Decarbonization

Inside Delta’s plan to take single-use plastic cups off its flights

The cup redesign will cut 7 million pounds of plastics annually, cutting in-flight waste. Read More

How $20 billion food giant General Mills turned its climate goals into action

Its Climate Transition Action Plan identifies dozens of initiatives, but the company acknowledges that they are not enough. Read More

How candymaker Mars cut emissions 16% and still grew its business by 60%

The parent for brands like Ben's Rice and M&Ms saw these enviable big reductions from the ways it grew cocoa, beef and soy. Read More

Why we need to reengineer carbon finance to support sustainable energy infrastructure

Carbon finance should drive the development of the infrastructure necessary to ensure the energy transition, according to Verra's former CEO. Read More

New studies indicate SBTi will still exclude offsets for Scope 3 emissions

The reports preview SBTi’s upcoming update to the Net Zero Standard. Read More

These fashion brands fail at emissions disclosures, industry watchdog finds

Nearly a quarter of the biggest fashion businesses decline to share any information about decarbonization efforts. Check out who's staying mum. Read More

Get to Know the $1 Billion Carbon Startup that Works with Airbnb, BlackRock and Pinterest

Trouble registering? Try switching your browser and double check that cookies are enabled. You can also try registering directly in Gradual here. If you are still having issues, please contact support@greenbiz.com. Date/Time: August 28, 2024 (1-1:40PM ET / 10-10:40AM PT) What do Airbnb, BlackRock, Canva, Pinterest, Shopify and Stripe have… Read More

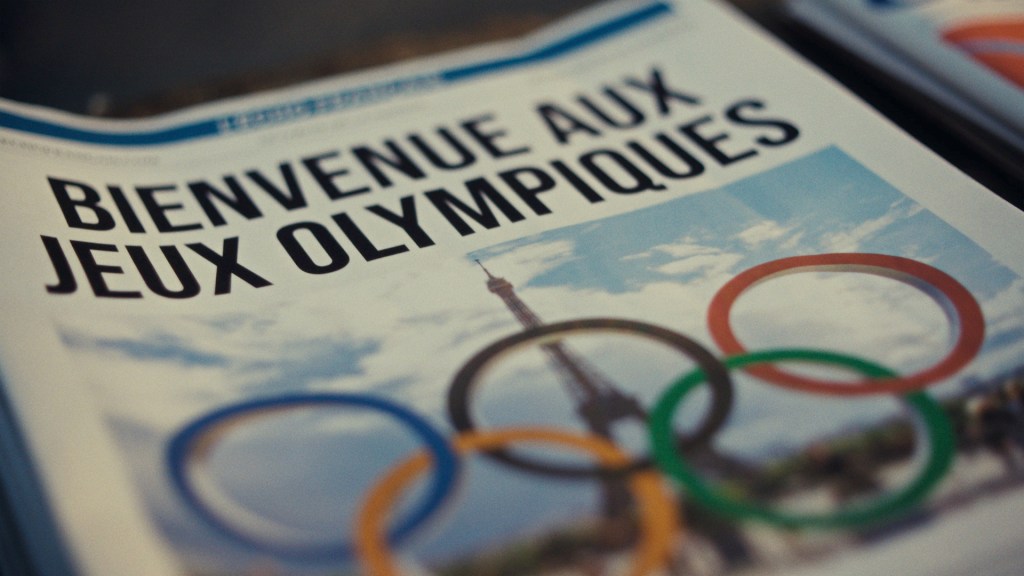

Paris Olympics aims to set records for event sustainability. Here’s how

Organizers minimize construction, ban most single-use plastics and eliminate generators to cut emissions in half compared with past events. Read More

Stripe pledged $1 million to carbon removal in 2020. Now it manages $1 billion

Meet the Stripe exec spurring $1 billion in demand for carbon removal. Read More

The state of carbon removal in 3 charts

The carbon removal industry lags behind where it needs to go in the next 6 years to fulfill the Paris Agreement. Read More