Why businesses need climate transition plans more than ever — and how to get started

Starting in 2025, Europe requires companies to share a climate transition plan or explain why they don’t have one. Here's where to turn for help. Read More

About 5,500 companies have net zero goals with a stamp of approval from the Science-Based Targets initiative. How, exactly, do they intend to reach across layers of operations and serpentine supply chains to decarbonize by 2050?

Only one-quarter of net-zero-aspiring businesses have explained by crunching numbers, presenting models and planning scenarios to build a climate transition action plan (CTAP).

Such plans are a relatively new, and growing, part of sustainability work. Until recently, companies would set a goal, work on it, and later announce whether they succeeded.

“But now as the stakes seem higher, as we see climate events happening on a regular basis, stakeholders like customers and investors really want to know that companies are taking the steps to actually meet the goals way before they get to the end of that goal,” said Jenny Ahlen, managing director of net zero at We Mean Business, in an explanatory video.

A CTAP differs from an internal strategy in that it tells the world the tiny steps a company will take to arrive at net zero.

Because there’s a lag time between the incremental work and the ultimate emissions reductions, a climate transition plan is the perfect place to tell a narrative that explains the gaps, according to Ahlen.

Who are the early movers?

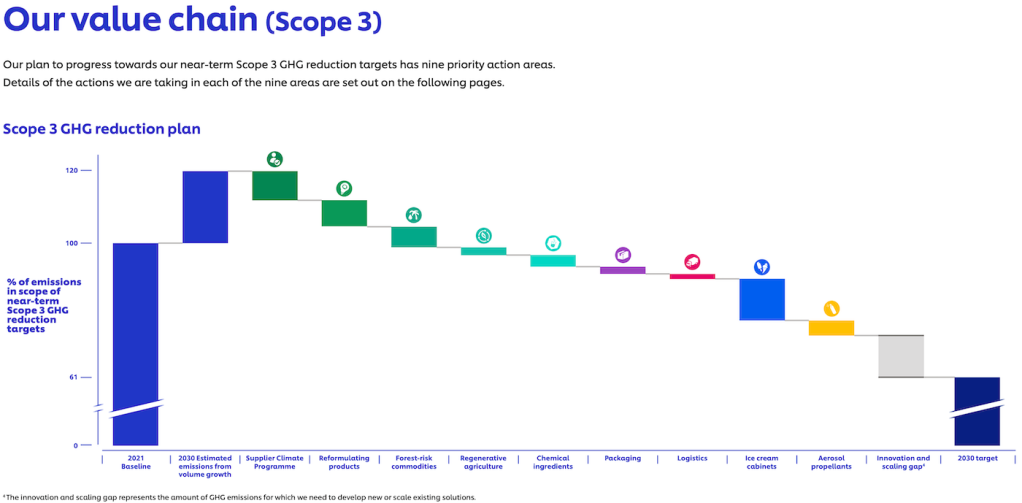

Companies in high-emitting industries are among the first to offer CTAPs in the past few years. These include Unilever, Glencore and Royal Dutch Shell.

Forty-seven percent of companies have net zero plans, 10 percent have pledged them and 41 percent have none, according to the Net Zero Tracker. One in four of the 23,000 companies disclosing to the CDP have gone further by releasing a climate transition plan.

Who’s going to force you to create a transition plan?

In January, the European Union’s Corporate Sustainability Reporting Directive (CSRD) demands that companies either share their transition plans or explain why they lack one.

That steps up in 2027 to a requirement, under the EU’s Corporate Sustainability Due Diligence Directive (CSDDD), that businesses develop climate transition plans. These directives apply to companies based in, publicly traded in or operating a large subsidiary within any of the 27 European Union member states.

Failing to satisfy those rules may result in paying fines in the millions of euros, facing potential civil liability and losing access to certain public contracts.

The United Kingdom may establish a rule under its Sustainability Disclosure Requirements (SDR), perhaps in 2025, for banks and other big businesses to create transition plans.

Under a second Trump administration, hopes are dim for a U.S. Securities and Exchange Commission (SEC) proposed requirement for public companies to disclose climate-related risks and strategies. However, on Sept. 27, California Gov. Gavin Newsom updated two laws that mandate climate-related disclosures for businesses operating in the state.

- Under the Climate Corporate Data Accountability Act, starting in 2026, companies with more than $1 billion in sales must report prior-year Scopes 1 and 2 emissions. A Scope 3 requirement follows in 2027. Penalties for non-compliance are up to $1 million per reporting year.

- In addition, in 2026 the Climate-Related Financial Risk Act will require that firms with more than $500 million in revenue create reports that detail climate-related financial risks and planned mitigations. The penalty for not complying has a $50,000 annual cap.

Who else cares about these plans?

Such rules are likely driving some of the 8,600 businesses that told the CDP they plan to have a transition plan within two years. The number of companies with a plan jumped by 44 percent from 2022 to 2023, according to the CDP.

Beyond the regulatory sticks, however, why would any company that doesn’t have to file a CTAP bother to create one?

“Investors are increasingly asking and looking for CTAP-like information,” said Jenny Ahlen, managing director of the net zero program at the We Mean Business Coalition, based in New York City.

One large initiative, Climate Action 100+, encourages investors to ask businesses in their portfolios whether they maintain strong governance, with board oversight and accountability, around climate risk. Ceres, Principles for Responsible Investment (PRI) and others back that effort.

Climate Action 100+ also urges investors to push companies for “action to reduce emissions, engage policymakers, address sectoral barriers, provide enhanced disclosure, and implement transition plans to deliver on robust targets,” Ahlen told GreenBiz via email.

Unilever’s detailed plan

Bracing for exposure

Companies leave themselves exposed to serious risks if they haven’t spelled out their path to decarbonize, according to advocates of transition plans.

Transition risks include failing to prepare for disgruntled investors, facing the impacts of climate-related legislation and losing a competitive advantage. Plus there are the physical risks of being unprepared for floods, droughts, fires and other events that disrupt supply chains and hurt business performance, Ahlen said.

What if a climate transition plan backfires?

Maybe this sounds like a strong case for crafting a plan. But does a company face a different kind of exposure by sharing too much of its inner workings?

“Despite safe harbor provisions, some companies remain nervous about including forward-looking statements in their transition plans,” Ahlen said.

And the fear of sharing potentially competitive information may result in omitting key information from a plan or not publishing at all. “This could give the impression to stakeholders that they aren’t taking climate risks and opportunities seriously enough, which could be a reputational risk,” Ahlen added.

However, the positive advantages of sharing the specific steps toward net zero outweigh the potential downsides, according to climate transition plan proponents.

“Companies who have a robust CTAP are improving their sustainability communication efforts and reputation by demonstrating their climate leadership to a variety of stakeholders – customers, investors, employees, suppliers, and competitors.”

So you’re sold on creating a climate transition plan

You’ve decided to dig in and create a plan. Now what?

Leading proponents of corporate net zero work offer plenty of guidance. Their guides share in common an emphasis the bread and butter of the sustainability office, such as disclosing emissions, but also advance the concept of ensuring a just social transition to net zero.

This 20-page Climate Transition Action Plans Transformation guide, released in 2022, describes approaches from Mercedes-Benz, Microsoft, Natura, Nike and Unilever. Five core questions, a checklist and a page of links are included.

The report outlines 11 elements of a sound plan, including: near-and long-term science-based targets; robust governance; integration of climate into financial planning; GHG accounting; low-carbon initiatives; net-zero-aligned CO2 removal plans; value chain engagement; policy engagement; a systems approach to issues related to climate, nature and society; a “just and inclusive” transition strategy; and transparency and reporting.

EDF offers an interactive website to “Develop a Climate Transition Action Plan.” Visitors can walk through eight action steps, from establishing the CTAP foundations to disclosing a plan and checking progress. Dropdown menus help to customize the pathway, such as filtering for the finance, procurement or sustainability team as well as by sector. Resources include PDFs for filling out a transition plan template or three-page checklist by hand.

It’s a joint effort with the We Mean Business Coalition, CDP, Ceres and Ramboll Consulting.

Released in June, the Ceres resource offers case studies of Ball Corporation, General Mills, Mars and National Grid. In 30 pages, the report sets forth the business case. It outlines how to build upon existing disclosures to develop a “leading” plan.

Its six action areas include setting science-based targets; “decarbonizing the business; ensuring a just transition; advocating for public policy; supporting integration and accountability; and tracking and reporting progress.”

As of the publication date, this EPA website updated in March defines the key components of these plans, including a hypothetical “wedge chart” template of a decarbonization roadmap. It links to fundamental steps, such as developing a GHG inventory. The EPA defines the key components of a transition plan as near-and long-term emissions targets; time-bound strategies for the targets; engagement plans for the value chain and stakeholders; scenario analysis of climate risks and opportunities; priorities to respond to physical and transition risks; accountability mechanisms and KPIs; and financial planning.

Where to go from here?

Companies should pick one plan that resonates and stick with it, according to Levi’s Senior Director of Sustainability Jennifer Dubuisson. She was deeply engaged in the creation of Levi’s plan, making it among the first handful of apparel companies to create one, released Oct. 16.

How can an often resource-strapped sustainability team keep the effort moving?

Sustainability professionals need to be open to feedback, Dubuisson said. “We did that about midway through in the creation of this transition plan, and it was incredibly helpful, and gave us a lot of perspective on the opportunities and gaps.”

Finally, be flexible with timelines, not only in creating and sharing the plan but also in talking to external stakeholders, she advised.

“A transition plan is a business plan, if you do it right and well,” she said. “By working really in lockstep with our key business partners, that is how we are integrating this into their strategic business plans. That is how we make sure that this work continues to live, not just within the sustainability team, but as a commitment shared amongst the entire organization.”