Why we need to reengineer carbon finance to support sustainable energy infrastructure

Carbon finance should drive the development of the infrastructure necessary to ensure the energy transition, according to Verra's former CEO. Read More

This is the fifth article in a six-part series examining how carbon markets can catalyze the transition to a green economy, creating a new paradigm for carbon finance. Previous articles in this series describe reimagining carbon markets, a new model for additionality, government’s role in carbon markets and the integration of natural climate solutions.

Carbon markets have driven substantial financing toward the development of new renewable energy projects. Renewable energy projects were a key asset class under the Clean Development Mechanism and then in the voluntary carbon market. However, current rules hinder investment in the types of infrastructure needed for the energy transition. That’s why I’m arguing that we should rethink carbon finance so that it supports the development of the infrastructure we need to ensure the energy transition.

An unequal playing field

The conventional approach to assessing additionality for renewable energy projects, which essentially compares their internal rates of return with those of fossil-fired facilities within each project’s boundaries, overlooks two important factors:

- Access to the grid: Renewable energy projects, such as large-scale solar and wind, are often situated in remote locations, making direct grid connections less feasible compared to fossil-fired facilities, which are typically built near existing grids. Consequently, the costs associated with connecting renewable energy projects to the grid are generally much higher than those for fossil-fired facilities.

- Storage needs: To make a comprehensive comparison between a renewable energy facility and a fossil-fired facility, it is essential to evaluate the need for and use of storage capacity, particularly given the intermittent nature of most renewable energy sources.

Neither of these important elements are captured through the use of the existing additionality tool, which has been the dominant way renewable energy projects are vetted.

Positive tipping points for renewables

Previous articles in this series have argued that carbon finance can make the early, necessary investments leading to the green transition of particular sectors of the global economy. This approach could be applied to the electricity sector, especially considering the effectiveness with which carbon markets channeled critical finance to this sector in the past.

Using carbon finance to further drive the expansion of renewable energies requires defining what is needed for the energy transition. Because most renewable energy projects can stand on their own when compared with fossil-fired facilities, this means determining the expansion and upgrades needed for old and ailing grids that would then enable new renewable energy projects to readily connect to the grid.

These expansions should not be too difficult to determine. The limitations of existing grids are well known, and there are sophisticated resource maps that identify regions of the world with the potential to generate significant volumes of renewable energy — but which are often not served by existing grids. Making such a determination is akin to establishing a positive tipping point (PTP) for the electricity sector — the point at which carbon finance is no longer necessary for the further development of new projects. Going forward, then, renewable energy projects could be charged a fee that would be used to build the grid and develop needed storage capacity until the PTP is reached.

Unlike conventional additionality metrics, which focus on a project’s ability to stand alone financially, a PTP approach tailored for the renewables sector would hinge on achieving sufficient grid expansion and storage capacity. This framework would enable renewable projects to contribute to grid development through a predetermined fee system, ensuring critical early-stage financing for infrastructure expansions.

By integrating the costs of grid expansion and storage capacity into the carbon credit framework, carbon finance can catalyze the development of renewable energy projects that would otherwise struggle to connect to existing infrastructure. This approach not only enhances the viability of renewable energy investments, but also accelerates the deployment of clean energy solutions in regions previously constrained by inadequate grid infrastructure.

South Africa as a case study

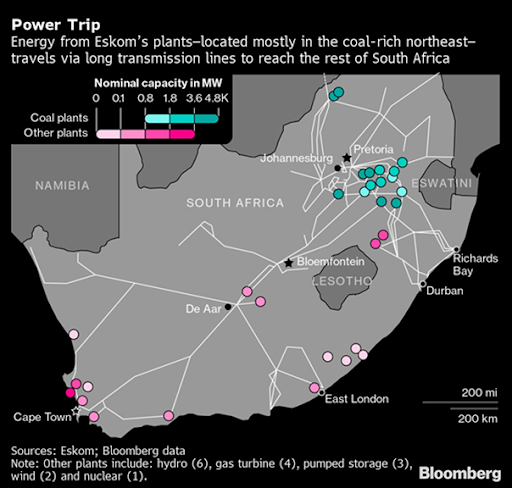

South Africa illustrates the potential of applying a PTP to the electricity sector. Initially developed around coal-rich areas, South Africa’s current grid, managed by the national utility Eskom, expands to urban centers but lacks coverage in regions with significant renewable energy potential, such as the sunny Kalahari Desert that borders Botswana to the north and Namibia to the west.

Implementing a PTP approach would identify the needed grid expansion and define, upfront, where investments need to be made. This method would also simplify additionality assessments by relying on a streamlined positive list approach, eliminating the need for extensive documentation. As long as the fee paid by projects represents true additional costs needed to upgrade and expand the grid, as well as build the needed storage capacity, the carbon credits those projects would generate would be considered of the highest integrity.

Another key element to consider is that South Africa has a large potential source of domestic, readily available financing for this national challenge: its own domestic carbon tax, some of which can be paid for by retiring approved carbon credits. Revising the rules governing the credits that can be used to comply with the country’s carbon tax to finance the expansion of the grid and the development of storage capacity would help South Africa meet the challenging target of greening its electricity sector.

Renewables revisited?

The carbon market is currently undergoing a transition. At a macro level, there are important initiatives such as the Integrity Council for the Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Market Integrity Initiative (VCMI) working to address concerns about integrity. At a more micro level, there is a big debate around whether renewable energy projects should be generating carbon credits. While major carbon crediting programs such as the Gold Standard and Verra’s Verified Carbon Standard (VCS) no longer accept new renewable energy projects in most countries, other programs such as the Global Carbon Council do. That debate, however, is a zero-sum game — renewables are either in or out.

Instead, a more constructive proposition would be to design carbon finance so that it supports the development of the infrastructure needed to ensure the energy transition. The greening of the electricity sector is one of the critical challenges the world faces, and it is a sector where carbon finance has demonstrated it can work incredibly well, filling in important gaps. Designing the market intervention so that carbon finance funds essential infrastructure not only helps meet immediate energy needs but also lays the foundation for a resilient and sustainable energy system. There is a desperate need to electrify and green the energy sector. Carbon finance can help, as long as we consider the long-term objective and design the system properly.

The next and last installment in this series considers the scope of the climate challenge and provides some concluding thoughts on the importance of using carbon finance as a tool to enable the green transition.

The topic of innovative financing is addressed in Chapter 5 of David Antonioli’s recently released report Financing the Transitions the World Needs; Towards a New Paradigm for Carbon Markets.