Finance & Investing

Why May 26 matters to companies and investors

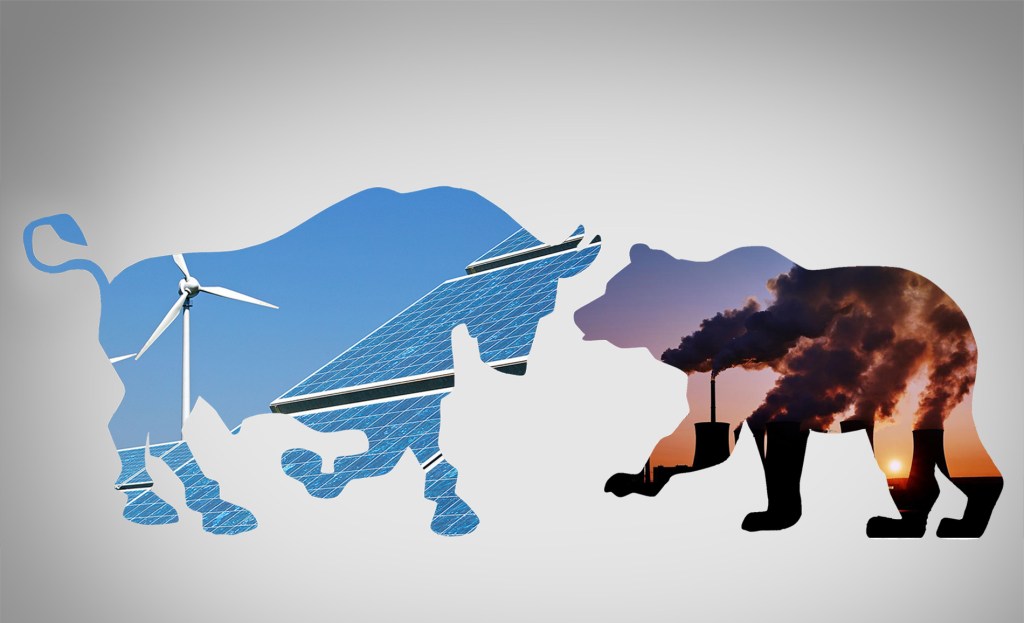

Three big oil companies had a comeuppance on a single day in May. Is it a revolution? Read More

A spotlight on Beam Global's profit model for EV charging

Can businesses flourish from the market supporting electric vehicles? Here's one effort. Read More

7 days in May: The climate finance week when everything changed

Last week may be seen as the pivotal moment when climate change finally got serious. Read More

Why needless growth isn’t needed

We have to get comfortable with different kinds of growth. Read More

IEA energy roadmap: Stop new fossil fuels investments

The International Energy Agency has set out a vision for a major transformation of the global economy. Here are its top conclusions. Read More

What you should know about the EU Taxonomy

It is neither a rating of “good” or “bad” companies nor a mandatory list of economic activities to invest in or to divest from. It does, however, aim to provide clear definitions of what is green to companies, investors and policymakers. Read More

Amazon issues its first sustainability bond at $1 billion

The e-commerce giant joins a growing band of corporates and governments around the world that have turned to the sustainable debt market. Read More

Infrastructure, green finance and net zero

Not every infrastructure upgrade qualifies as climate related, but a whole lot of them would. Read More

Morgan Stanley exec breaks mold on impact investing

Lilly Trager outlines how Impact investing can have the power to create impactful results for sustainability. Read More

HSBC, RRG are reaching for the canopy in nature-based investments

The two major funds partnering with nonprofits to show how natural assets can boost capital by building investment products around nature. Read More