Trump’s tariffs deepen America’s need for domestic circular economy

A growing need for rare minerals is bolstering the case. Read More

The Trump administration has launched a series of trade skirmishes that include tariffs on China and on aluminum and steel, endangering supplies of raw materials for the clean energy transition and underlining the need for a domestic circular economy.

On Feb. 11, Trump announced a plan for a 25 percent tariff on all steel and aluminum imports — the majority of which come from Canada and Mexico. That announcement came on the heels of the administration’s 10 percent tariff on Chinese imports, which has already led to the Middle Kingdom’s retaliatory restriction of critical mineral exports, including tellurium, bismuth and tungsten.

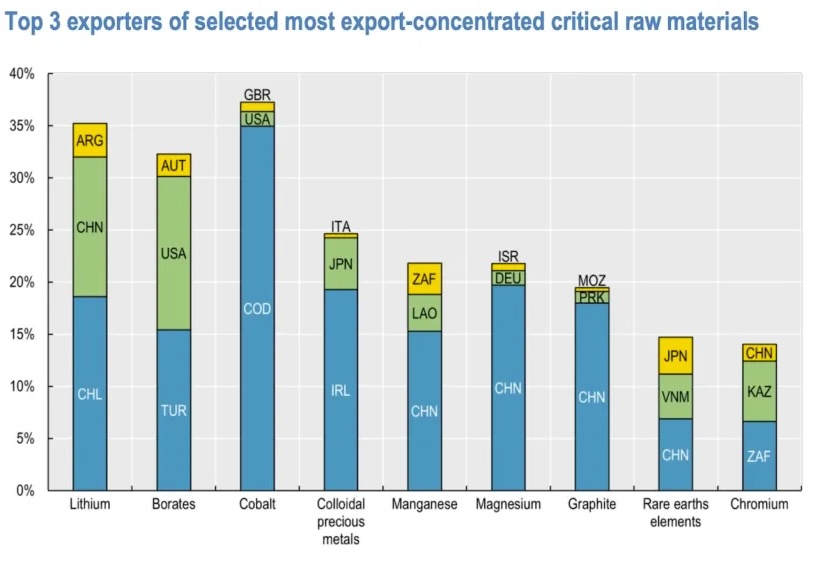

These minerals are vital to solar panel manufacturing and used in a range of technologies, from cell phones to renewable energy tech, while aluminum and steel are vital for grid expansion and construction of data centers. Some critical minerals are also only found in specific geographical locations, allowing only a few countries such as China, Japan and Turkey to control the supply.

Due to this chokehold, a price increase will affect the marketplace in one of two ways, if not both: consumer prices for these vital materials will increase across the board to compensate for the increase in material price; and/or U.S. manufacturers will be outpriced by the tariffs.

“Energy markets are highly integrated, and free and fair trade across our borders is critical for delivering affordable, reliable energy to U.S. consumers,” said American Petroleum Institute president and CEO Mike Sommers in a statement.

Demand for raw materials

At its current pace and without a circular economy, the need for rare critical minerals and metals is projected to nearly double from 92 to 167 gigatonnes between 2017 and 2060, according to the Organization for Economic Co-operation and Development (OECD). To combat the growing need for virgin rare minerals, a domestic economy focused on reusing metals from waste and scraps could supplement the supply and increase market activity.

The policies to enable the creation of such a market are already in place. In 2024, Sens. Bill Cassidy (R-La.) and Michael Bennet (D-Colo.) introduced the Americas Act, a bipartisan bill proposing the investment of $14 billion to create a domestic circular textile economy. While focused specifically on textiles rather than minerals, the bill would create financial incentives for manufacturers to relocate their supply chains to U.S. soil along with tax cuts for repurposing and recycling developers.

In addition to the Americas Act, OECD has proposed creating trading agreements that allow battery material waste from electric vehicles (EVs) and solar waste to come to the U.S. to ensure the durability of a domestic circular economy. It’s estimated that EVs will provide 235,000 tons of battery material waste by 2040, while solar waste will reach a total of 1 million tons by 2050.

The ongoing trade wars with allies such as Canada emphasize the need for economic stability ensured by a U.S. domestic circular economy. In 2023, for example, Canada accounted for $47 billion of U.S. critical mineral imports.

“Mexico and Canada’s exports of grid equipment will take a big hit,” said Stephanie Muro, Trade & Supply Chains associate at BloombergNEF. “These two countries provided over half of U.S. imports of large power transformers last year, and about a third of imported conductors and converters – equipment that forms the backbone of the power grid.”

[Join over 1,500 professionals transforming how we make, sell, and circulate products at Circularity, April 29-May 1, Denver.]