. Compliance offers clear value by preventing regulatory penalties, avoiding legal costs and further reducing operational and financial risks.

France made headlines in 2024 because, in addition to a $81,400 fine for failing to comply with the Corporate Sustainability Reporting Directive, corporate officers could face up to five years in prison. In California, companies that fail to comply with the Climate Corporate Data Accountability Act could face civil penalties of up to $500,000 per year.

Cost savings

Cost savings is the second most common business benefit we hear. Being more efficient with water usage, reducing power consumption and switching to renewable energy resources helps organizations improve operating margins and increase asset efficiency.

For one Fortune 500 company, moving from piecemeal sustainability data management to using enterprise-grade tech enabled an emissions reduction of more than 50 percent over five years. For another large multinational company, leveraging sustainable field service data led to an 11 percent reduction in miles traveled, a carbon usage reduction of more than 150 tons and $17 million in savings unlocked via tech productivity.

Growth

When it comes to growth, we hear about both revenue protection and new revenue opportunities from our customers. On the former, at Salesforce, we’ve seen consistent year-over-year growth in requests from customers for our sustainability data. As part of our customers’ supply chains, we collect and report this data to show the clear tie between our sustainability performance and our ability to grow our customer relationships.

Sustainability also accelerates growth via new revenue opportunities. For example, one facilities management firm is using Net Zero Cloud for their own ESG management and a sustainability-as-a-service offer to their customers. Supporting multiple sustainability motions simultaneously is a powerful way to maximize sustainability-led growth.

Talent

Talent attraction, retention and engagement have long been improved by company values and sustainability initiatives. In fact, 64 percent of executives at organizations with ESG strategies said having an ESG strategy positively affected talent recruitment.

2. Manage sustainability performance data effectively

As sustainability leaders have more conversations with investors, boards and stakeholders, data is increasingly critical. When it comes to effective sustainability data management, the most mature companies do three things from the start: align to the urgency and scope of ESG compliance, prioritize employee upskilling, and get the right stakeholders at the table.

Align to the urgency and scope of ESG compliance

The data required for ESG reporting is complex and often hard to work with, particularly at the start. It comes from all corners of an organization, in many formats, and sometimes in different languages.

Managing sophisticated business data through spreadsheets is no way to maximize value creation — and as regulations become more stringent, disconnected data leads to inefficiencies and compliance risks. Early adoption of data management solutions not only ensures that companies meet reporting obligations, but also allows them to identify efficiencies, reduce costs and differentiate themselves in the market.

Prioritize employee upskilling

Effective sustainability data management is just as much about employee upskilling as it is about technology. LinkedIn data shows that sustainability-related job postings have grown by 8 percent annually, but the talent pool hasn’t kept pace. This makes employee upskilling vital for organizations.

This need is even more acute in the age of AI, where employees working alongside autonomous AI agents with technology such as Agentforce is key to scaling sustainability faster. Agents can help with everything from platform setup to accounting and operations to ESG reporting. But first, employees need to understand what agents are, how to use them, and how to build custom agents for their needs.

Get the right stakeholders at the table

The most sustainability-mature organizations have three key teams at the data table from the start:

- Sustainability led by the chief sustainability officer

- Finance led by the chief financial officer, often including Legal & Risk

- Technology led by the chief information/technology officer

Each team has specific — but critical — data-related needs. For example, finance needs solutions with audit trails and governance controls to meet compliance requirements. Technology, on the other hand, seeks to reduce the number of point solutions requiring their management. The teams with key data responsibilities must be part of the discussion from the beginning.

3. Focus on the ‘magic triangle’ of sustainability, finance and technology

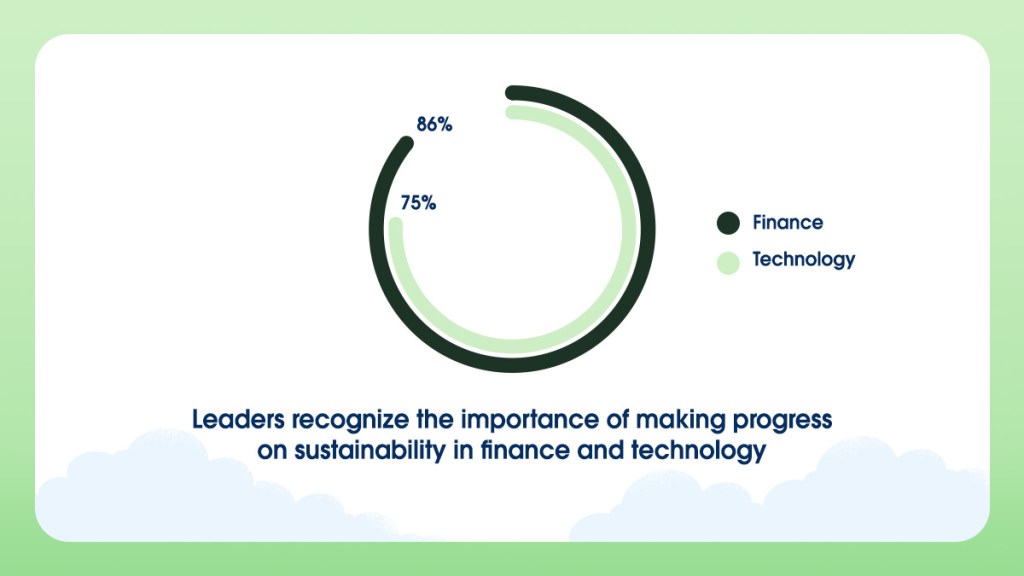

The importance of collaboration between sustainability, finance and technology extends beyond data management, as the executive sponsors engaged from the C-suite is arguably the most important practice among sustainability-mature organizations.

Why sustainability, finance and technology? Because sustainability transformation deeply depends on each of these functions, and each function has adjacent but different needs to deliver success.

At the highest level, sustainability teams develop and manage sustainability strategies, ensuring compliance with ESG standards and reducing the environmental footprint. Finance teams are increasingly on the hook for ESG compliance, in addition to aligning sustainability initiatives with financial health, capital allocation and reporting frameworks. IT teams leverage technology and innovation to support sustainability programs, improve efficiency and enable data-driven decision-making.

While many companies lean on sustainability teams to drive corporate initiatives, successful transformation cannot be achieved by one department or function alone. By focusing on this “magic triangle” of sustainability leadership, you can accelerate the integration of sustainable business practices across your entire enterprise.

This doesn’t mean other teams aren’t necessary. Procurement, legal, real estate, and many others are key to sustainable transformation, too. However, the role of each can vary significantly between businesses and industries. By comparison, leaders across finance, technology and sustainability are consistently essential in guiding what are the opportunities, how to measure them and how to make the resource allocations to achieve them. That way, they sit at a unique intersection to drive long-term sustainability value creation and innovation at the heart of the business.

Accelerating sustainability value creation

Sustainability will only continue to grow as a value creator. And now, we’re starting to engage with customers about how humans with AI-powered agents can drive sustainability together. Accelerating our collective ability to meet this moment is directly correlated with reducing barriers and sharing best practices. Toward that end, several leading sustainability and tech organizations have formed a Sustainability Value Creation research partnership to help accelerate best practices integrating sustainability across the C-suite.

We hope this partnership will enable leaders to address the gap in sustainability value creation. There has never been a more important moment for leaders to embrace sustainability transformation.